Saving Money Challenge PLR Course 22k Words

in Finance PLR , Finance PLR Ebooks , PLR Checklists , PLR eBooks , PLR eCourses , PLR List Building Reports , Premium PLR , Premium PLR eBooks , Premium PLR Reports , Premium White Label Brandable PLR Coaching Courses , Private Label Rights ProductsChoose Your Desired Option(s)

has been added to your cart!

have been added to your cart!

#savingmoney #moneychallenge #financeplr #budgetingtips #wealthbuilding #plrcourse #financialfreedom #moneymanagement #plrcontent

Saving Money Challenge PLR Course – Transform Your Finances in 30 Days

Develop Smart Saving Habits, Reduce Expenses, and Build Financial Confidence

Are you tired of living paycheck to paycheck, feeling like your money disappears too quickly, or struggling to save for your goals? The Saving Money Challenge PLR Course is here to change that. This step-by-step course provides actionable strategies, practical exercises, and fun challenges to help anyone start saving effectively, stay motivated, and build a lifetime habit of financial responsibility.

Whether you’re a financial coach, blogger, content creator, or entrepreneur, this PLR course is fully editable and ready to be resold, bundled, or transformed into digital products, e-courses, or coaching programs.

With over 20,000 words of content, this course guides participants from setting savings goals to mastering budgeting, cutting unnecessary expenses, and building long-term financial habits.

Presenting…

Saving Money Challenge PLR Course 22k Words

Why This Course is Essential

Many people struggle with saving money—not because they don’t want to, but because they lack a structured, practical plan. Common challenges include:

- Difficulty tracking spending and knowing where the money goes

- Constant impulse purchases and hidden expenses

- Struggling to stick to a budget or reach savings goals

- Feeling overwhelmed by financial responsibilities

- Lack of motivation or fun in the saving process

The Saving Money Challenge PLR Course tackles these issues with a structured, enjoyable, and actionable approach, designed to engage participants, motivate consistent action, and produce measurable results.

Who This Course is For

This PLR course is perfect for:

- Financial coaches and advisors who want ready-made training for clients

- Bloggers and influencers in the personal finance niche

- Digital marketers and entrepreneurs looking for a complete, sellable course

- Individuals seeking guidance to improve financial habits

- Anyone wanting to turn financial education into a digital product, ebook, or online course

What You’ll Learn

The Saving Money Challenge PLR Course is organized into five comprehensive modules, each broken into four actionable steps. Here’s what’s included:

Module 1: Setting the Foundation for Saving

Goal: Establish a strong financial foundation and mindset for saving money.

Step 1: Define Your “Why” for Saving

- Clarify your financial goals: vacations, emergency funds, debt payoff, or early retirement.

- Activity: Write down the top three goals and display them to stay motivated.

Step 2: Analyze Your Current Spending

- Track all expenses for the past 30 days using apps or notebooks.

- Identify patterns and highlight areas to cut unnecessary spending.

Step 3: Create a Realistic Budget

- Categorize expenses into needs, wants, and savings.

- Allocate a fixed percentage of income to each category and commit to sticking with it.

Step 4: Set a Savings Goal for This Challenge

- Choose a realistic 30-day target, breaking it into weekly or daily mini-goals.

- This provides achievable milestones to maintain motivation.

Module Benefits:

Participants gain clarity about financial priorities, track spending effectively, and set a realistic, actionable plan for saving.

Module 2: Cutting Unnecessary Expenses

Goal: Identify and eliminate wasteful spending for immediate savings impact.

Step 1: Identify Your Money Leaks

- Pinpoint subscriptions, impulse purchases, and recurring habits that drain finances.

- Cancel or downgrade at least one unnecessary expense.

Step 2: Adopt the “Wait Before You Buy” Rule

- Delay non-essential purchases by 48 hours.

- Evaluate whether the purchase is necessary or add the money to savings.

Step 3: Make Smart Swaps & DIY Solutions

- Meal prep at home instead of dining out.

- Switch to generic brands or discount alternatives.

Step 4: Reduce Energy & Utility Bills

- Turn off unused appliances, adjust thermostat, and compare plans for savings.

- Small changes create significant long-term impact.

Module Benefits:

Participants cut unnecessary expenses efficiently, freeing up cash for their savings goals.

