Real Estate Investing PLR Course 29k Words

in PLR Checklists , PLR eBooks , PLR eCourses , PLR List Building Reports , Premium PLR , Premium PLR eBooks , Premium PLR Reports , Premium White Label Brandable PLR Coaching Courses , Private Label Rights Products , Real Estate , Real Estate PLR , Real Estate PLR eBooksChoose Your Desired Option(s)

has been added to your cart!

have been added to your cart!

#realestateinvesting #plrcourse #realestateplr #passiveincome #investmentstrategies #propertyinvestment #wealthbuilding #financialfreedom #realestatesuccess

Turn Properties into Profitable Assets

Are you ready to step into the world of real estate investing and start building long-term wealth? Whether you’re a beginner exploring your first property deal or an experienced investor looking to sharpen your strategy, this Real Estate Investing PLR Course provides everything you need to succeed.

This course covers everything from finding profitable properties and analyzing deals to securing financing, managing rentals, and scaling your portfolio. It’s designed to educate, empower, and provide actionable steps for anyone looking to make money in real estate.

And the best part? You can resell, rebrand, or repurpose this PLR course to build your own real estate investment training business!

Presenting…

Real Estate Investing PLR Course 29k Words

What You’ll Learn in This Course

Module 1: Introduction to Real Estate Investing

Start with the fundamentals and lay the groundwork for a successful investment journey.

- What is Real Estate Investing? – Learn how real estate generates passive income, equity growth, and financial security.

- Types of Real Estate Investments – Explore residential, commercial, fix-and-flip, short-term rentals, and REITs.

- Why Real Estate? – Discover the tax benefits, cash flow potential, and wealth-building power of real estate.

- Avoiding Beginner Mistakes – Learn common pitfalls that cost investors money and how to avoid them.

Module 2: Finding and Evaluating Investment Opportunities

Discover how to find, assess, and select profitable properties that align with your investment goals.

- Where to Find Great Real Estate Deals – Learn how to uncover properties through MLS listings, auctions, and off-market deals.

- How to Analyze a Property’s Profit Potential – Understand key factors like market trends, location, and property condition.

- Calculating ROI & Cash Flow – Master essential formulas like cap rate, cash-on-cash return, and appreciation potential.

- Conducting Due Diligence – Learn how to perform property inspections, financial checks, and legal verifications.

Module 3: Financing Your Real Estate Investments

Explore different ways to finance your deals and maximize profits.

- Funding Your Investment – Learn about traditional mortgages, private lenders, hard money loans, and seller financing.

- The Power of Leverage – Discover how to use other people’s money (OPM) to grow your portfolio faster.

- Prepping Your Finances – Improve your credit score, secure a down payment, and build lender trust.

- How to Get Approved for a Loan – Learn the best strategies for negotiating with banks and lenders.

Module 4: Managing & Scaling Your Real Estate Portfolio

Once you’ve acquired properties, learn how to manage and expand your investments effectively.

- Property Management 101 – Find out how to screen tenants, handle maintenance, and maximize rental income.

- When to Hire a Property Manager – Learn when to delegate responsibilities to a property management company.

- Strategies to Scale Your Portfolio – Discover methods to reinvest profits, purchase multiple properties, and diversify your assets.

- Real Estate Tax Strategies – Learn how to reduce taxes, maximize deductions, and protect your wealth.

Module 5: Advanced Real Estate Investing Strategies

Take your investments to the next level with proven advanced strategies.

- Fix-and-Flip Investing – Learn how to buy, renovate, and sell properties for quick profits.

- Investing in Commercial Real Estate – Explore office spaces, retail properties, and multi-family investments.

- Real Estate Syndications & Partnerships – Discover how to partner with other investors for larger deals.

- Market Trends & Future-Proofing Your Portfolio – Learn how to predict market shifts and stay ahead.

Why This PLR Course is a Smart Investment

This Real Estate Investing PLR Course is professionally written and fully customizable. Whether you want to teach, resell, or use it as a content asset, this course will provide endless opportunities for revenue generation.

How You Can Use This PLR Course:

✔️ Sell It As Your Own Course – Rebrand and sell it as a premium real estate training program.

✔️ Use It for Coaching & Training – Offer one-on-one mentorship or group coaching using this content.

