Recession Proof Credit Repair PLR Course 21k Words

in Business Finance PLR , Business PLR , Business PLR eBooks , Finance PLR , Finance PLR Ebooks , PLR Checklists , PLR eBooks , PLR eCourses , PLR List Building Reports , Premium PLR , Premium PLR eBooks , Premium PLR Reports , Private Label Rights ProductsChoose Your Desired Option(s)

has been added to your cart!

have been added to your cart!

#creditrepair #financialfreedom #recessionproof #financeplr #plrcourse #moneymanagement #businesscontent #plrcontent #financialtips

Recession Proof Credit Repair PLR Course – Take Control of Your Credit and Secure Your Financial Future

Your credit score isn’t just a number—it’s your gateway to financial freedom. Whether you want to buy a home, secure a business loan, or simply feel confident about your finances, maintaining a strong credit score is essential—especially during economic uncertainty.

The Recession Proof Credit Repair PLR Course is a comprehensive, step-by-step training program designed to empower individuals to rebuild, protect, and maximize their credit, even in tough economic climates. With 19,455 words of structured content, this PLR package is perfect for creating digital products, coaching programs, webinars, membership sites, or personal financial education offerings.

Presenting…

Recession Proof Credit Repair PLR Course 21k Words

Why This Course is Essential

Economic instability affects everyone, but your credit doesn’t have to suffer. Many people struggle with:

- Errors on their credit report that lower their score unnecessarily

- Collections and late payments dragging down their credit history

- Lack of knowledge about safe, effective credit rebuilding strategies

- Uncertainty about leveraging good credit to achieve financial freedom

This course equips learners with a complete roadmap to credit repair and maintenance, giving them actionable steps to:

- Understand their credit report and score in detail

- Remove negative items legally and efficiently

- Rebuild credit safely and responsibly

- Protect credit against future downturns

- Leverage strong credit for wealth-building opportunities

Who This Course is For

This course is designed for a wide audience, including:

- Individuals struggling with poor or average credit who want a structured plan for improvement

- Financial coaches and advisors who want a ready-made resource for clients

- Digital entrepreneurs seeking PLR content for membership sites, e-learning, or online products

- Small business owners looking to improve business and personal credit for future investments

- Anyone who wants to protect their credit during recessions and economic uncertainty

Course Overview

The Recession Proof Credit Repair PLR Course is divided into five comprehensive modules, each containing four actionable steps. The course is designed to be interactive, practical, and empowering, giving learners the confidence to take control of their finances.

Module 1: Understanding Your Credit Report & Score

Before you can repair credit, you must understand it. This module provides a solid foundation for credit knowledge.

Step 1: Getting Your Credit Report

- Learn where to obtain free, legitimate credit reports from all three major bureaus.

- Understand how to read your credit report, identify key sections, and check for red flags.

- Activity: Request your report and highlight areas requiring attention.

Step 2: Identifying Negative Items

- Spot errors, late payments, collections, charge-offs, and outdated accounts.

- Learn the statute of limitations on debts and prioritize items for dispute.

- Discover which negative items have the largest impact on your credit score.

Step 3: Understanding Credit Score Calculation

- Breakdown of the five major components: payment history, credit utilization, length of credit history, credit mix, and new inquiries.

- Learn how hard vs. soft inquiries affect your score differently.

- Understand how daily financial decisions affect long-term credit health.

Step 4: Setting Credit Repair Goals

- Define realistic, measurable credit score goals.

- Learn how to create a step-by-step credit improvement plan.

- Understand the importance of tracking progress and adjusting strategies as needed.

Module Benefits: By the end of this module, learners will fully understand their current credit situation and have a clear, actionable roadmap for improvement.

Module 2: Disputing & Removing Negative Items

Cleaning up your credit report is crucial before rebuilding. This module covers legal, effective methods to remove negative items.

Step 1: Disputing Errors on Your Credit Report

- Learn how to write powerful dispute letters (templates included).

- Understand the legal obligations of credit bureaus when handling disputes.

- Track disputes to ensure results and document progress.

Step 2: Removing Collections & Charge-Offs

- Understand the difference between paid and unpaid collections.

- Learn negotiation strategies, including pay-for-delete agreements.

- Discover best practices for settling or disputing debts.