Module 3: Boosting Your Savings the Fun Way

Goal: Make saving enjoyable and motivating through creative challenges.

Step 1: Start a No-Spend Challenge

- Designate one day per week to spend only on essentials.

- Progressively extend it to weekends or a full week.

Step 2: Use the “Cash-Only” Method

- Withdraw weekly budgets in cash to improve spending awareness.

- Physically handling money reinforces financial discipline.

Step 3: Try the 52-Week Savings Challenge

- Start with a small amount (e.g., $1/₹10) and increase weekly.

- At year-end, participants will save a substantial amount without feeling deprived.

Step 4: Turn Savings into a Game

- Compete with friends or family to see who saves more in 30 days.

- Reward milestones with low-cost fun activities, adding motivation and excitement.

Module Benefits:

Participants stay motivated, develop fun habits, and see measurable progress in a short time.

Module 4: Finding Extra Money to Save

Goal: Maximize savings by boosting income streams.

Step 1: Sell What You Don’t Use

- Identify unused items around the house (clothes, electronics, furniture).

- Sell online through Facebook Marketplace, eBay, or local groups.

Step 2: Pick Up a Side Gig

- Explore freelance work, part-time jobs, or gig economy opportunities.

- Even small weekly earnings accelerate financial progress.

Step 3: Use Cashback & Rewards Programs

- Sign up for cashback apps, loyalty points, or reward cards.

- Convert rewards into cash or discounts for everyday expenses.

Step 4: Automate Your Savings

- Schedule automatic transfers to a savings account each payday.

- Treat savings as a fixed expense to ensure consistency.

Module Benefits:

Participants increase savings without sacrificing lifestyle, leveraging additional resources smartly.

Module 5: Making Your Savings Habit Stick for Life

Goal: Transform temporary savings actions into long-term financial habits.

Step 1: Review & Celebrate Your Progress

- Reflect on savings achieved over 30 days.

- Reward yourself with low-cost celebrations, reinforcing positive behavior.

Step 2: Adjust & Improve Your Budget

- Identify successes and areas for improvement.

- Refine strategies to optimize long-term financial growth.

Step 3: Set Up a Long-Term Savings Plan

- Open dedicated accounts for big goals, such as vacations, emergencies, or investments.

- Integrate investment strategies for exponential growth.

Step 4: Keep the Momentum Going

- Set new savings targets and challenges every few months.

- Maintain habits through tracking, reflection, and community support.

Module Benefits:

Participants develop lifelong saving habits, achieve consistent financial growth, and gain confidence in managing money.

Bonus Materials

- Saving Money Challenge Checklist (479 words) – Quick reference for daily and weekly actions

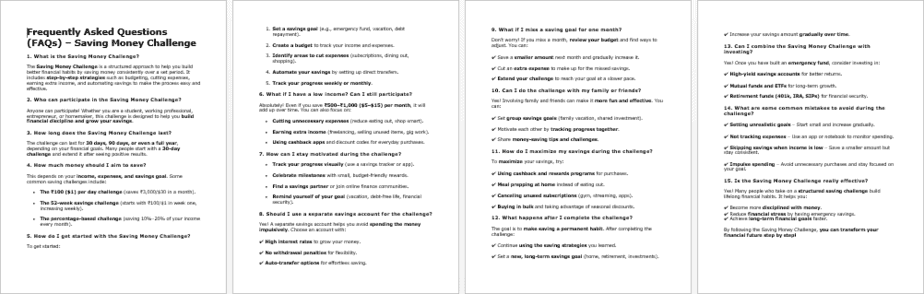

- FAQs (776 words) – Answers to common questions about saving and budgeting

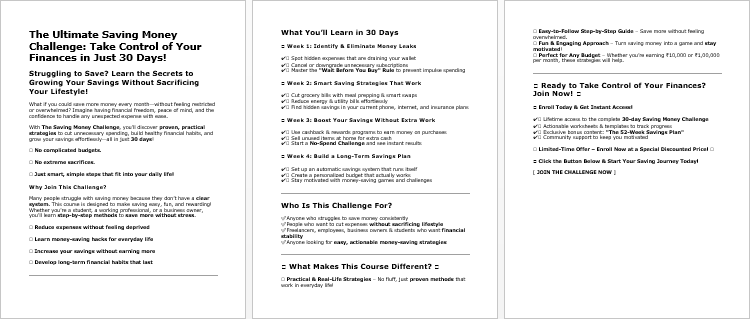

- Salespage Copy (514 words) – Ready-to-use marketing copy for your PLR product

How to Use and Profit from This PLR Course

- Sell as a complete digital course to audiences looking to improve finances.

