Wealth Creation PLR Course 21k Words

in Entrepreneur PLR , Entrepreneur PLR Ebooks , Finance PLR , Finance PLR Ebooks , Make Money Online PLR Ebooks , Make Money PLR , PLR Checklists , PLR eBooks , PLR eCourses , PLR List Building Reports , Premium PLR , Premium PLR eBooks , Premium PLR Reports , Premium White Label Brandable PLR Coaching Courses , Private Label Rights ProductsChoose Your Desired Option(s)

has been added to your cart!

have been added to your cart!

#wealthcreation #financialfreedom #moneymindset #businessmarketing #plrcontent #passiveincome #successtips #plrcourse #entrepreneurship

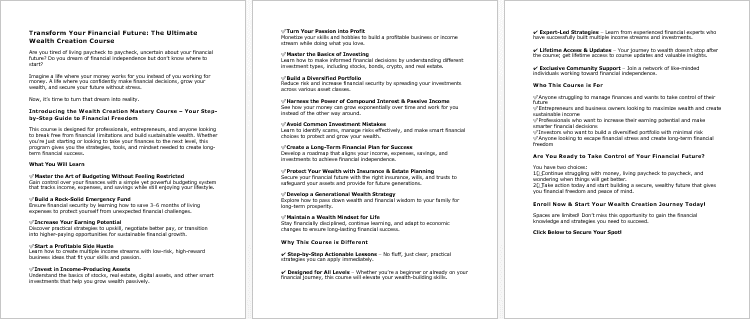

Wealth Creation PLR Course – The Complete Guide to Building, Growing & Sustaining Financial Success

Empower Your Audience to Take Control of Their Finances and Build Real Wealth — While You Profit from One of the Most Evergreen Niches in the World!

Everyone dreams of financial freedom — the ability to live life on their own terms, free from debt, stress, or limitations.

But for most people, wealth creation feels confusing and out of reach.

That’s where your brand-new Wealth Creation PLR Course comes in.

This done-for-you Private Label Rights course simplifies the process of building and managing wealth with step-by-step lessons, real-world strategies, and actionable tips anyone can apply — regardless of their starting point.

With over 19,000 words of high-quality content, you can resell, rebrand, or repurpose this complete course to educate, empower, and inspire your audience — while generating profit in one of the most lucrative niches online.

Presenting…

Wealth Creation PLR Course 21k Words

Why the Wealth Creation Niche Is Always in Demand

Money and personal finance are evergreen topics — people will always look for ways to earn more, save more, and invest smarter.

From young professionals trying to break free from paycheck-to-paycheck living to entrepreneurs striving for financial independence, the demand for wealth-building education never fades.

This course positions you as an authority in financial growth, giving your audience the knowledge and structure they need to build long-term prosperity — while giving you a ready-made digital asset you can sell for years to come.

Course Overview

The Wealth Creation PLR Course is a five-module training program that walks readers through every stage of wealth-building — from mindset and money management to income generation and long-term investment strategies.

Each module includes four focused lessons written in a friendly, conversational tone to ensure accessibility for beginners and relevance for experienced learners alike.

Module 1: Laying the Foundation for Wealth

Understanding the Basics & Setting the Right Mindset

Every journey to financial freedom begins with mindset and clarity. This module helps learners define what wealth means to them and lays the mental groundwork for success.

- Step 1: Define What Wealth Means to You

Wealth is more than just money — it’s freedom, security, and choice. Students reflect on their personal goals to create a meaningful vision of wealth. - Step 2: Master the Wealth Mindset

Introduces the key shift from scarcity thinking to abundance — showing how beliefs influence financial results. - Step 3: Set Clear Financial Goals

Learners set SMART goals that align with their definition of wealth, ensuring progress through structure and accountability. - Step 4: Understand the Power of Multiple Income Streams

Explains why relying on a single income source is risky and teaches how to start diversifying for long-term stability.

This module builds the foundation of every successful wealth strategy — mindset, clarity, and a defined direction.

Module 2: Smart Money Management

Budgeting, Saving & Handling Money Wisely

Building wealth starts with mastering your money. This module helps learners take control of their finances and make smarter daily decisions.

