Retirement Planning PLR Course 24k Words

in Finance PLR , Finance PLR Ebooks , PLR Checklists , PLR eBooks , PLR eCourses , PLR List Building Reports , Premium PLR , Premium PLR eBooks , Premium PLR Reports , Premium White Label Brandable PLR Coaching Courses , Private Label Rights ProductsChoose Your Desired Option(s)

has been added to your cart!

have been added to your cart!

#retirementplanning #plrcourse #financialfreedom #wealthbuilding #moneymanagement #passiveincome #financialindependence #investsmart

Empower Your Audience to Plan for a Secure & Fulfilling Retirement – Sell This High-Demand PLR Course for Instant Profits!

Retirement planning is one of the most important and sought-after financial topics today. Millions of people are searching for guidance on how to retire comfortably, manage their finances, and maintain a high quality of life in their golden years.

With this Retirement Planning PLR Course, you get a ready-made, professionally written course that you can rebrand, customize, and sell as your own.

No content creation required! Simply download, edit, and launch your course to start making money today.

Presenting…

Retirement Planning PLR Course 24k Words

Why This PLR Course is a Smart Investment for You?

✅ Completely Done-for-You Course – Get a high-quality, fully researched course without spending hours writing or hiring a writer.

✅ Evergreen & High-Demand Niche – Retirement planning is a topic that never goes out of style, making it highly profitable year-round.

✅ Multiple Ways to Monetize – Sell it as an online course, coaching program, eBook, or premium content on your membership site.

✅ Position Yourself as an Expert – Offer valuable insights and financial strategies to build authority in the finance and wealth-planning niche.

✅ Instant Product to Sell – Save time and effort! Just download, brand, and start selling today.

What’s Inside the Retirement Planning PLR Course?

Module 1: Understanding Retirement Planning Basics

The foundation of a successful and stress-free retirement begins with understanding key financial principles.

- Defining Retirement Goals – Help learners create a clear vision of their dream retirement based on lifestyle, travel, and financial needs.

- Assessing Current Financial Status – Guide them through analyzing their savings, assets, debts, and expenses to determine where they stand.

- The Power of Compounding Interest – Teach the importance of early saving and how compound interest helps maximize long-term wealth.

- Exploring Retirement Accounts & Investment Tools – Cover options like 401(k), Roth IRA, pensions, mutual funds, and real estate investments.

Module 2: Setting Up a Retirement Fund for Long-Term Security

Learn how to build a solid financial foundation for a comfortable retirement.

- Creating a Realistic Budget for Retirement – Guide users on how to allocate funds efficiently for savings, healthcare, travel, and living expenses.

- Choosing the Right Retirement Accounts – Compare Traditional IRA, Roth IRA, and employer-sponsored 401(k) plans to find the best fit.

- Diversifying Investment Strategies – Explain the benefits of stocks, bonds, ETFs, and real estate for a balanced retirement portfolio.

- Monitoring & Adjusting Contributions – Teach how to increase savings over time and optimize investments based on age and risk tolerance.

Module 3: Planning for Health, Wellness & Medical Expenses

A fulfilling retirement isn’t just about money—it’s about staying healthy, active, and prepared for healthcare needs.

- Anticipating Healthcare Costs – Provide insights into Medicare, supplemental insurance, long-term care plans, and out-of-pocket expenses.

- Building an Emergency Health Fund – Help students create a dedicated health savings plan to cover unexpected medical bills.

- Maintaining a Healthy Lifestyle – Share expert advice on nutrition, fitness, mental wellness, and preventive healthcare.

- Discussing Healthcare Wishes with Family – Encourage open conversations about medical preferences, power of attorney, and end-of-life care.

Module 4: Lifestyle Planning for an Active & Enjoyable Retirement

Teach your audience how to make their golden years fulfilling, productive, and stress-free.

- Exploring New Passions & Hobbies – Help retirees discover meaningful activities, side projects, and personal development opportunities.