Step 3: Dealing with Late Payments & Inquiries

- Request goodwill adjustments from creditors for past late payments.

- Remove unauthorized hard inquiries and learn strategies to prevent future issues.

Step 4: Handling Debt Validation Requests

- How to respond to debt collectors professionally and legally.

- Learn your rights under the Fair Credit Reporting Act (FCRA).

- Protect yourself from unlawful collections and disputes.

Module Benefits: Learners will gain the tools to legally remove damaging credit report items, often resulting in immediate improvements in their credit score.

Module 3: Rebuilding & Boosting Your Credit Score

After negative items are addressed, it’s time to rebuild credit safely.

Step 1: Securing a Credit Builder Account

- Learn about secured credit cards and credit builder loans.

- Understand how to use these tools safely without accumulating new debt.

- Discover the best starter credit options for rebuilding.

Step 2: Using Credit Responsibly

- Apply the 30% utilization rule and understand why keeping it lower is ideal.

- Automate payments to avoid missed bills.

- Create a plan to maintain low balances consistently.

Step 3: Becoming an Authorized User

- Boost your score by being added to someone else’s established credit account.

- Understand the potential risks and benefits.

- Learn questions to ask before accepting authorized user status.

Step 4: Diversifying Your Credit Mix

- Why having a combination of revolving and installment accounts helps your score.

- Learn how to strategically add credit without harming your score.

Module Benefits: Learners will rebuild their credit foundation and develop long-term strategies to increase and maintain a strong credit score.

Module 4: Long-Term Credit Protection Strategies

Maintaining good credit is just as important as rebuilding it. This module shows learners how to protect their credit for life.

Step 1: Avoiding Common Credit Mistakes

- Identify behaviors that damage your credit score.

- Learn how to avoid scams and predatory credit repair offers.

- Discover why regular credit checks are essential.

Step 2: Freezing & Locking Your Credit

- Learn when and why to freeze your credit.

- Understand how fraud alerts work.

- Discover the differences between credit freezes and locks.

Step 3: Managing Debt Smartly

- Learn strategies to pay down debt efficiently.

- Prioritize high-interest debts using snowball and avalanche methods.

Step 4: Building a Recession-Proof Credit Plan

- Protect your credit during economic downturns.

- Build an emergency financial cushion.

- Maintain strong credit even in uncertain times.

Module Benefits: Learners will be prepared to navigate financial challenges while keeping their credit intact.

Module 5: Leveraging Good Credit for Financial Success

A strong credit score is a tool for wealth building, not just protection.

Step 1: Using Credit to Build Wealth

- Secure low-interest business loans.

- Leverage credit for real estate and investment opportunities.

Step 2: Credit Card Rewards & Benefits

- Maximize cashback, travel, and rewards safely.

- Avoid overspending while enjoying perks.

Step 3: Scaling Your Credit to Financial Freedom

- Increase credit lines strategically.

- Use business and personal credit responsibly to fund opportunities.

Step 4: Staying Credit-Savvy for Life

- Adopt lifelong habits of high scorers.

- Continue monitoring credit and teaching others.

Module Benefits: Learners can leverage their rebuilt credit to create long-term wealth and financial stability.

Bonus Materials

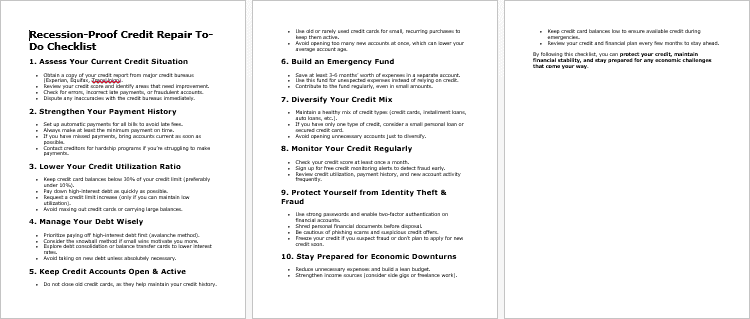

- Checklist (473 words): Step-by-step action plan for credit repair and ongoing protection.