- Step 1: Create a Foolproof Budget

Teaches practical budgeting systems that don’t feel restrictive but still promote disciplined spending and saving. - Step 2: Build a Strong Emergency Fund

Explains how to create a safety net that prevents debt traps during unexpected financial challenges. - Step 3: Cut Unnecessary Expenses Without Sacrificing Quality of Life

Helps identify spending leaks while still maintaining enjoyment and balance. - Step 4: The Power of Paying Yourself First

A simple, proven wealth principle that ensures saving and investing happen before spending — not after.

This module turns financial chaos into control, giving readers a clear, repeatable system for managing money effectively.

Module 3: Income Growth Strategies

How to Make More Money the Smart Way

Once learners have control of their money, it’s time to increase their earning potential.

This module reveals practical strategies for growing income — whether through career advancement, side hustles, or smart investments.

- Step 1: Increase Your Earning Potential

Teaches how to upskill, seek promotions, and leverage existing strengths for higher income opportunities. - Step 2: Start a Profitable Side Hustle

Explores low-risk business ideas that generate additional income without quitting a day job. - Step 3: Invest in Income-Producing Assets

Introduces key investment options such as real estate, dividend stocks, and digital assets. - Step 4: Turn Your Passion into Profit

Shows how to monetize hobbies and interests through freelancing, online business, or content creation.

This module provides a roadmap for income expansion — a critical pillar in long-term wealth creation.

Module 4: Building Wealth Through Investments

Grow Your Money the Smart & Sustainable Way

Here, students discover how to make their money work for them through informed investment choices.

- Step 1: Master the Basics of Investing

A beginner-friendly introduction to stocks, bonds, real estate, and other investment vehicles. - Step 2: Build a Diversified Portfolio

Teaches risk management and the importance of spreading investments across asset classes. - Step 3: Understand Compound Interest & Passive Income

Explains how compounding builds exponential wealth — and how to create income that doesn’t require trading time for money. - Step 4: Avoid Common Investment Mistakes

Helps learners avoid traps like emotional investing, scams, and lack of due diligence.

This module empowers learners to grow their money confidently through strategy, patience, and smart risk management.

Module 5: Sustaining & Protecting Wealth

Ensuring Long-Term Financial Success

It’s not enough to build wealth — it must be protected and sustained for generations.

This final module focuses on maintaining financial discipline, protecting assets, and creating legacy wealth.

- Step 1: Create a Financial Plan for Long-Term Success

Students learn how to create a living, adaptable plan that guides all financial decisions. - Step 2: Protect Your Wealth with Insurance & Estate Planning

Explains how to secure finances through insurance, wills, and trusts — ensuring peace of mind. - Step 3: Develop a Generational Wealth Strategy

Introduces the concept of passing wealth and knowledge to the next generation responsibly. - Step 4: Maintain a Wealth Mindset for Life

Encourages ongoing learning, adaptability, and emotional intelligence in money matters.

This final module ensures learners not only create wealth but preserve it for life and beyond.

What’s Included in the PLR Package

When you purchase the Wealth Creation PLR Course, you’ll receive everything you need to start selling, teaching, or repurposing this content immediately:

- Full 19,057-Word Course Content

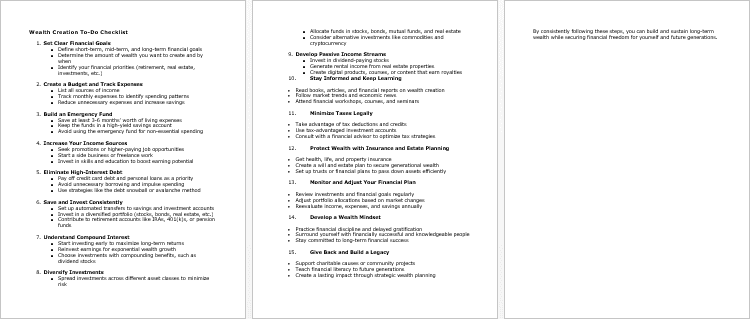

Five complete modules, each with four steps written in clear, easy-to-understand language. - Wealth Creation Checklist (475 Words)