✔️ Turn It into Digital Products – Convert the lessons into ebooks, video courses, or masterclasses.

✔️ Break It into Blog Posts & Lead Magnets – Use the content to drive traffic, generate leads, and build authority.

✔️ Bundle It with Other Wealth-Building Courses – Create a high-value package by combining it with financial literacy or passive income guides.

What You’ll Get with This PLR Package:

✅ Complete Course Content – Over 24,635 words of high-quality real estate investing lessons.

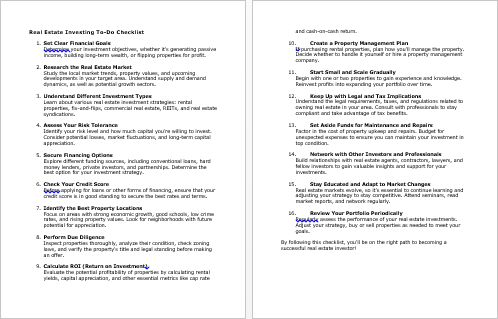

✅ Real Estate Investing Checklist – A step-by-step guide for quick reference and implementation.

✅ FAQs Document – Answers to common real estate investing questions.

✅ Done-for-You Sales Page – Professionally written sales copy to help you start selling instantly.

Start Building Wealth Through Real Estate Today!

With the Real Estate Investing PLR Course, you can educate yourself, grow your audience, and generate profit—without spending hours creating content from scratch.

👉 Get instant access now and turn real estate investing into a profitable business!

has been added to your cart!

have been added to your cart!

Here A Sample of Real Estate Investing PLR Course

Welcome to Real Estate Investing, a course designed to help you unlock the potential of real estate as a powerful investment tool. Whether you’re new to real estate or looking to sharpen your skills, this course will guide you through the key principles and steps of successful real estate investing. Let’s dive right in!

Module 1: Introduction to Real Estate Investing

Step 1: Understanding Real Estate as an Investment

Real estate investing is a time-tested and powerful tool for building wealth. To succeed in this field, it’s crucial to understand the basics and grasp how investing in real estate works, as well as its potential to create long-term financial security. Let’s break this step into detailed, actionable instructions for learning about real estate investing.

1. Define Real Estate Investing

What it is: Real estate investing involves purchasing, managing, and selling or renting properties with the intent of generating income or capital gains. Unlike stocks or bonds, real estate is a tangible asset, meaning you can see and touch it.

Why it matters: Real estate offers unique advantages over other types of investments, including steady cash flow, appreciation in value, and diversification for your portfolio. It’s often considered a hedge against inflation, as property values tend to rise over time.

Actionable Steps:

- Research the basics of real estate investing through reputable sources such as industry blogs, government websites, and books by experts.

- Familiarize yourself with key terms like equity, cash flow, appreciation, cap rate, and ROI (Return on Investment).

2. Explore the Benefits of Real Estate as an Investment

Key Advantages:

- Steady Income: Rental properties can provide a consistent income stream, making them an attractive option for investors looking to supplement their earnings.

- Tax Benefits: Many countries offer tax incentives for property investors, such as deductions for mortgage interest, property taxes, and depreciation.

- Leverage: Unlike other investments, real estate allows you to use borrowed money to increase your potential return on investment.

- Appreciation: Over time, properties typically increase in value, creating potential for substantial profits when sold.

Actionable Steps:

- Create a simple comparison chart to see how real estate stacks up against other investments like stocks, bonds, or savings accounts.

- Review case studies of successful real estate investors to understand how they’ve leveraged these benefits.

3. Understand the Long-Term Wealth Potential

Building Wealth Over Time: Real estate investing is not just about immediate cash flow; it’s also about building equity. Each mortgage payment increases your ownership stake in the property, contributing to long-term wealth accumulation. Additionally, property appreciation can significantly enhance your net worth over decades.

Wealth Preservation: Unlike other investments that can lose value rapidly, real estate tends to retain and grow its value over time, making it a reliable asset for wealth preservation.

Actionable Steps:

- Use a mortgage amortization calculator to visualize how paying down a property loan increases your equity over time.

- Learn how compounding works with real estate appreciation. For example, a property that appreciates 3% annually can double its value in approximately 24 years.