- Staying Socially Connected – Provide strategies for maintaining strong relationships, joining communities, and avoiding isolation.

- Downsizing & Smart Living Arrangements – Guide learners on how to simplify life, relocate affordably, or transition to senior-friendly housing.

- Creating a Daily Routine for a Purposeful Life – Teach the importance of routine, structure, and active engagement in retirement.

Module 5: Securing Your Financial & Personal Legacy

Ensure a lasting financial and personal impact for future generations.

- Drafting a Will & Estate Plan – Cover essential legal and financial steps to protect and distribute wealth wisely.

- Organizing Important Financial Documents – Help learners compile insurance policies, legal papers, and bank details for easy access.

- Passing on Knowledge & Values – Encourage retirees to leave a meaningful legacy through letters, journals, or family storytelling.

- Regularly Reviewing & Updating Retirement Plans – Teach the importance of adapting financial strategies to life changes.

How You Can Make Money with This PLR Course

💰 Sell It as an Online Course – Launch your own retirement planning training and start generating sales immediately.

💰 Offer It as a Coaching Program – Use it to educate clients, provide financial consultations, or run group coaching sessions.

💰 Turn It Into an eBook or Digital Guide – Convert the course into a valuable digital download to sell on Amazon Kindle, Gumroad, or your website.

💰 Include It in a Membership Program – Provide exclusive access to premium content and create recurring revenue.

💰 Repurpose for Blog Content & Lead Magnets – Use sections for email marketing, blog posts, or free guides to build your audience.

💰 Bundle It with Other Finance & Wealth Courses – Combine it with money management, investment, or passive income courses for higher value.

What You’ll Receive in This PLR Package

✅ Full Course Content (22,930 Words) – Professionally written, structured, and ready to sell.

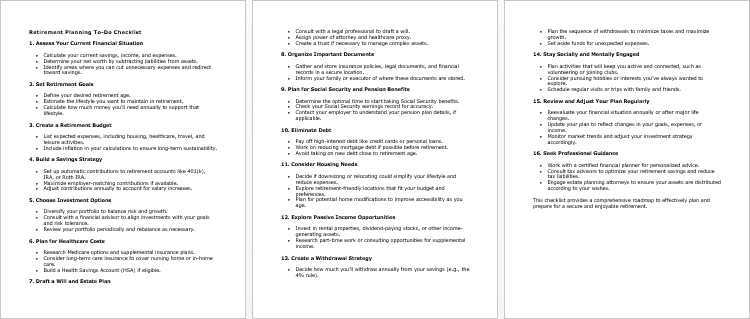

✅ Retirement Planning Checklist – A detailed step-by-step guide to keep learners on track.

✅ Comprehensive FAQs Document – Answers to common retirement planning concerns.

✅ Done-for-You Sales Page – A high-converting sales copy to help you start selling immediately.

Start Selling or Teaching This Course Today!

This Retirement Planning PLR Course is the easiest way to profit from a high-demand niche while helping people secure their financial future.

Whether you’re a financial coach, course creator, blogger, or entrepreneur, this done-for-you digital product allows you to generate revenue without creating content from scratch.

No writing, no research, no stress. Just download, customize, and sell!

👉 Grab Your Copy Now & Start Profiting from This High-Value PLR Course!

has been added to your cart!

have been added to your cart!

Here A Sample of Retirement Planning PLR Course

Module 1: Understanding Retirement Planning Basics

Step 1: Define Retirement Goals

Purpose:

Defining your retirement goals is the cornerstone of a successful retirement plan. By clearly identifying what you want your post-working life to look like, you set the stage for creating a financial and lifestyle plan tailored to your unique vision. This step ensures your retirement is not only financially sustainable but also personally fulfilling.

Instructions:

1. Reflect on Your Ideal Retirement Life

Begin by sitting in a quiet place where you can think without distractions. Have a notebook or digital note-taking tool ready to capture your thoughts.