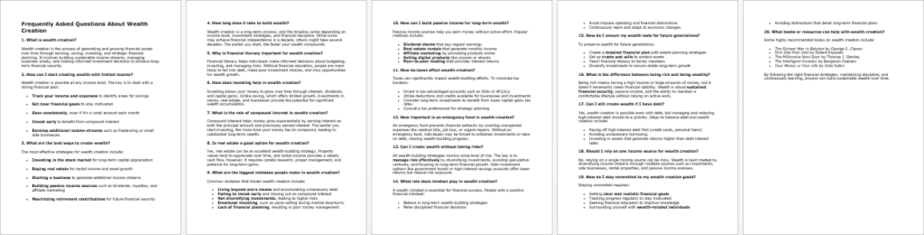

A practical, printable summary for readers to stay on track and implement what they learn. - FAQs (1,043 Words)

Addresses common financial questions and clarifies core wealth principles. - Done-for-You Sales Page Copy (732 Words)

Professionally written copy ready for your website or sales funnel.

Why This PLR Course Is Perfect for You

This Wealth Creation PLR Course gives you an instant, ready-to-sell digital product that’s educational, empowering, and profitable.

✅ Evergreen Niche: Personal finance and wealth education never go out of style.

✅ Actionable Content: Every module includes real-world strategies people can implement immediately.

✅ Fully Editable: Customize it, rebrand it, or merge it with your other financial PLR products.

✅ Perfect for Coaches, Bloggers, and Course Creators: Use it as a lead magnet, mini-course, or premium training.

✅ High-Perceived Value: Financial education courses sell for $97–$497 — and you get to keep 100% of the profit.

✅ No Creation Hassle: Save months of writing and research — everything is already done for you.

Ways to Profit from This Course

Here are multiple ways to turn this content into consistent income:

- Sell It as a Standalone Course

Offer it on your website, membership portal, or course platform like Thinkific or Teachable. - Bundle It with Other PLR Finance Products

Combine it with related content such as Smart Budgeting or Passive Income Mastery and sell as a “Financial Freedom Bundle.” - Convert It into a Video or Audio Training

Record the course and create a multimedia product with higher perceived value. - Use It for a Membership Site

Deliver each module weekly to paying subscribers for recurring income. - Turn It into a Lead Generation Funnel

Offer the first module or checklist for free and upsell the full course. - Offer It as a Coaching Program Resource

Use it as part of your 1-on-1 or group coaching sessions on financial growth. - Flip It for Profit

Rebrand it with your own logo and resell the entire course or website as a “ready-to-sell financial education business.”

License Terms

You CAN:

✅ Edit, rebrand, and sell as your own product.

✅ Convert into audio, video, or eLearning content.

✅ Add to a paid membership or course bundle.

✅ Use sections as lead magnets, blog posts, or email content.

You CANNOT:

❌ Pass on or resell PLR rights to your customers.

❌ Give away the full course for free.

❌ Offer 100% affiliate commissions (max 75%).

Start Building Wealth and Profit from the Financial Freedom Niche Today!

The Wealth Creation PLR Course gives you a complete, ready-to-sell product in one of the world’s most profitable and enduring markets.

You’ll help your audience master the mindset and strategies of true wealth, while establishing yourself as a trusted authority in personal finance.

Here’s what you get:

✅ 19,000+ words of professional, ready-to-edit content

✅ 5 actionable modules + checklist and FAQs

✅ Full PLR rights to sell, teach, or repurpose

✅ High-demand, evergreen niche content

Start selling your own Wealth Creation Course today — and turn financial education into financial freedom! 💰

has been added to your cart!

have been added to your cart!

Here A Sample of Wealth Creation PLR Course

This course is divided into 5 modules, each with 4 simple steps to guide you on your wealth creation journey.

Module 1: Laying the Foundation for Wealth

(Understanding the basics and setting the right mindset)

Step 1: Define What Wealth Means to You

Wealth is more than just money in the bank. It represents financial freedom, security, and the ability to make choices that align with your personal and professional aspirations. Before you embark on the journey of wealth creation, it is essential to define what wealth truly means to you.