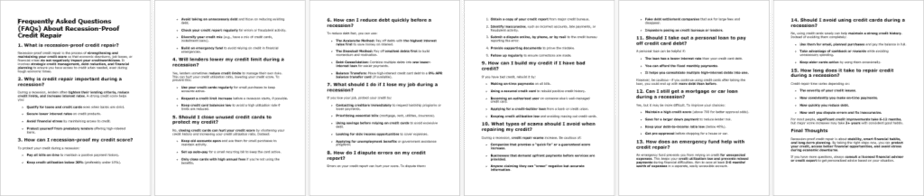

- FAQs (1,073 words): Answers to common credit questions, strategies, and legal guidance.

- Salespage Copy (523 words): Prewritten marketing material for your PLR product.

How to Use and Profit from This PLR Course

- Sell the full course as a ready-made digital product.

- Break modules into mini-products for $10–$20 each.

- Bundle with other financial or wealth courses for higher-ticket offers ($47–$97).

- Create a membership site with ongoing access to generate monthly recurring revenue.

- Convert to audio, video, or webinar series for coaching programs.

- Lead magnets: Use excerpts to grow email lists and attract clients.

- Flip the content: Create a credit repair resource website and sell for profit.

Licensing Terms

Permissions:

- Sell, edit, and repurpose content.

- Claim copyright with 75% modification.

- Use in coaching, e-learning, or digital products.

Restrictions:

- Cannot transfer PLR rights to others.

- Maximum affiliate commission: 75%.

- Cannot give full content away for free.

- Cannot bundle without additional purchase.

Why This PLR Course Stands Out

- 19,455 words of structured, actionable content.

- Focused on recession-proof strategies to protect and rebuild credit.

- Includes templates, dispute letters, and step-by-step guidance.

- Bonus materials for checklists, FAQs, and prewritten sales copy.

- Flexible PLR ready for digital products, memberships, webinars, or coaching programs.

Take control of your financial future with Recession Proof Credit Repair PLR Course—a ready-made, comprehensive, and profitable solution for individuals and entrepreneurs alike.

has been added to your cart!

have been added to your cart!

Here A Sample of Recession Proof Credit Repair PLR Course

A step-by-step guide to repairing and maintaining strong credit—even in tough times!

Module 1: Understanding Your Credit Report & Score

Before we start fixing anything, we need to know what we’re working with!

Step 1: Getting Your Credit Report

Before you can start improving your credit, you need to understand exactly where you stand. Your credit report is a financial record that lenders use to assess your creditworthiness. It includes details about your borrowing history, payments, credit accounts, and any negative marks like late payments or defaults.

In this step, you will learn:

- Where to Get Your Free Credit Report (Without Scams)

- How to Read and Interpret Your Credit Report

- The Key Factors That Impact Your Credit Score

By the end of this step, you will have a clear understanding of your financial status and know what areas need improvement.

1. Where to Get Your Free Credit Report (Without Scams)

Every country has credit bureaus that collect and maintain credit data. The best way to access your report is through these official agencies.

Global Credit Bureaus & Official Sources

Depending on where you live, you can request your credit report from the following major credit bureaus:

- United States: Experian, Equifax, TransUnion (AnnualCreditReport.com provides free reports)

- Canada: Equifax Canada, TransUnion Canada

- United Kingdom: Experian UK, Equifax UK, TransUnion UK (access via MoneyHelper)

- Australia & New Zealand: Equifax Australia, illion, Experian

- European Union Countries: Varies by country; check with the national credit reporting agency

- India: CIBIL, Experian India, Equifax India, CRIF High Mark

- South Africa: Experian South Africa, TransUnion South Africa, Compuscan

- Other Regions: Check with your country’s financial regulatory authority for approved credit bureaus

Steps to Request Your Report Safely

- Go to the Official Website of the credit bureau in your country. Avoid third-party websites that claim to offer free credit reports but may sell your information.

- Provide Your Identification Details. You may need to enter your name, date of birth, address, and government-issued ID number (passport, driver’s license, or national ID).

- Select the Free Credit Report Option. Some countries allow you to request a free report once per year, while others may provide one every few months.

- Download or Request a Mailed Copy. Some bureaus allow immediate online access, while others send a physical copy via mail.

- Save a Copy for Reference. Print or save your report in a secure digital location to track changes over time.

Warning:

- Avoid websites that ask for credit card details for a “free” credit report. This is a common scam.

- Do not pay unless you are requesting additional services, such as credit monitoring.