4. Identify Common Misconceptions About Real Estate Investing

Misconception 1: “You need to be rich to start.” Real estate investing can start small. Options like house hacking, real estate investment trusts (REITs), or purchasing a modest property in a growing market can be accessible to beginners.

Misconception 2: “It’s too risky.” While all investments carry risk, proper research, planning, and diversification can mitigate most risks associated with real estate.

Actionable Steps:

- List any assumptions or fears you have about real estate investing. Research and counter these with facts from reliable sources.

- Connect with a local or virtual real estate investment group to learn from experienced investors and address any concerns.

5. Take the First Steps Toward Real Estate Investing

Now that you understand what real estate investing is and its potential to build long-term wealth, it’s time to take your first steps toward becoming an investor.

Practical Actions:

- Set clear financial goals for your investment journey. Decide whether you’re looking for passive income, long-term growth, or both.

- Begin researching local and international real estate markets. Start with areas showing stable or rising property values and strong rental demand.

- Establish a budget and explore your financing options, such as savings, loans, or partnerships.

By understanding the basics of real estate investing and its potential to create long-term wealth, you’re laying a strong foundation for your journey. Keep building your knowledge step by step, and remember that real estate investing is as much about patience and persistence as it is about opportunity.

Step 2: Different Types of Real Estate Investments

Understanding the different types of real estate investments is crucial for building a diversified and profitable portfolio. Real estate offers a variety of opportunities, each with its own potential benefits, risks, and strategies. In this step, we will explore the most common types of real estate investments and provide you with actionable instructions to evaluate which options align with your goals.

1. Residential Properties

What They Are: Residential properties include homes, apartments, and condominiums where people live. Investors typically purchase these properties to rent them out for monthly income or to sell them later for a profit after appreciation.

Investment Strategies:

- Buy-and-Hold: Purchase a property, rent it out to tenants, and benefit from long-term appreciation and monthly rental income.

- House Hacking: Live in one part of a property (e.g., a duplex) while renting out the other part to offset your mortgage.

Actionable Steps:

- Research rental demand in your local or target market. Websites like Zillow or Realtor.com can provide insights.

- Learn about landlord responsibilities, tenant laws, and property management basics.

2. Commercial Properties

What They Are: Commercial real estate includes office buildings, retail spaces, warehouses, and industrial properties. These investments are typically leased to businesses rather than individuals.

Investment Strategies:

- Office Spaces: Lease out to professional service providers or corporate tenants.

- Retail Properties: Invest in shopping centers or standalone stores with long-term commercial leases.

Key Benefits:

- Commercial properties often have higher returns than residential ones.

- Longer lease terms reduce tenant turnover.

Actionable Steps:

- Study market trends to identify areas with business growth potential.

- Evaluate commercial property expenses, such as maintenance and property taxes, to calculate net operating income (NOI).

3. Fix-and-Flip Projects

What They Are: Fix-and-flip involves purchasing undervalued properties, renovating them, and selling them for a profit. This strategy is popular among hands-on investors with a keen eye for market trends and renovation costs.

Key Considerations:

- Requires knowledge of local markets to identify undervalued properties.

- You’ll need a team of contractors, designers, and possibly real estate agents.

Actionable Steps:

- Build a budget that includes purchase costs, renovation expenses, and unexpected contingencies (at least 10–15% extra).

- Work with contractors to get accurate renovation estimates before purchasing a property.

4. Real Estate Investment Trusts (REITs)

What They Are: REITs are companies that own, operate, or finance income-generating real estate. Investors can buy shares of REITs on stock exchanges, making it an accessible option without the need for property ownership.

Key Benefits:

- Highly liquid compared to physical properties.

- Provides exposure to real estate markets without requiring large capital.

Actionable Steps:

- Research different types of REITs, such as equity REITs (own properties) and mortgage REITs (finance real estate).

- Compare the performance, dividend yields, and risk levels of various REITs on investment platforms like Morningstar or Yahoo Finance.

5. Short-Term Rentals

What They Are: Short-term rentals include vacation homes or properties listed on platforms like Airbnb or Vrbo. These properties generate income from short-term stays rather than long-term leases.

Key Considerations:

- High potential income in tourist-friendly locations or business hubs.

- Requires active management to handle bookings, cleaning, and guest communication.

Actionable Steps:

- Research local regulations on short-term rentals; some areas have strict rules or bans.