Understanding Wealth Beyond Money

Many people associate wealth with large sums of money, luxury possessions, or a high-income lifestyle. While financial resources play a significant role, true wealth encompasses much more than just monetary success. Wealth includes time freedom, the ability to support loved ones, access to quality healthcare and education, and the capacity to make choices without financial constraints.

For some, wealth means having enough passive income to cover their living expenses without having to work a traditional job. For others, it may mean the ability to travel the world, invest in passion projects, or support charitable causes. Defining your own version of wealth allows you to set meaningful financial goals and create a strategy that aligns with your values.

Reflecting on Your Personal Wealth Definition

Take a moment to reflect on what wealth means to you. Consider the following questions:

- What does financial freedom look like in your life?

- How would you like to use your wealth to impact yourself, your family, and your community?

- Do you value material possessions, experiences, or the ability to give back?

- What kind of lifestyle do you envision when you think of being wealthy?

By answering these questions, you will begin to develop a clearer understanding of your personal definition of wealth. This step is crucial because it helps you establish a financial roadmap tailored to your unique goals rather than someone else’s idea of success.

Creating a Vision of Your Ideal Wealth

Once you have identified what wealth means to you, take the next step by creating a clear vision of your ideal wealthy life. Write down a detailed description of your desired financial future, including where you live, how you spend your time, the work you do (if any), and the level of financial security you have.

Consider visualizing your wealth journey through a vision board or journal. Collect images, quotes, or financial milestones that represent your goals. This practice helps reinforce your motivation and keeps you focused on your path to wealth creation.

Aligning Your Wealth Definition with Your Life Goals

Your wealth goals should align with your broader life aspirations. If your definition of wealth includes freedom of time, your strategy should focus on building passive income streams. If security is a priority, your focus may be on savings, investments, and risk management. If giving back is important to you, your financial plan should include philanthropic efforts or community projects.

Understanding that wealth is personal ensures that your journey is fulfilling and purpose-driven. It prevents you from chasing financial success that does not align with your true desires. When you define wealth on your own terms, you create a financial strategy that supports both your short-term and long-term goals.

Taking Action: Defining Your Wealth Statement

To make this step actionable, write a personal wealth statement that summarizes your vision of wealth. This statement should be clear, specific, and inspiring.

For example:

“Wealth, to me, means financial freedom, the ability to work on projects I love, and the security to provide a comfortable life for my family. It means having enough passive income to cover my essential expenses, the ability to travel without financial stress, and the freedom to contribute to causes that matter to me.”

Your wealth statement serves as a guiding principle throughout your financial journey. It helps you stay focused, make informed financial decisions, and measure progress toward your vision of wealth.

By taking the time to define what wealth means to you, you lay the foundation for a successful wealth-building strategy. Without a clear definition, it is easy to chase financial goals that do not truly fulfill you. Understanding your personal wealth vision ensures that every financial decision you make brings you closer to the life you truly desire.

Step 2: Master the Wealth Mindset

Wealth is not just about financial strategies and investments. It begins with the way you think. Your mindset plays a crucial role in shaping your financial reality. Many people remain stuck in financial struggles not because of a lack of opportunity but because of limiting beliefs about money. To build lasting wealth, you must shift your thinking from a scarcity mindset to an abundance mindset.

Understanding the Scarcity Mindset

The scarcity mindset is the belief that resources, opportunities, and wealth are limited. It fosters fear, anxiety, and hesitation around money. People with a scarcity mindset often believe that wealth is only for a select few or that financial success comes at the expense of others. They may fear spending money, avoid taking financial risks, or believe that earning more is beyond their reach.

A scarcity mindset manifests in thoughts such as:

- There is never enough money.

- Making money is difficult and only possible for a lucky few.

- If someone else becomes wealthy, it means there is less for me.

- I have to work extremely hard to deserve financial success.

- Investing is risky, and I might lose everything.