Ask yourself thought-provoking questions:

What does a typical day in my retirement look like?

Do I see myself living in my current home, downsizing, or relocating to a new country or city?

What are the activities that bring me joy, such as hobbies, learning new skills, or volunteering?

Think about your preferred pace of life. Do you envision a busy, socially active lifestyle, or a peaceful, relaxed environment?

2. Break Down Your Goals into Categories

Organize your retirement aspirations into clear categories to better understand your priorities. Use the following internationally relevant categories:

Lifestyle: Consider your preferred living arrangement (e.g., urban apartment, suburban house, or countryside villa).

Travel: Identify specific destinations or experiences you’d like to pursue, such as visiting cultural landmarks, taking luxury cruises, or spending extended time in another country.

Hobbies and Interests: List activities you’ve always wanted to explore, such as painting, gardening, playing a musical instrument, or writing a book.

Family and Relationships: Think about how much time you’d like to spend with family and friends, whether it’s babysitting grandchildren or hosting regular gatherings.

Personal Growth: Include goals for learning, such as taking online courses, mastering new languages, or attending international workshops.

3. Create a Vision Statement

Summarize your thoughts into a concise vision statement for your retirement. For example:

“I want to retire in a coastal town, spend mornings painting, travel to Europe once a year, and host family gatherings during holidays.”

Write this statement in your notebook or save it digitally. It will act as a guiding light throughout your planning journey.

4. Align Your Goals with Your Partner or Family

If you have a spouse or close family involved in your retirement, it’s crucial to align your visions. Schedule a discussion to share your goals and listen to theirs.

Address potential differences early. For instance, one partner might want to relocate abroad, while the other prefers staying close to family. Finding common ground is key to a harmonious plan.

5. Set Realistic and Measurable Goals

Define your goals using internationally recognized benchmarks and timelines. For example:

Instead of saying, “I want to travel a lot,” say, “I will visit one new country every two years.”

Replace vague ideas like “I want to stay healthy,” with “I will walk 10,000 steps daily and attend weekly yoga classes.”

Prioritize your goals to focus on what’s most important in the early stages of retirement.

6. Visualize and Document Your Dream Retirement

Create a vision board, either physically or digitally, using images and keywords that represent your goals. For example:

A picture of a serene beach for a dream home.

Photos of family gatherings to symbolize time spent with loved ones.

Travel destinations marked on a world map.

Regularly revisit this visual representation to keep your motivation alive.

Why This Step is Crucial:

By defining your retirement goals in detail, you create a roadmap that helps guide your decisions on saving, investing, and planning. This clarity ensures that your financial resources are directed toward what truly matters to you, reducing stress and enhancing your overall retirement experience.

Step 2: Assess Your Current Financial Situation

Purpose:

Before planning for retirement, it’s essential to understand your current financial standing. Assessing your savings, assets, debts, and monthly expenses provides a clear picture of where you are today, helping you make informed decisions about your financial future. This step ensures your retirement plan is built on a strong, realistic foundation.

Instructions:

1. Gather All Financial Documents

Start by collecting essential documents that detail your financial situation. These may include:

Bank account statements.

Investment account summaries (e.g., stocks, mutual funds, or retirement accounts like 401(k) or IRA).

Debt records (e.g., mortgage statements, credit card balances, or personal loans).

Utility bills and other recurring expense statements.

Insurance policies and documentation for any significant assets like property or vehicles.

2. Calculate Your Savings

Review your savings accounts, including emergency funds and liquid assets. Use the following steps:

Add up the total balance of all savings accounts.

Include any short-term investments that can be easily accessed (e.g., money market funds).

Example: If you have $10,000 in a savings account and $5,000 in a money market account, your total savings are $15,000.

3. List Your Assets

Identify and assign value to your tangible and intangible assets. Categorize them into the following groups:

Real Estate: Include primary residences, rental properties, or undeveloped land. Use current market values.

Investments: List stocks, bonds, mutual funds, or ETFs, using their latest valuations.