- Break into mini-reports ($10–$20) targeting budgeting, saving hacks, or side hustles.

- Bundle with other finance products ($47–$97) for premium packages.

- Launch a membership site with ongoing tips, challenges, and community support.

- Convert to audio, video, or workbook formats for multi-platform products.

- Use excerpts as lead magnets to grow an email list.

- Flip into an e-book, coaching program, or financial guide for additional revenue streams.

Licensing Terms

Permissions:

- Sell, edit, and repurpose content

- Claim copyright with 75% modification

- Use in coaching, e-courses, membership sites, or digital products

Restrictions:

- No transfer of PLR rights

- Max affiliate commission: 75%

- Cannot give full content away for free

- Cannot bundle without additional purchase

Why This PLR Course is a Must-Have

- 20,807 words of structured, actionable content

- Covers budgeting, cutting expenses, boosting savings, increasing income, and building long-term habits

- Includes checklists, FAQs, and sales copy ready for use

- Fully editable and PLR-ready for coaches, bloggers, and entrepreneurs

- Helps users achieve financial freedom and confidence

Take action today and help your audience develop life-changing financial habits while building your business!

has been added to your cart!

have been added to your cart!

Here A Sample of Saving Money Challenge PLR Course

To help you save money effectively by developing smart habits, eliminating wasteful spending, and setting clear financial goals—all while keeping the process fun and motivating!

Module 1: Setting the Foundation for Saving

Before we start saving, let’s build a solid foundation!

Step 1: Define Your “Why” for Saving

Saving money isn’t just about putting aside a portion of your income—it’s about giving your money a purpose. Without a clear motivation, saving can feel like an obligation rather than an empowering habit. This step will help you identify why you want to save, set meaningful financial goals, and create a strong foundation for long-term financial success.

1. Understanding the Power of a Clear Financial Goal

Think of saving money as a journey. Every journey needs a destination, and that destination is your financial goal. Without a goal, it’s easy to lose motivation and revert to old spending habits.

To make saving easier and more intentional, ask yourself:

- What am I saving for? (A specific event, long-term security, or personal growth?)

- How much do I need to save? (A specific number makes the goal more concrete.)

- Why is this goal important to me? (Emotional connection increases commitment.)

Some common reasons why people save include:

- A vacation or travel experience – Explore a new country, visit loved ones, or take a break.

- An emergency fund – Protect yourself from unexpected expenses like medical bills or car repairs.

- Early retirement – Gain financial freedom and stop working earlier than the traditional retirement age.

- Buying a home – Save for a down payment to secure a comfortable place to live.

- Starting a business – Invest in turning your passion into a source of income.

- Education and skill development – Save for higher education or professional training.

Your why should be specific and personally meaningful. The stronger your reason, the easier it will be to stay committed when challenges arise.

2. Choosing Your Top Three Financial Goals

Now that you have thought about your why, it’s time to narrow it down to your top three financial goals. Choosing three instead of just one ensures that you are balancing short-term and long-term priorities.

How to Choose the Right Goals:

- Pick One Short-Term Goal (0–12 months) – A small, achievable goal that builds confidence.

- Example: Saving $1,000 for an emergency fund within six months.

- Example: Saving $1,000 for an emergency fund within six months.

- Pick One Medium-Term Goal (1–5 years) – A goal that requires more effort but is still within reach.

- Example: Saving $10,000 for a down payment on a house.

- Example: Saving $10,000 for a down payment on a house.

- Pick One Long-Term Goal (5+ years) – A major financial milestone that provides long-term security.

- Example: Saving $500,000 for early retirement.

Write your three chosen goals clearly. Make sure they are realistic, specific, and measurable.

3. Writing Down and Displaying Your Goals

Writing down your goals reinforces them in your mind and increases the likelihood of achieving them. A study conducted by Dr. Gail Matthews at the Dominican University of California found that people who write down their goals are 42% more likely to achieve them compared to those who don’t.