These beliefs create mental blocks that prevent financial growth. They keep individuals trapped in low-paying jobs, hesitant to start businesses, and fearful of making investments that could improve their financial situation. Recognizing these limiting thoughts is the first step toward changing them.

Shifting to an Abundance Mindset

An abundance mindset is the belief that wealth, opportunities, and success are unlimited. It allows you to see possibilities instead of obstacles. People with an abundance mindset believe that money is a tool that can be earned, multiplied, and used to create positive change. They view setbacks as learning experiences rather than failures and remain open to financial growth.

Developing an abundance mindset involves changing the way you think about money and success. Instead of saying, “I can’t afford this,” reframe your thinking to “How can I afford this?” Instead of fearing financial loss, focus on the potential for gain. By seeing wealth as something that grows rather than something that is scarce, you create new opportunities for financial success.

Reprogramming Your Thoughts About Money

To truly master the wealth mindset, you must actively reprogram the way you think about money. This requires daily mental exercises and intentional changes in behavior. Consider incorporating the following practices into your routine:

- Practice Gratitude for Financial Growth

Start by appreciating the financial resources you already have. Gratitude shifts your focus from what you lack to what you possess, creating a positive relationship with money. Each day, acknowledge the income you receive, the opportunities available to you, and the financial progress you make. - Surround Yourself with Financially Successful People

The people you associate with influence your mindset. Spend time with individuals who have a healthy relationship with money, who invest wisely, and who believe in financial growth. Their perspectives will help you develop confidence in your own financial journey. - Challenge Negative Money Beliefs

Identify any limiting beliefs you hold about money and actively challenge them. If you believe that making money is difficult, seek out success stories of people who built wealth from nothing. If you fear investing, educate yourself on financial strategies that minimize risk. Replace negative money beliefs with empowering thoughts. - Adopt a Growth-Oriented Financial Perspective

Instead of seeing money as something that is fixed or limited, recognize that your financial situation is always evolving. Skills can be learned, income can increase, and wealth can be built with the right strategies. Adopt a long-term perspective and commit to continuous financial learning.

Taking Control of Your Financial Mindset

Mastering the wealth mindset requires a shift from passive financial habits to active financial control. This means taking responsibility for your financial future instead of relying on external circumstances. Wealth does not happen by chance; it is the result of intentional decisions and a confident mindset.

Developing a wealth-oriented mindset is not an overnight process. It takes time, practice, and commitment to change deeply ingrained beliefs. However, by consistently reinforcing positive financial thinking, you set yourself up for long-term success. Your mindset determines your financial actions, and your actions ultimately create your wealth.

When you master the wealth mindset, financial opportunities become clearer, risk becomes manageable, and the path to wealth becomes achievable. It all starts with changing the way you think about money.

Step 3: Set Clear Financial Goals

Wealth is not built by chance. It requires clear direction, structured planning, and intentional action. Setting financial goals gives you a roadmap to follow, ensuring that every decision you make moves you closer to your vision of wealth. Without clear goals, financial success remains vague and unstructured.

One of the most effective methods for setting financial goals is using the SMART framework. SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound. This approach helps you create well-defined goals that can be tracked and achieved systematically.

Defining Your Financial Goals with the SMART Method

A financial goal must be more than just a broad statement like “I want to be rich” or “I want financial freedom.” These general goals lack direction and do not provide a clear path to follow. By applying the SMART criteria, you can turn your financial vision into actionable steps.

- Specific – Your goal should be clear and precise, answering the questions: What do you want to achieve? Why is this goal important?

- Measurable – You need a way to track progress and determine when you have reached your goal.

- Achievable – Your goal should challenge you but still be realistic based on your financial situation.

- Relevant – It should align with your personal definition of wealth and overall financial vision.

- Time-bound – Every goal should have a deadline to create urgency and accountability.

Creating SMART Financial Goals

To illustrate how the SMART framework works, consider the difference between a vague goal and a well-defined goal:

- Vague goal: “I want to save money.”

- SMART goal: “I will save $10,000 in the next 12 months by setting aside $850 per month from my income.”