- If unsure, visit your country’s consumer financial protection website for official links.

2. How to Read and Interpret Your Credit Report

Once you have your credit report, the next step is understanding what it means. Credit reports can look complicated at first, but they typically include the following key sections:

Key Sections of a Credit Report

A. Personal Information

- Full Name

- Date of Birth

- Address History

- Government ID (last few digits for security)

- Employment History

What to Look For:

- Ensure your name and address are correct to avoid mix-ups.

- Check for any unfamiliar addresses—this could indicate identity theft.

B. Credit Accounts (Trade Lines)

This section lists all credit accounts in your name, including:

- Credit cards

- Loans (personal, auto, mortgage, student)

- Retail store accounts

For each account, you will see:

- Lender Name (e.g., Bank XYZ, Credit Card ABC)

- Account Type (Credit Card, Loan, Mortgage)

- Credit Limit (Total amount available)

- Current Balance (Amount owed)

- Payment History (Shows on-time or missed payments)

- Status (Open, Closed, Delinquent)

What to Look For:

- Verify that all accounts belong to you.

- Check for any late or missed payments.

- Look at your credit utilization (high balances can hurt your score).

C. Public Records & Negative Items

This section includes legal and financial issues, such as:

- Bankruptcies

- Foreclosures

- Tax Liens

- Civil Judgments

- Collections (Unpaid debts sent to collection agencies)

What to Look For:

- Ensure there are no incorrect negative records.

- If you see collections, verify whether they are valid.

- Check how long negative items will stay on your report (varies by country).

D. Credit Inquiries

Whenever a lender checks your credit, it appears in this section. There are two types:

- Hard Inquiries: Affect your credit score (e.g., applying for a loan or credit card).

- Soft Inquiries: Do not affect your score (e.g., checking your own report).

What to Look For:

- Too many hard inquiries in a short time can lower your credit score.

- If you see unauthorized inquiries, report them immediately.

3. Understanding What Factors Impact Your Credit Score

Your credit score is a three-digit number that summarizes your creditworthiness. Different countries use different scoring models, but the most common are:

- FICO Score (United States, Canada, UK, etc.) – Ranges from 300 to 850

- VantageScore (United States & Canada) – Ranges from 300 to 850

- CIBIL Score (India) – Ranges from 300 to 900

- Experian Score (Various Countries) – Ranges from 0 to 1000

Main Factors That Determine Your Credit Score

| Factor | Weight (%) | Impact on Score |

| Payment History | 35% | Paying on time improves your score; late/missed payments lower it. |

| Credit Utilization | 30% | Using less than 30% of your available credit is ideal. |

| Length of Credit History | 15% | Older accounts improve your score. |

| Types of Credit | 10% | A mix of credit cards, loans, and mortgages is beneficial. |

| New Credit Inquiries | 10% | Too many hard inquiries in a short period can hurt your score. |

What This Means for You:

- Always pay bills on time to maintain a strong score.

- Try to keep credit card balances low (below 30% of the limit).

- Avoid opening too many new accounts in a short period.

- Keep old accounts open to maintain a long credit history.

Step 2: Identifying Negative Items

Now that you have your credit report, the next step is to analyze it carefully for negative items that may be damaging your credit score. These negative marks can include errors, late payments, collections, and even fraudulent accounts. Some of these items can be disputed and removed, while others require strategic action to minimize their impact.

In this step, you will learn:

- How to Spot Errors, Late Payments, and Collections

- Understanding the Statute of Limitations on Debts

- How to Prioritize Which Items Need Urgent Attention

By the end of this step, you will have a clear plan for tackling the most damaging items on your credit report.

1. How to Spot Errors, Late Payments, and Collections

When reviewing your credit report, you should carefully check for inaccuracies and negative marks. Even a small mistake can lower your score and affect your ability to get loans, credit cards, or even rent a home.

Common Errors to Look For

Errors on your credit report can appear in different sections. Go through each category carefully:

A. Personal Information Errors

- Incorrect Name – Spelling mistakes, incorrect middle names, or mixed-up names.

- Wrong Address – Addresses where you have never lived.

- Incorrect Date of Birth – Ensure your date of birth is accurate.

- Employment Errors – Outdated or incorrect employer details.