Best Practices for Writing Your Goals:

- Use clear numbers and deadlines (e.g., “Save $5,000 for a Europe trip by December 2025”).

- Use positive and motivational language (e.g., “I am building financial freedom for my future”).

- Break down big goals into smaller steps (e.g., “Save $100 per month for 24 months”).

Where to Keep Your Goals Visible:

- On paper in a notebook or planner – Ideal for daily reminders.

- As a note on your phone or tablet – Easy to check on the go.

- On a vision board – Use images and charts to visualize progress.

- As a sticky note on your mirror or workspace – A daily reminder to stay on track.

- In a financial app or savings tracker – Digital tools can automate progress tracking.

The more you see your goals, the more they will stay top-of-mind, keeping you motivated and focused.

4. Turning Your Goals into Action

Now that you have defined and written down your goals, it’s time to take the first step toward making them a reality. Here’s how:

- Open a Separate Savings Account – If you haven’t already, set up a dedicated savings account for your goals. Some banks allow you to create sub-accounts for specific purposes.

- Set an Automatic Savings Plan – Automate a portion of your income to be transferred to your savings account every month. Even small, consistent deposits add up over time.

- Eliminate Unnecessary Expenses – Start cutting back on non-essential spending to free up more money for your savings goals.

- Find an Accountability Partner – Share your goals with a friend or mentor who can encourage and support you.

Final Thoughts

Defining your why for saving is the most important step in building financial discipline. A clear goal will keep you motivated, help you make smarter financial decisions, and provide a sense of purpose to your savings efforts.

Now, take 5 minutes to write down your top three financial goals and place them where you will see them daily. The journey toward financial success starts with a single step—this is yours!

Step 2: Analyze Your Current Spending

Before you can successfully save money, you need to understand where your money is going. Many people struggle with saving not because they don’t earn enough, but because they don’t realize how much they’re spending on non-essential items. This step will help you take control of your finances by tracking your expenses, identifying patterns, and finding areas where you can cut back.

1. Tracking Your Expenses for the Last 30 Days

The first step to analyzing your spending is tracking every single expense for the past month. You need a clear picture of your financial habits to determine where adjustments can be made.

How to Track Your Expenses:

There are several methods to track your spending, so choose the one that fits your lifestyle:

- Use a Budgeting App – Apps like Mint, YNAB (You Need A Budget), or PocketGuard automatically categorize your transactions when linked to your bank account.

- Check Your Bank and Credit Card Statements – Review your past transactions and manually record them in a spreadsheet or notebook.

- Keep a Daily Spending Journal – Write down every expense as soon as you make a purchase.

- Use a Simple Spreadsheet – List your income and expenses in a digital file to track spending trends.

What to Include in Your Tracking:

- Fixed Expenses – These are consistent payments, such as rent, mortgage, insurance, and loan payments.

- Variable Expenses – These fluctuate monthly, including groceries, gas, and utility bills.

- Discretionary Spending – Non-essential purchases, such as entertainment, dining out, and impulse buys.

- Hidden Expenses – Subscription services, membership fees, and small daily expenses like coffee or snacks.

Make sure to track every transaction, no matter how small. A few dollars spent daily on coffee or snacks can add up to a significant amount over time.

2. Identifying Spending Patterns

Once you’ve gathered a full month’s worth of data, it’s time to look for spending trends and behaviors. Identifying these patterns will help you determine where your money is going and where you can make improvements.

Key Questions to Ask:

- Where does most of my money go? – Are essential expenses taking up most of your income, or is a large portion spent on entertainment and luxuries?

- Do I spend more on weekends or weekdays? – Some people spend more on weekends due to dining out or leisure activities.

- Do I make impulsive purchases? – Identify whether you’re making unnecessary purchases due to emotional spending or marketing influence.

- Are there expenses I forgot about? – Look for unused subscriptions, auto-renewing memberships, or one-time purchases that add up.

- Do I spend more on card payments or cash? – If most of your spending is digital, you may not notice how quickly small purchases accumulate.

Recognizing Spending Triggers:

- Emotional Spending – Buying items when stressed, bored, or celebrating.