This SMART goal is specific (saving a set amount), measurable (progress can be tracked monthly), achievable (based on an income assessment), relevant (it aligns with the overall financial plan), and time-bound (it has a clear deadline).

Here are examples of SMART financial goals in different areas of wealth creation:

- Savings Goal: “I will build an emergency fund of $5,000 within six months by saving $200 per week.”

- Investment Goal: “I will invest $500 per month into index funds for the next five years to build long-term wealth.”

- Debt Reduction Goal: “I will pay off $20,000 in credit card debt in two years by making extra payments of $1,000 per month.”

- Income Growth Goal: “I will increase my annual income by 30 percent in the next 18 months by acquiring new certifications and applying for higher-paying job opportunities.”

By setting SMART financial goals, you create a clear structure that helps you track progress and stay accountable.

Breaking Down Large Financial Goals into Manageable Steps

Some financial goals, such as becoming debt-free or achieving financial independence, may take years to accomplish. Breaking these goals into smaller, manageable steps makes them less overwhelming and easier to achieve.

For example, if your goal is to build a $100,000 investment portfolio within five years, you can break it down as follows:

- Year 1: Save and invest $20,000

- Year 2: Increase investment contributions by 10 percent

- Year 3: Diversify investments to reduce risk

- Year 4: Maximize contributions to retirement accounts

- Year 5: Reach the $100,000 milestone

By dividing large goals into smaller milestones, you create a sense of progress and motivation along the way.

Tracking Your Financial Goals and Making Adjustments

Once you have set your financial goals, tracking your progress is essential. Regularly reviewing your financial plan helps you stay on track and make necessary adjustments.

Use financial tracking tools or spreadsheets to monitor savings, expenses, investments, and debt repayments. If you find that you are not meeting your targets, analyze the reasons and make the necessary changes. You may need to cut unnecessary expenses, find additional sources of income, or adjust the timeline for your goals.

Staying flexible while maintaining focus is key. Financial circumstances can change, and your goals should be adaptable to reflect new opportunities and challenges.

Committing to Your Financial Goals

Setting clear financial goals is a commitment to your future wealth. It provides clarity, motivation, and a sense of purpose in your financial journey. When you define what you want to achieve and develop a structured plan to get there, you increase your chances of long-term success.

Every financial decision you make should align with your goals. By staying consistent, tracking progress, and making adjustments when necessary, you will be able to build the wealth you desire.

Step 4: Understand the Power of Multiple Income Streams

Building wealth requires more than just saving money from a single source of income. True financial success comes from creating multiple income streams that provide stability, growth, and long-term security. Relying on a single paycheck leaves you vulnerable to financial setbacks, while multiple sources of income give you more freedom, flexibility, and opportunities for wealth creation.

Diversification is key to financial resilience. If one income stream slows down or stops, others can continue to support your financial goals. There are two main types of income streams: active income and passive income. Understanding how to balance both will help you achieve long-term financial independence.

Active Income: Trading Time for Money

Active income is the money you earn through direct effort, usually in exchange for your time, skills, or labor. This includes salaries, hourly wages, freelance work, consulting, and commissions. While active income is essential for meeting daily expenses, it has limitations.

- Limited time availability: Since active income is tied to your time, there are only so many hours you can work in a day.

- Dependence on one source: If you rely on a single job or client, your financial stability is at risk if that income source disappears.

- Lack of scalability: Your earnings are usually capped by salary limits, contract terms, or industry standards.

To maximize active income, consider ways to increase your earning potential. This could involve upgrading your skills, negotiating higher pay, taking on side projects, or diversifying client work. However, the ultimate goal should be to transition from purely active income to building passive income streams that generate money even when you are not working.

Passive Income: Earning Without Constant Effort

Passive income is money earned with little to no ongoing effort. It is generated from investments, royalties, rental income, online businesses, or automated revenue streams. Unlike active income, passive income allows you to earn money while you sleep, travel, or focus on other projects.

Some common sources of passive income include:

- Investments: Stocks, bonds, dividends, mutual funds, and exchange-traded funds (ETFs) generate income through market growth and interest.