✅ Why This Matters: These mistakes can indicate a mix-up with another person’s report or even identity theft.

B. Account Errors

- Accounts That Don’t Belong to You – If you see an account you don’t recognize, it could be fraudulent.

- Duplicate Accounts – Sometimes, the same debt appears twice, making it look like you owe more than you do.

- Incorrect Balances – Ensure the balances shown are accurate.

- Incorrect Credit Limits – If your credit limit is lower than it should be, it could affect your credit utilization ratio.

- Closed Accounts Reported as Open – This can make it seem like you have more available credit than you actually do.

✅ Why This Matters: Errors in account details can unfairly lower your credit score or make you look riskier to lenders.

C. Payment History Errors

- Late Payments You Paid on Time – If you made a payment on time but it is listed as late, dispute it immediately.

- Wrong Dates for Late Payments – A late payment reported for the wrong month can make it harder to get it removed.

- Settled Debts Still Showing as Unpaid – If you’ve paid a debt in full, it should not appear as outstanding.

✅ Why This Matters: Payment history is the biggest factor in determining your credit score, so any mistake here can have serious consequences.

D. Collection Accounts & Public Records

- Debt That Shouldn’t Be in Collections – If a lender sent your account to collections before the due date, this is an error.

- Paid Collections Still Marked as Unpaid – Some collections agencies fail to update records.

- Bankruptcies, Foreclosures, or Tax Liens That Don’t Belong to You – These should be removed if inaccurate.

✅ Why This Matters: Collection accounts and public records can stay on your credit report for years, significantly lowering your score.

2. Understanding the Statute of Limitations on Debts

The statute of limitations (SOL) on debt is the legal time limit for creditors to sue you for unpaid debt. Once this period expires, creditors can no longer take legal action, although the debt may still appear on your credit report.

The SOL varies by country and by the type of debt:

| Country | Statute of Limitations (Varies by Debt Type) |

| United States | 3–10 years depending on the state and debt type |

| Canada | 2–6 years depending on the province |

| United Kingdom | 6 years for most debts (5 years in Scotland) |

| Australia | 6 years for most debts |

| India | 3 years for most debts |

| European Union Countries | Varies by country, typically 3–10 years |

How to Use SOL to Your Advantage

- If the debt is past the SOL, you are not legally required to pay it.

- If you make a payment on old debt, it can reset the SOL. Be careful when negotiating with creditors.

- Just because a debt is past the SOL doesn’t mean it disappears from your report. Most negative marks stay for 6-7 years, but they carry less weight over time.

✅ Action Step: Find out the statute of limitations for debt in your country to know which debts are still legally enforceable.

3. How to Prioritize Which Items Need Urgent Attention

Now that you have identified the negative items on your report, it’s time to create a priority list for addressing them.

High-Priority Negative Items (These should be tackled first)

- Errors & Fraudulent Accounts – These can be disputed and removed quickly, often leading to an immediate credit score boost.

- Recent Late Payments – The newer the late payment, the bigger the impact on your score.

- Active Collection Accounts – If the debt is valid, consider negotiating a Pay-for-Delete Agreement with the collection agency.

- High-Balance Credit Cards – If your credit utilization is high, paying down balances can improve your score fast.

✅ Action Step: Start by disputing errors and addressing the most recent negative marks.

Medium-Priority Negative Items

- Older Late Payments – These have less impact over time but are still worth addressing.

- Paid Collections – Even though they are marked as “paid,” they can still lower your score.

- Closed Accounts with Negative History – You cannot remove them, but you can work on improving other areas of your credit.

✅ Action Step: Work on these once high-priority issues are resolved.

Low-Priority Negative Items

- Old Negative Marks Near Expiration – If a late payment or collection is set to fall off your report soon (within a year), it may not be worth the effort to dispute it.

- Past-Due Debts Beyond the Statute of Limitations – If a creditor can no longer sue you, focus on newer debts instead.

✅ Action Step: Monitor these items but don’t waste time fighting them unless absolutely necessary.

Final Steps: What to Do Next

- Review Your Credit Report Again – Go line by line to ensure you don’t miss any errors or negative items.

- Make a List of Disputes – Highlight any incorrect information that you need to challenge with the credit bureaus.

- Research the Statute of Limitations – Identify which debts are still enforceable and which ones are past the legal time limit.