- Marketing Influence – Being tempted by discounts, sales, or advertisements.

- Convenience Purchases – Paying extra for takeout, delivery, or quick checkout items.

- Social Pressure – Spending money to keep up with friends or social expectations.

By recognizing these patterns, you can start making intentional financial decisions rather than reacting to habits or emotions.

3. Highlighting Areas to Cut Back

Now that you have a clear view of your expenses, it’s time to identify areas where you can reduce spending without sacrificing quality of life.

How to Find Opportunities for Saving:

- Cancel Unused Subscriptions – Check for streaming services, gym memberships, or magazine subscriptions you don’t use often.

- Reduce Eating Out – Try meal prepping at home instead of ordering takeout.

- Switch to Generic Brands – Many store-brand products offer the same quality as name brands at a lower price.

- Limit Impulse Buying – Wait 24 hours before making non-essential purchases.

- Use Public Transport or Carpooling – Reduce gas and parking costs by exploring alternative transport methods.

- Negotiate Bills – Call your internet, insurance, or phone provider to ask for better rates.

- Set a Weekly Spending Limit – Allocate a fixed amount for discretionary expenses and stick to it.

Identifying “Wants” vs. “Needs”

- Needs – Essential for survival and daily living (housing, food, healthcare, utilities).

- Wants – Non-essential but enjoyable expenses (entertainment, designer clothes, vacations).

Cutting back on wants doesn’t mean eliminating them completely—it’s about finding a balance that allows you to save while still enjoying life.

4. Creating a Spending Plan for Better Financial Control

Now that you’ve identified unnecessary expenses, it’s time to build a spending plan that aligns with your savings goals. A spending plan isn’t about restriction—it’s about making conscious choices that help you reach financial stability.

Steps to Create a Spending Plan:

- List Your Monthly Income – Include salary, freelance earnings, rental income, or any other sources.

- Categorize Your Expenses – Divide spending into essential and non-essential categories.

- Set Limits for Each Category – Allocate a fixed percentage of your income to each expense type.

- Automate Savings – Set up automatic transfers to your savings account before spending on anything else.

- Review and Adjust Monthly – Analyze your progress every month and make changes as needed.

Example of a Simple Budget Breakdown:

- 50% Needs (Rent, utilities, groceries, healthcare)

- 30% Wants (Entertainment, dining, shopping)

- 20% Savings (Emergency fund, retirement, investments)

If you find that your discretionary spending is too high, adjust your plan accordingly. The goal is to prioritize saving while maintaining a sustainable lifestyle.

Final Thoughts

Analyzing your current spending is a critical step in achieving financial freedom. By tracking your expenses, identifying spending patterns, and making conscious adjustments, you can take full control of your financial future.

Take 10 minutes today to review your last 30 days of spending. Write down three things you can immediately cut back on, and start making small changes that will have a big impact on your savings journey.

Step 3: Create a Realistic Budget

Now that you have analyzed your current spending, it’s time to take control of your finances by creating a realistic budget. A budget is not about restricting yourself—it’s about allocating your money wisely to ensure you meet your financial goals while still covering necessary expenses.

In this step, you will learn how to:

- Categorize your expenses into needs, wants, and savings.

- Allocate a fixed percentage of your income to each category.

- Stick to your budget and make adjustments when necessary.

By following this structured approach, you will gain financial stability, reduce unnecessary expenses, and save consistently.

1. Categorizing Your Expenses: Needs, Wants, and Savings

A successful budget starts with understanding where your money should go. Your income should be divided into three main categories:

A. Needs (Essential Expenses)

These are expenses you must pay to maintain a basic standard of living. They include:

- Housing – Rent or mortgage payments.

- Utilities – Electricity, water, gas, and internet bills.

- Groceries – Essential food and household items.

- Healthcare – Insurance, medications, and medical expenses.

- Transportation – Public transport, car payments, fuel, and maintenance.

- Debt Repayments – Minimum payments on loans and credit cards.

These expenses should generally make up 50-60% of your total income, but this percentage can vary based on your financial situation and location.

B. Wants (Non-Essential Expenses)

These are discretionary expenses—things that improve your lifestyle but are not strictly necessary. They include:

- Dining out – Restaurants, takeout, and coffee shops.

- Entertainment – Streaming services, movies, concerts, and hobbies.