- Real estate: Rental properties, vacation homes, and commercial spaces provide recurring income from tenants.

- Digital products: Selling e-books, online courses, templates, or software offers ongoing revenue without constant effort.

- Affiliate marketing: Promoting other companies’ products or services earns you commissions from sales.

- Automated online businesses: Dropshipping, print-on-demand, or subscription services generate income with minimal management.

The key to successful passive income is setting up systems that require initial effort but continue generating revenue long-term. Some passive income sources require upfront capital, while others can be started with minimal investment and grow over time.

Combining Active and Passive Income for Financial Security

The most financially secure individuals and businesses combine active and passive income streams to create a strong financial foundation. This approach allows you to use active income for immediate expenses while reinvesting profits into passive income opportunities.

For example, an entrepreneur may start by offering a service (active income), then reinvest profits into creating an online course or investment portfolio (passive income). Over time, as passive income grows, they can reduce reliance on active income, leading to financial independence.

Another example is a full-time employee who builds multiple income streams by:

- Working a stable job for salary income.

- Investing a portion of earnings in stocks or real estate.

- Starting a side business that generates passive income.

- Monetizing expertise through consulting or online courses.

By doing this, they reduce financial risk and create a pathway toward wealth and freedom.

How to Start Building Multiple Income Streams

To create multiple income streams, follow a step-by-step approach:

- Assess your current income and skills: Identify opportunities to increase earnings from your job, freelancing, or business.

- Start with one additional income source: Choose an income stream that aligns with your interests, expertise, and available time.

- Reinvest earnings: Use profits from active income to build passive income assets such as investments or digital products.

- Automate and scale: Set up systems to reduce time involvement and expand revenue streams.

- Continue diversifying: Explore new opportunities to ensure long-term financial security.

Creating multiple income streams takes time, but the effort is worth it. By diversifying income sources, you gain greater control over your financial future, reduce risk, and create lasting wealth.

We’re also giving these extra bonuses

Wealth Creation – Checklist

Wealth Creation – FAQs

Wealth Creation – Salespage Content

Package Details:

Word Count: 19 057 Words

Number of Pages: 79

Wealth Creation – Bonus Content

Checklist

Word Count: 475 words

FAQs

Word Count: 1043 words

Salespage Content

Word Count: 732 words

Total Word Count: 21 307 Words

Your PLR License Terms

PERMISSIONS: What Can You Do With These Materials?

Sell the content basically as it is (with some minor tweaks to make it “yours”).

If you are going to claim copyright to anything created with this content, then you must substantially change at 75% of the content to distinguish yourself from other licensees.

Break up the content into small portions to sell as individual reports for $10-$20 each.

Bundle the content with other existing content to create larger products for $47-$97 each.

Setup your own membership site with the content and generate monthly residual payments!

Take the content and convert it into a multiple-week “eclass” that you charge $297-$497 to access!

Use the content to create a “physical” product that you sell for premium prices!

Convert it to audios, videos, membership site content and more.

Excerpt and / or edit portions of the content to give away for free as blog posts, reports, etc. to use as lead magnets, incentives and more!

Create your own original product from it, set it up at a site and “flip” the site for megabucks!

RESTRICTIONS: What Can’t You Do With These Materials?

To protect the value of these products, you may not pass on the rights to your customers. This means that your customers may not have PLR rights or reprint / resell rights passed on to them.

You may not pass on any kind of licensing (PLR, reprint / resell, etc.) to ANY offer created from ANY PORTION OF this content that would allow additional people to sell or give away any portion of the content contained in this package.

You may not offer 100% commission to affiliates selling your version / copy of this product. The maximum affiliate commission you may pay out for offers created that include parts of this content is 75%.

You are not permitted to give the complete materials away in their current state for free – they must be sold. They must be excerpted and / or edited to be given away, unless otherwise noted. Example: You ARE permitted to excerpt portions of content for blog posts, lead magnets, etc.

You may not add this content to any part of an existing customer order that would not require them to make an additional purchase. (IE You cannot add it to a package, membership site, etc. that customers have ALREADY paid for.)

Share Now!