- Prioritize Your Actions – Start with high-priority items that will have the biggest impact on your credit score.

Once you complete this step, you will be ready to take action on removing negative items and improving your credit. In the next module, you will learn how to dispute errors and negotiate with creditors to fix your credit report effectively.

Step 3: Understanding Credit Score Calculation

A strong credit score is essential for financial stability, access to better loan terms, and lower interest rates. But how exactly is your credit score calculated? Many people don’t realize that credit scores are based on specific factors, each carrying a different weight.

In this step, you will learn:

- How Your Credit Score is Calculated (Payment History, Utilization, Credit Mix, and More)

- The Impact of Hard vs. Soft Inquiries on Your Credit Score

- How to Prevent Further Credit Damage

By understanding these factors, you’ll be able to take smart actions that improve your score and protect your financial future.

1. How Your Credit Score is Calculated

Your credit score is a three-digit number that represents your creditworthiness. Different credit scoring models exist, but the most commonly used ones are:

- FICO Score (Used by 90% of lenders worldwide)

- VantageScore (Used by some lenders and free credit score providers)

Though the exact formula varies, the following five factors always play a key role:

| Factor | Weight in Score Calculation |

| Payment History | 35% – The most important factor |

| Credit Utilization | 30% – The ratio of credit used to credit available |

| Credit History Length | 15% – How long you’ve had credit accounts |

| Credit Mix | 10% – Types of credit (loans, cards, etc.) |

| New Credit Inquiries | 10% – Recent applications for new credit |

Now, let’s break down each factor in detail.

A. Payment History (35%) – Your Record of On-Time vs. Late Payments

Your payment history is the biggest factor affecting your credit score. Lenders want to see that you consistently make payments on time.

✅ Positive Impact: Paying your bills on time, even if it’s just the minimum payment, helps build a good credit score.

❌ Negative Impact: Late payments, missed payments, and defaults can significantly lower your score.

How to Improve This Factor:

- Set up automatic payments or reminders to never miss a due date.

- If you’ve missed a payment, pay it as soon as possible—the longer it remains unpaid, the worse the impact.

- Contact creditors to request a “goodwill adjustment” if you have a history of on-time payments but missed one due to an emergency.

B. Credit Utilization (30%) – How Much Credit You Use

Credit utilization refers to the percentage of your available credit that you are using.

✅ Ideal Utilization: Below 30% (Below 10% is even better).

❌ High Utilization Warning: If you max out your credit cards or carry high balances, your score will drop.

Example:

- If your credit card has a limit of $10,000, you should keep your balance below $3,000 to maintain a good utilization rate.

How to Improve This Factor:

- Pay down high balances as soon as possible.

- Request a credit limit increase (but don’t increase your spending).

- Make multiple small payments throughout the month to keep balances low.

C. Length of Credit History (15%) – The Age of Your Accounts

Lenders prefer borrowers with a long, stable credit history. This factor considers:

- The age of your oldest account

- The average age of all accounts

- How recently you used your accounts

✅ Good Credit History Length: 7+ years

❌ Short Credit History: If all your accounts are new, lenders see you as a higher risk.

How to Improve This Factor:

- Keep old accounts open (even if you don’t use them) to maintain account history.

- Use older accounts occasionally to keep them active.

- Avoid closing your oldest credit card, even if you don’t use it.

D. Credit Mix (10%) – The Types of Credit You Have

Lenders like to see a mix of different credit types, such as:

- Credit cards

- Personal loans

- Auto loans

- Mortgages

- Student loans

✅ Good Credit Mix: Having both revolving credit (credit cards) and installment loans (personal or auto loans) improves your score.

❌ Bad Credit Mix: If you only have one type of credit, your score may not be as strong.

How to Improve This Factor:

- If you only have credit cards, consider taking out a small personal loan (only if needed).

- If you don’t have a credit card, applying for one and using it responsibly can improve your credit mix.

E. New Credit Inquiries (10%) – Applying for Too Much Credit

Every time you apply for new credit, lenders check your credit report. This is called a hard inquiry.

✅ Safe Zone: 1–2 inquiries per year

❌ Risky Zone: 4+ inquiries in a short period

How to Improve This Factor:

- Avoid applying for multiple credit cards or loans at once.