- Shopping – Clothing, gadgets, and accessories.

- Luxury Services – Spa treatments, personal trainers, and high-end subscriptions.

Limit this category to 20-30% of your income to ensure that your spending doesn’t interfere with your financial goals.

C. Savings and Investments

This is the most important category for building financial security. Your savings should cover:

- Emergency Fund – 3-6 months’ worth of living expenses.

- Retirement Savings – Contributions to pension funds, 401(k), or IRAs.

- Investments – Stocks, real estate, mutual funds, or other assets.

- Debt Repayment (Above Minimum) – Paying off debts faster to reduce interest costs.

Aim to save at least 20% of your income, adjusting as needed to meet your personal goals.

2. Allocating a Fixed Percentage to Each Category

Once you have categorized your expenses, you need to allocate a fixed percentage of your income to each category. The 50/30/20 rule is a popular method:

- 50% Needs (Essentials: housing, food, utilities, transportation, insurance)

- 30% Wants (Entertainment, shopping, dining out, luxury items)

- 20% Savings & Debt Repayment (Emergency fund, retirement, extra loan payments)

Example: Monthly Income of $3,000

- $1,500 for Needs

- $900 for Wants

- $600 for Savings & Debt Repayment

This method ensures that you can pay for essentials, enjoy life, and still save for the future. However, you can adjust these percentages based on your personal goals and financial situation.

Alternative Budgeting Methods:

If the 50/30/20 rule doesn’t fit your needs, try:

- The 70/20/10 Rule – 70% for needs and wants, 20% for savings, 10% for debt repayment.

- The Zero-Based Budget – Every dollar of income is assigned to a specific expense or saving goal.

- The Envelope Method – Cash is divided into envelopes for different categories (great for controlling discretionary spending).

Choose a system that works for your lifestyle and income level.

3. Sticking to Your Budget and Adjusting as Needed

Creating a budget is only the first step—the real challenge is sticking to it consistently. Here’s how to make your budget work in real life:

A. Track Your Spending Regularly

- Use a budgeting app (Mint, YNAB, PocketGuard) or a spreadsheet to record expenses.

- Keep receipts or use bank statements to monitor spending.

- Review your spending weekly to ensure you’re staying within your limits.

B. Set Spending Limits for Non-Essentials

- Give yourself a weekly allowance for entertainment and dining out.

- Avoid impulse purchases by using the 24-hour rule—wait a day before buying non-essential items.

- Use cash or a prepaid card for discretionary spending to prevent overspending.

C. Automate Your Savings

- Set up automatic transfers to your savings account every payday.

- Use apps that round up purchases and save the difference (e.g., Acorns).

- Open a separate savings account to prevent easy access to your funds.

D. Review Your Budget Monthly

- Check if you stayed within your limits for each category.

- Adjust your spending percentages if needed.

- Increase your savings rate whenever possible.

If you consistently overspend in one category, find areas where you can cut back. A budget should be flexible and realistic, not a source of stress.

4. Making Your Budget Sustainable

A budget is only effective if you can maintain it long-term. Follow these strategies to ensure your budget is sustainable:

A. Find Motivation for Sticking to Your Budget

- Set a clear financial goal (e.g., saving for a home, early retirement, or a dream vacation).

- Keep a visual reminder (e.g., a savings tracker, vision board).

- Reward yourself when you reach milestones (but stay within budget).

B. Avoid Budgeting Mistakes

- Being Too Strict – Allow room for fun so you don’t feel deprived.

- Not Tracking Small Expenses – Even small daily purchases add up.

- Ignoring Emergency Savings – Always have a financial safety net.

- Relying on Credit Cards – Avoid debt by sticking to your spending plan.

C. Get Support

- Involve Your Family – Ensure everyone in the household follows the budget.

- Find an Accountability Partner – A friend or financial coach can help keep you on track.

- Join Online Communities – Forums and social media groups can provide tips and encouragement.

The key to successful budgeting is consistency. Even if you make mistakes, learn from them and adjust your approach.

Final Thoughts

Creating a realistic budget is the foundation of financial success. By categorizing your expenses, allocating a fixed percentage to each category, and following through with your plan, you will:

✅ Gain control over your finances.

✅ Reduce unnecessary expenses.