Personal Property: Include vehicles, valuable jewelry, or collectibles.

Retirement Accounts: Account for the balance in 401(k), IRA, pensions, or other retirement plans.

Example: If your primary home is worth $200,000, and you have $50,000 in a retirement account, your assets total $250,000.

4. Account for Your Debts

Create a comprehensive list of all outstanding debts. Categorize them as follows:

Secured Debts: Include mortgages or auto loans.

Unsecured Debts: Include credit card balances, medical bills, or personal loans.

Student Loans: Note any remaining balances.

Calculate the total debt by summing up all liabilities. This provides a clear picture of what you owe.

Example: If you owe $120,000 on a mortgage and $15,000 in credit card debt, your total debt is $135,000.

5. Track Your Monthly Expenses

Document your monthly spending to understand your cash flow. Use the following categories for an international audience:

Essential Expenses: Rent or mortgage, utilities, groceries, transportation, insurance premiums, and healthcare.

Discretionary Spending: Entertainment, dining out, subscriptions, travel, and hobbies.

Savings Contributions: Any regular contributions to savings or investments.

Use a spreadsheet or financial tracking app to log these expenses. Sum them up for an accurate monthly total.

Example: If you spend $2,000 on essentials, $500 on discretionary items, and $300 on savings, your total monthly expenses are $2,800.

6. Determine Your Net Worth

Calculate your net worth using this simple formula:

Net Worth = Total Assets – Total Liabilities (Debts).

Example: If your assets are $250,000 and your liabilities are $135,000, your net worth is $115,000.

7. Identify Financial Strengths and Weaknesses

Reflect on the data you’ve gathered.

Strengths: High savings, valuable assets, or low debt.

Weaknesses: High-interest debt, insufficient savings, or excessive monthly expenses.

Highlight areas that require immediate attention, such as paying off high-interest credit cards or increasing retirement contributions.

8. Document and Store Your Findings

Use internationally accessible software or tools like Google Sheets, Excel, or cloud storage to document your financial situation.

Ensure all data is securely backed up and organized for easy reference during future planning stages.

Why This Step is Crucial:

Assessing your current financial situation is like drawing a map of your starting point. Without this clarity, planning for retirement can feel overwhelming or misguided. By calculating savings, assets, debts, and expenses, you’ll have a realistic view of what needs to be done to achieve your ideal retirement.

Step 3: Learn the Importance of Compounding

Purpose:

Understanding the power of compounding is key to building a successful retirement fund. Compounding allows your money to grow exponentially over time, as you earn interest not only on your initial investment but also on the accumulated interest. This step will guide you through the concept and demonstrate why starting early significantly impacts your financial future.

Instructions:

1. Understand the Concept of Compound Interest

What is Compounding?

Compounding occurs when the returns on your investments are reinvested, allowing you to earn interest on the principal amount as well as on previously earned interest.

The Formula for Compound Interest:

Use the standard formula to calculate compound interest:

A = P(1 + r/n)^(nt)

A: The future value of the investment/loan.

P: The principal amount (initial investment).

r: Annual interest rate (in decimal form).

n: Number of times the interest is compounded per year.

t: Time the money is invested for, in years.

Example: If you invest $10,000 at a 5% annual interest rate compounded annually for 20 years, your future value would be:

A = $10,000(1 + 0.05/1)^(1×20) = $26,532.98.

2. Discover the Impact of Starting Early

Why Time Matters:

The earlier you start saving, the longer your money has to grow through compounding. Delaying even a few years can drastically reduce your final retirement fund.

Illustrative Example:

Investor A starts saving $5,000 annually at age 25 and stops at age 35, leaving the fund to grow until age 65.

Investor B starts saving $5,000 annually at age 35 and continues until age 65.

Assuming a 7% annual return:

Investor A ends with approximately $602,070.

Investor B ends with approximately $540,741.