- Calculate occupancy rates and nightly rental prices to estimate potential income.

6. Land Investments

What It Is: Investing in raw land involves purchasing undeveloped land with the potential for future development or appreciation. Investors may lease it for agricultural use or hold it for long-term value increase.

Key Benefits:

- Low maintenance compared to developed properties.

- Potential for significant appreciation if located in a growing area.

Actionable Steps:

- Evaluate zoning laws and potential uses for the land.

- Investigate infrastructure developments nearby, such as new highways or commercial projects, which may increase the land’s value.

7. Real Estate Crowdfunding

What It Is: Crowdfunding platforms allow multiple investors to pool resources for larger real estate projects, such as apartment complexes or commercial buildings. This option is accessible to investors with smaller budgets.

Key Benefits:

- Lower entry cost compared to buying a property outright.

- Provides exposure to large-scale real estate projects.

Actionable Steps:

- Research platforms like Fundrise or RealtyMogul to compare investment opportunities and fees.

- Understand the risks, including the potential lack of liquidity and dependence on the project’s success.

8. Mixed-Use Properties

What They Are: Mixed-use properties combine residential and commercial spaces, such as an apartment complex with ground-floor retail stores.

Key Benefits:

- Diversified income streams reduce overall risk.

- Often located in high-demand urban areas.

Actionable Steps:

- Analyze the market for both residential and commercial demand in your target area.

- Plan for additional costs, such as maintaining common areas used by both types of tenants.

By exploring the various types of real estate investments, you can identify which opportunities best align with your financial goals, risk tolerance, and management preferences. Take the time to research each type and create a clear plan to enter the market strategically. Real estate investing is diverse and flexible, offering options for every kind of investor.

Step 3: Why Real Estate?

Understanding the unique advantages of real estate investing is critical to making informed decisions about your financial future. Real estate is a dynamic and versatile investment vehicle that offers benefits like steady cash flow, tax advantages, and long-term appreciation. In this step, we’ll explore these benefits in detail and provide actionable steps to help you apply them to your investment journey.

We’re also giving these extra bonuses

Real Estate Investing – Checklist

Real Estate Investing – FAQs

Real Estate Investing – Salespage Content

Package Details:

Word Count: 24 635 Words

Number of Pages: 103

Real Estate Investing – Bonus Content

Checklist

Word Count: 469 words

FAQs

Word Count: 1314 words

Salespage Content

Word Count: 841 words

Total Word Count: 27 259 Words

Your PLR License Terms

PERMISSIONS: What Can You Do With These Materials?

Sell the content basically as it is (with some minor tweaks to make it “yours”).

If you are going to claim copyright to anything created with this content, then you must substantially change at 75% of the content to distinguish yourself from other licensees.

Break up the content into small portions to sell as individual reports for $10-$20 each.

Bundle the content with other existing content to create larger products for $47-$97 each.

Setup your own membership site with the content and generate monthly residual payments!

Take the content and convert it into a multiple-week “eclass” that you charge $297-$497 to access!

Use the content to create a “physical” product that you sell for premium prices!

Convert it to audios, videos, membership site content and more.

Excerpt and / or edit portions of the content to give away for free as blog posts, reports, etc. to use as lead magnets, incentives and more!

Create your own original product from it, set it up at a site and “flip” the site for megabucks!

RESTRICTIONS: What Can’t You Do With These Materials?

To protect the value of these products, you may not pass on the rights to your customers. This means that your customers may not have PLR rights or reprint / resell rights passed on to them.

You may not pass on any kind of licensing (PLR, reprint / resell, etc.) to ANY offer created from ANY PORTION OF this content that would allow additional people to sell or give away any portion of the content contained in this package.

You may not offer 100% commission to affiliates selling your version / copy of this product. The maximum affiliate commission you may pay out for offers created that include parts of this content is 75%.

You are not permitted to give the complete materials away in their current state for free – they must be sold. They must be excerpted and / or edited to be given away, unless otherwise noted. Example: You ARE permitted to excerpt portions of content for blog posts, lead magnets, etc.

You may not add this content to any part of an existing customer order that would not require them to make an additional purchase. (IE You cannot add it to a package, membership site, etc. that customers have ALREADY paid for.)

Share Now!