✅ Save consistently for your future goals.

Action Step: Take 30 minutes today to categorize your expenses and set up your budget. Make it simple, realistic, and sustainable!

Step 4: Set a Savings Goal for This Challenge

Now that you have a clear budget in place, it’s time to set a specific savings goal for the next 30 days. A goal provides motivation, direction, and accountability, helping you stay focused on your financial progress.

In this step, you will learn how to:

- Choose a realistic savings target that aligns with your budget.

- Break it down into weekly or even daily mini-goals to make saving more manageable.

- Track your progress to stay motivated and make adjustments as needed.

By the end of this step, you will have a clear and achievable goal, setting you up for success in your savings challenge.

1. Choosing a Realistic Savings Target for 30 Days

Your savings target should be challenging but achievable within the next 30 days. Setting an unrealistic goal might lead to frustration, while setting a too-easy goal may not push you enough to develop better financial habits.

How to Determine Your Savings Target:

A. Consider Your Income and Expenses

- Review your budget from Step 3 and determine how much you can reasonably set aside.

- Avoid setting a target that requires you to sacrifice essential expenses like rent, food, or medical costs.

- Ensure your goal fits your lifestyle—for example, if you have a family, your expenses will differ from someone living alone.

B. Use a Percentage-Based Approach

A simple way to set a savings target is by saving a percentage of your income rather than a fixed amount. This makes the goal more flexible and achievable for different income levels.

- Beginner Level: Save 5-10% of your income.

- Intermediate Level: Save 15-20% of your income.

- Advanced Level: Save 25-30% of your income (if your expenses allow).

C. Set a Fixed Amount Based on Your Goal

If you have a specific savings goal in mind (e.g., a vacation, emergency fund, or paying off debt), calculate how much you need and divide it over 30 days.

Examples:

- If you want to save $300 in 30 days, that’s $10 per day.

- If you aim to save $600 in 30 days, that’s $20 per day.

- If you plan to build an emergency fund of $1,000, you might set a three-month challenge instead.

Key Tip: If this is your first savings challenge, start with a smaller goal and increase it over time.

2. Breaking It Down Into Weekly or Daily Mini-Goals

Saving large amounts at once can feel overwhelming, but breaking it down into small, achievable steps makes it easier to stay on track.

A. Weekly Breakdown

Dividing your goal into weekly milestones ensures you stay consistent and adjust your plan if needed.

Example:

- Goal: Save $400 in 30 days

- Weekly Target: Save $100 per week

- Track your progress every Sunday and adjust if necessary.

B. Daily Breakdown

For even greater accountability, break your savings target into daily mini-goals.

Example:

- Goal: Save $300 in 30 days

- Daily Target: Save $10 per day

By saving a small amount daily, you make the process automatic and effortless.

C. Use a Savings Tracker

To keep yourself motivated, use:

- A savings chart where you mark off each day or week when you hit your target.

- A spreadsheet or app (like Mint, YNAB, or Goodbudget) to track your progress.

- A physical jar where you deposit small amounts daily (useful if saving cash).

3. Methods to Reach Your Savings Goal Faster

Once you have set your target, use these strategies to boost your savings and make the challenge easier to complete.

A. Automate Your Savings

- Set up an automatic transfer from your checking account to your savings account every payday.

- Use apps like Acorns or Digit, which round up your purchases and save the spare change.

B. Reduce Unnecessary Expenses

- Cut out small daily expenses (e.g., buying coffee, dining out, or unused subscriptions).

- Use discount codes or coupons when shopping.

- Find free alternatives for entertainment (e.g., free streaming services, library books, community events).

C. Earn Extra Money

- Sell unused items (clothing, gadgets, furniture) on online marketplaces.

- Take on freelance or side gigs (writing, design, tutoring, or online surveys).

- Offer a paid skill or service (pet-sitting, babysitting, photography, etc.).

D. Save Unexpected Money

- Put any bonus, tax refund, or gift money directly into savings.

- If you receive a raise, save the extra amount instead of increasing your spending.

4. Staying Motivated and Overcoming Challenges

Many people start a savings challenge but struggle to stay consistent. Here’s how to keep going:

A. Track Your Progress and Celebrate Small Wins

- Check your progress daily or weekly to see how close you are to your goal.