Even though Investor B saved for 30 years compared to Investor A’s 10 years, Investor A has more money due to the early start.

3. Explore Real-Life Applications

Long-Term Investments:

Compound interest benefits long-term investments like retirement accounts (e.g., 401(k), IRA, or mutual funds). The longer you leave the investment untouched, the greater the compounding effect.

Reinvesting Dividends:

If your investments generate dividends, reinvesting them instead of withdrawing boosts the compounding process.

Retirement Accounts:

Many retirement plans offer tax advantages that amplify the benefits of compounding by reducing tax liabilities on contributions or earnings.

4. Simulate Growth Using Financial Tools

Use Online Calculators:

Leverage free international financial tools or calculators to experiment with different investment amounts, interest rates, and timelines. Popular tools include:

Bankrate Compound Interest Calculator.

Investor.gov Compound Interest Calculator.

Conduct What-If Scenarios:

Experiment with variables such as increasing monthly contributions or starting later to see the impact on your retirement fund.

5. Commit to Starting Now

Make Small Steps Count:

Even if you can only save a small amount initially, start as soon as possible. Contributions over time lead to significant growth.

Automate Savings:

Set up automatic transfers to your retirement or investment accounts to ensure consistency.

Why This Step is Crucial:

The power of compounding is often referred to as the “eighth wonder of the world.” By understanding and utilizing it, you maximize your retirement savings without requiring substantial effort. Starting early, reinvesting returns, and leveraging time allows you to achieve financial security and freedom in retirement.

Step 4: Identify Key Retirement Planning Tools

Purpose:

To build a strong retirement strategy, it is essential to understand the various financial tools available. Each tool has unique benefits and can play a critical role in securing your financial future. This step provides detailed insights into popular retirement tools like 401(k), IRA, and pensions, and explains how to integrate them into your personalized retirement plan.

Instructions:

1. Understand the Basics of a 401(k) Plan

What is a 401(k)?

A 401(k) is a retirement savings plan sponsored by employers, commonly available in the United States. Employees contribute a portion of their salary to the plan, which grows tax-deferred.

Key Features:

Employers often offer matching contributions, typically up to a percentage of the employee’s salary.

Contributions are made pre-tax, reducing taxable income in the short term.

Withdrawals are taxed as regular income during retirement.

How It Fits Into Your Plan:

Start contributing as early as possible to maximize compounding.

Take full advantage of employer matching, as it’s essentially free money.

Use contribution limits wisely: For 2024, the annual contribution limit is $22,500 (or $30,000 if age 50 or older).

2. Explore Individual Retirement Accounts (IRA)

What is an IRA?

An IRA is a retirement account that individuals can open independently, without employer sponsorship. There are two primary types:

Traditional IRA: Contributions are tax-deductible (subject to income limits), and earnings grow tax-deferred. Withdrawals during retirement are taxed as income.

Roth IRA: Contributions are made with after-tax dollars, but qualified withdrawals during retirement are tax-free.

Key Features:

The contribution limit for 2024 is $6,500 (or $7,500 if age 50 or older).

Roth IRAs allow tax-free growth, which can be advantageous if you expect to be in a higher tax bracket during retirement.

How It Fits Into Your Plan:

Diversify your retirement savings by combining IRAs with employer-sponsored plans like a 401(k).

Use a Roth IRA to hedge against future tax increases.

3. Learn About Pension Plans

What is a Pension?

A pension is a retirement benefit provided by some employers. It guarantees a fixed monthly income during retirement based on factors like salary and years of service.

Key Features:

Funded primarily by the employer, though some plans require employee contributions.

Provides lifetime income, offering financial stability in retirement.

May include survivor benefits for spouses.

How It Fits Into Your Plan:

Consider pensions as a cornerstone for covering essential living expenses.

If you have access to a pension, focus additional savings on 401(k) or IRA accounts to cover discretionary spending.

4. Investigate International Alternatives

Global Options:

For individuals outside the United States, explore equivalent tools:

Superannuation Funds (Australia): A mandatory savings program funded by employer contributions.