- Only apply for new credit when necessary.

2. The Impact of Hard vs. Soft Inquiries

Hard Inquiries (Negative Impact)

A hard inquiry occurs when a lender checks your credit report for a loan or credit application.

Examples:

- Applying for a credit card

- Applying for a personal or auto loan

- Applying for a mortgage

✅ Best Practice: Space out credit applications by at least six months to avoid hurting your score.

Soft Inquiries (No Impact)

A soft inquiry does not affect your score. It happens when:

- You check your own credit report.

- Employers check your credit.

- Credit card companies pre-approve you for an offer.

✅ Best Practice: Regularly check your own credit report to track your score without worry.

3. How to Prevent Further Credit Damage

Now that you understand how your credit score is calculated, it’s time to protect it from further harm.

A. Pay All Bills On Time

- Even one missed payment can drop your score by 50+ points.

- Set up auto-pay or use calendar reminders.

B. Keep Credit Utilization Low

- Never exceed 30% of your credit limit.

- If you carry a balance, pay it off as quickly as possible.

C. Avoid Applying for Too Much Credit

- Space out applications to minimize hard inquiries.

- Only apply for new credit when absolutely necessary.

D. Monitor Your Credit Report Regularly

- Check your credit report every 3-6 months for errors.

- If you find fraudulent activity, report it immediately.

Final Steps: What to Do Next

- Review your current credit score and understand your weak areas.

- Identify which of the five credit factors you need to improve.

- Create a plan to maintain healthy credit habits moving forward.

- Monitor your credit score regularly to track progress.

Now that you understand how your credit score is calculated, you can take proactive steps to improve it. In the next step, you will learn how to dispute errors and negotiate with creditors to clean up your credit report even further.

Step 4: Setting Credit Repair Goals

A solid credit repair strategy begins with clear, realistic goals. Without a defined target, improving your credit can feel overwhelming. Setting credit repair goals helps you track progress, stay motivated, and make informed financial decisions.

In this step, you will:

- Define Your Credit Score Goal and Timeline

- Learn the Importance of Consistent Action

- Get a Step-by-Step Credit Improvement Plan for the Course

By following these structured steps, you will create a customized roadmap to better credit and long-term financial success.

1. Define Your Credit Score Goal and Timeline

Before you start repairing your credit, you need to know where you are and where you want to go. Setting specific credit score goals helps you stay focused and measure progress.

A. Check Your Current Credit Score

If you haven’t done so already, get a copy of your credit report and check your current credit score. Depending on the country, you can access it from major credit bureaus such as:

- United States: Experian, Equifax, TransUnion

- United Kingdom: Experian, Equifax, TransUnion

- Canada: Equifax, TransUnion

- Australia: Experian, Equifax, illion

- India: CIBIL, Experian, Equifax, CRIF High Mark

Each bureau may show slightly different scores, so checking at least two reports can give you a more accurate picture.

B. Set a Realistic Credit Score Goal

Not all credit score improvements happen overnight. Understanding how much your score can improve and how long it takes will help you set practical expectations.

Here’s a general credit score range used internationally:

| Credit Score | Rating | Action Needed |

| 300-579 | Poor | Urgent improvement needed |

| 580-669 | Fair | Moderate improvement needed |

| 670-739 | Good | Small improvements for better rates |

| 740-799 | Very Good | Minor adjustments |

| 800+ | Excellent | Maintain good habits |

If your score is in the Poor or Fair range, you should set a goal to move to the Good or Very Good category over the next 6 to 12 months.

If your score is already in the Good range, aim to improve it within 3 to 6 months.

C. Create a Timeline for Your Goal

Setting a timeline ensures you stay on track and accountable. The table below gives a rough idea of how long it might take to improve your score:

| Credit Issue | Estimated Time to Improve |

| Fixing errors on credit report | 1-3 months |

| Lowering credit utilization | 1-6 months |

| Removing late payments | 3-6 months |

| Recovering from collections | 6-12 months |

| Rebuilding credit after bankruptcy | 2-7 years |

Example Goal Statement:

“I want to increase my credit score from 580 to 700 within the next 12 months by making on-time payments, reducing credit utilization, and disputing inaccurate information.”

2. Learn the Importance of Consistent Action

Improving credit requires persistence. Unlike quick-fix schemes that may harm your credit, steady and consistent efforts will yield long-lasting results.