- Celebrate when you reach halfway milestones (e.g., saving $150 out of $300).

- Reward yourself with free or low-cost treats (e.g., a relaxing day at home, a fun DIY project).

B. Have an Accountability Partner

- Find a friend, family member, or online group to join the challenge with you.

- Share weekly updates and encourage each other to stick to the plan.

C. Adjust When Needed

- If an emergency comes up, don’t quit—simply adjust your goal and keep going.

- If you save extra one week, roll it over to cover weeks where you might fall short.

D. Keep Your End Goal in Mind

- Place a visual reminder somewhere you can see it daily (e.g., a picture of your dream vacation or new home).

- Remind yourself why saving is important and how it will improve your financial future.

Final Thoughts

By setting a realistic savings goal, breaking it down into manageable mini-goals, and tracking your progress, you are creating strong financial habits that will help you succeed long-term.

Action Steps for Today:

- Decide on your 30-day savings goal (e.g., $300, $500, or another realistic amount).

- Break it down into weekly and daily targets to make it more achievable.

- Write down your goal and place it somewhere visible to stay motivated.

- Use a savings tracker or app to monitor your progress daily.

Take the first step today—your future self will thank you!

We’re also giving these extra bonuses

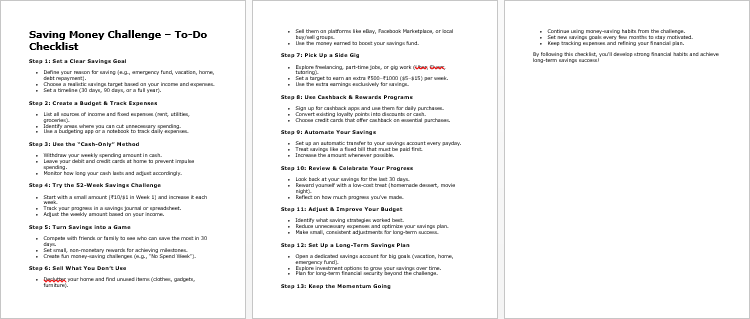

Saving Money Challenge – Checklist

Saving Money Challenge – FAQs

Saving Money Challenge – Salespage Content

Package Details:

Word Count: 20 807 Words

Number of Pages: 109

Saving Money Challenge – Bonus Content

Checklist

Word Count: 479 words

FAQs

Word Count: 776 words

Salespage Content

Word Count: 514 words

Total Word Count: 22 576 Words

Your PLR License Terms

PERMISSIONS: What Can You Do With These Materials?

Sell the content basically as it is (with some minor tweaks to make it “yours”).

If you are going to claim copyright to anything created with this content, then you must substantially change at 75% of the content to distinguish yourself from other licensees.

Break up the content into small portions to sell as individual reports for $10-$20 each.

Bundle the content with other existing content to create larger products for $47-$97 each.

Setup your own membership site with the content and generate monthly residual payments!

Take the content and convert it into a multiple-week “eclass” that you charge $297-$497 to access!

Use the content to create a “physical” product that you sell for premium prices!

Convert it to audios, videos, membership site content and more.

Excerpt and / or edit portions of the content to give away for free as blog posts, reports, etc. to use as lead magnets, incentives and more!

Create your own original product from it, set it up at a site and “flip” the site for megabucks!

RESTRICTIONS: What Can’t You Do With These Materials?

To protect the value of these products, you may not pass on the rights to your customers. This means that your customers may not have PLR rights or reprint / resell rights passed on to them.

You may not pass on any kind of licensing (PLR, reprint / resell, etc.) to ANY offer created from ANY PORTION OF this content that would allow additional people to sell or give away any portion of the content contained in this package.

You may not offer 100% commission to affiliates selling your version / copy of this product. The maximum affiliate commission you may pay out for offers created that include parts of this content is 75%.

You are not permitted to give the complete materials away in their current state for free – they must be sold. They must be excerpted and / or edited to be given away, unless otherwise noted. Example: You ARE permitted to excerpt portions of content for blog posts, lead magnets, etc.

You may not add this content to any part of an existing customer order that would not require them to make an additional purchase. (IE You cannot add it to a package, membership site, etc. that customers have ALREADY paid for.)

Share Now!