Registered Retirement Savings Plans (RRSPs) (Canada): Tax-deferred retirement accounts similar to IRAs.

State Pension Schemes (UK): A government-provided income based on National Insurance contributions.

Key Considerations:

Understand contribution limits, tax benefits, and withdrawal rules for your country.

Look into employer-sponsored plans and supplemental personal retirement accounts.

5. Maximize Retirement Contributions

Automate Savings:

Set up automatic deductions from your paycheck or bank account to ensure consistent contributions.

Catch-Up Contributions:

If you’re age 50 or older, take advantage of higher contribution limits to boost your savings.

Optimize Tax Benefits:

Work with a financial advisor to balance contributions between pre-tax and after-tax accounts, optimizing your tax situation.

6. Diversify Your Portfolio

Combine various tools to build a robust retirement portfolio. For example:

Use a 401(k) for employer matching and tax-deferred growth.

Supplement with a Roth IRA for tax-free withdrawals.

Consider international investment options to hedge against currency fluctuations or market risks.

Diversification reduces risk and ensures stability across different market conditions.

7. Research Fees and Costs

Why Fees Matter:

High management fees can erode your investment returns over time.

How to Evaluate Fees:

Compare expense ratios of mutual funds or ETFs in your 401(k) or IRA.

Opt for low-cost index funds when possible.

Be cautious of hidden fees in pensions or international plans.

Why This Step is Crucial:

Each retirement planning tool offers unique advantages and plays a different role in achieving your financial goals. By understanding their benefits and limitations, you can make informed decisions and create a comprehensive plan tailored to your needs. Recognizing the value of these tools early and using them strategically ensures financial stability and peace of mind during retirement.

We’re also giving these extra bonuses

Retirement Planning – Checklist

Retirement Planning – FAQs

Retirement Planning – Salespage Content

Package Details:

Word Count: 22 930 Words

Number of Pages: 92

Retirement Planning – Bonus Content

Checklist

Word Count: 545 words

FAQs

Word Count: 1157 words

Salespage Content

Word Count: 556 words

Total Word Count: 25 188 Words

Your PLR License Terms

PERMISSIONS: What Can You Do With These Materials?

Sell the content basically as it is (with some minor tweaks to make it “yours”).

If you are going to claim copyright to anything created with this content, then you must substantially change at 75% of the content to distinguish yourself from other licensees.

Break up the content into small portions to sell as individual reports for $10-$20 each.

Bundle the content with other existing content to create larger products for $47-$97 each.

Setup your own membership site with the content and generate monthly residual payments!

Take the content and convert it into a multiple-week “eclass” that you charge $297-$497 to access!

Use the content to create a “physical” product that you sell for premium prices!

Convert it to audios, videos, membership site content and more.

Excerpt and / or edit portions of the content to give away for free as blog posts, reports, etc. to use as lead magnets, incentives and more!

Create your own original product from it, set it up at a site and “flip” the site for megabucks!

RESTRICTIONS: What Can’t You Do With These Materials?

To protect the value of these products, you may not pass on the rights to your customers. This means that your customers may not have PLR rights or reprint / resell rights passed on to them.

You may not pass on any kind of licensing (PLR, reprint / resell, etc.) to ANY offer created from ANY PORTION OF this content that would allow additional people to sell or give away any portion of the content contained in this package.

You may not offer 100% commission to affiliates selling your version / copy of this product. The maximum affiliate commission you may pay out for offers created that include parts of this content is 75%.

You are not permitted to give the complete materials away in their current state for free – they must be sold. They must be excerpted and / or edited to be given away, unless otherwise noted. Example: You ARE permitted to excerpt portions of content for blog posts, lead magnets, etc.

You may not add this content to any part of an existing customer order that would not require them to make an additional purchase. (IE You cannot add it to a package, membership site, etc. that customers have ALREADY paid for.)

Share Now!