A. Why Consistency Matters

✅ Credit scores update monthly, meaning every positive action counts.

✅ Making one-time changes won’t improve your score significantly.

✅ Credit repair requires patience—major improvements take several months.

B. Building Consistent Habits

Developing good credit habits ensures steady growth. Here are key habits to maintain:

- Make All Payments on Time

- Payment history makes up 35% of your credit score.

- Even a single late payment can drop your score by 50+ points.

- Use automatic payments or reminders to never miss a due date.

- Keep Credit Utilization Below 30%

- If your credit limit is $5,000, keep your balance under $1,500.

- Pay off large balances before the statement closing date.

- Request a credit limit increase (only if you won’t overspend).

- Avoid Opening Too Many Accounts at Once

- Every time you apply for credit, a hard inquiry is added to your report.

- Multiple hard inquiries in a short period lower your score.

- Monitor Your Credit Regularly

- Check for errors and fraudulent activity every 3-6 months.

- Use credit monitoring services (such as Experian or Equifax).

- Dispute inaccurate negative items immediately.

3. Get a Step-by-Step Credit Improvement Plan for the Course

Now that you’ve set your goal and committed to consistent action, here is your step-by-step credit repair plan. Follow these steps carefully:

Step 1: Check Your Current Credit Score & Report

- Obtain your free credit report from authorized sources.

- Identify errors, late payments, and high balances.

Step 2: Set a Credit Score Target

- Define your goal score based on your current score.

- Set a realistic timeline (e.g., increase 100 points in 12 months).

Step 3: Create an Action Plan

- Dispute inaccuracies: File complaints with credit bureaus if needed.

- Reduce debt: Pay down high balances and avoid maxing out credit cards.

- Make consistent payments: Set up auto-pay to avoid missing due dates.

Step 4: Track and Adjust Your Strategy

- Monitor your credit score every 30-60 days.

- Adjust your budget to prioritize credit payments.

- Avoid unnecessary credit applications until your score improves.

We’re also giving these extra bonuses

Recession Proof Credit Repair – Checklist

Recession Proof Credit Repair – FAQs

Recession Proof Credit Repair – Salespage Content

Package Details:

Word Count: 19 455 Words

Number of Pages: 99

Recession Proof Credit Repair – Bonus Content

Checklist

Word Count: 473 words

FAQs

Word Count: 1073 words

Salespage Content

Word Count: 523 words

Total Word Count: 21 524 Words

Your PLR License Terms

PERMISSIONS: What Can You Do With These Materials?

Sell the content basically as it is (with some minor tweaks to make it “yours”).

If you are going to claim copyright to anything created with this content, then you must substantially change at 75% of the content to distinguish yourself from other licensees.

Break up the content into small portions to sell as individual reports for $10-$20 each.

Bundle the content with other existing content to create larger products for $47-$97 each.

Setup your own membership site with the content and generate monthly residual payments!

Take the content and convert it into a multiple-week “eclass” that you charge $297-$497 to access!

Use the content to create a “physical” product that you sell for premium prices!

Convert it to audios, videos, membership site content and more.

Excerpt and / or edit portions of the content to give away for free as blog posts, reports, etc. to use as lead magnets, incentives and more!

Create your own original product from it, set it up at a site and “flip” the site for megabucks!

RESTRICTIONS: What Can’t You Do With These Materials?

To protect the value of these products, you may not pass on the rights to your customers. This means that your customers may not have PLR rights or reprint / resell rights passed on to them.

You may not pass on any kind of licensing (PLR, reprint / resell, etc.) to ANY offer created from ANY PORTION OF this content that would allow additional people to sell or give away any portion of the content contained in this package.

You may not offer 100% commission to affiliates selling your version / copy of this product. The maximum affiliate commission you may pay out for offers created that include parts of this content is 75%.

You are not permitted to give the complete materials away in their current state for free – they must be sold. They must be excerpted and / or edited to be given away, unless otherwise noted. Example: You ARE permitted to excerpt portions of content for blog posts, lead magnets, etc.

You may not add this content to any part of an existing customer order that would not require them to make an additional purchase. (IE You cannot add it to a package, membership site, etc. that customers have ALREADY paid for.)

Share Now!