Master Your Money PLR Course 28k Words

in Finance PLR , Finance PLR Ebooks , PLR Checklists , PLR eBooks , PLR eCourses , PLR List Building Reports , PLR List Building Reports , Premium PLR , Premium PLR eBooks , Premium PLR Packages , Premium White Label Brandable PLR Coaching Courses , Private Label Rights ProductsChoose Your Desired Option(s)

has been added to your cart!

have been added to your cart!

moneymanagement #financialeducation #personalfinance #budgetingtips #wealthbuilding #financialsuccess #plrcourses #masteryourmoney #moneymindset

Master Your Money: A Beginner’s Guide to Financial Freedom PLR Course

Unlock the Path to Financial Freedom Today!

Are you ready to take control of your financial future? The Master Your Money: A Beginner’s Guide to Financial Freedom course is designed to empower professionals like you to gain clarity, confidence, and control over your finances. This comprehensive course covers everything from budgeting basics to building multiple income streams, with step-by-step guidance to help you achieve your financial goals.

Presenting…

Master Your Money: A Beginner’s Guide to Financial Freedom PLR Course

Master Your Money Course Overview

In the fast-paced world of business, managing your personal finances effectively is key to long-term success and peace of mind. Master Your Money provides the tools and knowledge to help you understand, manage, and grow your finances, all while building your business communication skills. By the end of this course, you’ll have a clear financial roadmap that leads to financial independence and freedom.

Master Your Money Course Outline

Module 1: Understanding Financial Freedom

Learn what it means to achieve financial freedom, and discover how to set SMART financial goals that align with your personal and professional ambitions.

Module 2: Budgeting Basics

Discover the power of budgeting and how to create a personal budget that supports your financial goals. This module covers tracking expenses, managing savings, and presenting financial plans.

Module 3: Managing Debt Effectively

Learn strategies to manage and eliminate debt, understand interest rates, and explore the difference between “good” and “bad” debt. This module also provides actionable steps to develop debt repayment strategies like the snowball or avalanche method.

Module 4: Saving and Investing

Gain insight into building an emergency fund and investing for long-term growth. From stocks to mutual funds, this module simplifies the investment landscape and helps you make informed decisions.

Module 5: Building Multiple Income Streams

Explore the difference between passive and active income, and learn strategies to diversify your income streams. Whether it’s through side hustles, freelancing, or investments, this module provides the framework to achieve financial security.

Module 6: Protecting Your Wealth

Understand the importance of insurance, legal protections, and estate planning. Learn how to protect your assets and ensure financial security for your future.

Module 7: Staying on Track with Your Financial Journey

Discover how to maintain motivation and stay committed to your financial goals with regular check-ins and by celebrating milestones.

Final Module: Your Financial Freedom Roadmap

Put it all together and create a long-term plan for financial independence. In this module, you’ll draft your personalized roadmap to achieve and maintain financial freedom.

Who Is This Course For?

- Professionals who want to gain control over their finances and plan for financial independence.

- Entrepreneurs and business owners seeking to better manage their personal and business finances.

- Coaches and educators looking for valuable financial content to offer their clients.

- Individuals who want to break free from debt, create multiple income streams, and secure their financial future.

Benefits of Master Your Money:

- Clarity and control over your personal finances.

- Actionable strategies for debt reduction, savings, and investment.

- A clear roadmap to financial independence.

- Confidence in your financial decision-making through improved communication skills.

What’s Included in the PLR Course Package?

- Master Your Money – Main Course (26,847 words)

- Master Your Money – Checklist (472 words)

- Master Your Money – FAQ (808 words)

- Master Your Money – Sales Page (605 words)

How to Use and Profit from This Course:

- Sell it as-is: Market this high-quality course as a product on your website.

- Break it into smaller reports: Divide the course into individual reports and sell for $10-$20 each.

- Bundle with other content: Combine this course with other financial or business-related content for a premium product bundle, priced at $47-$97.

- Create a membership site: Offer exclusive access to the course on a membership platform for recurring income.

- Develop a video series: Turn the course into video lessons or webinars to create an engaging learning experience.

- Lead magnet: Use portions of the course to attract new leads or offer it as a free resource to grow your email list.

License Terms:

- What Can You Do?

- Sell the content with minor modifications.

- Break it up into smaller portions for different products.

- Offer it through a membership site.

- Convert it into videos, audios, or other media formats.

- Use it for lead magnets, reports, or blog posts.

- What Can’t You Do?

- You cannot pass on PLR or resell rights to your customers.

- The course cannot be given away in its entirety for free.

- You cannot offer 100% commissions to affiliates promoting your product.

Ready to Empower Others to Take Control of Their Finances?

The Master Your Money course is the perfect solution for professionals and individuals looking to take control of their financial future. Help your audience break free from debt, save for their future, and build wealth by offering this valuable course.

Purchase the Master Your Money PLR Course today and start helping others achieve financial freedom while profiting from this powerful content!

has been added to your cart!

have been added to your cart!

Here A Sample of What Inside the Master Your Money PLR Course

Target Audience: Professionals seeking to gain control over their finances while learning practical communication skills for international business environments.

Welcome & Introduction

Objective: Help professionals develop financial confidence and clarity while mastering business communication.

Tone: Friendly, approachable, and supportive.

Key Themes: Financial literacy, global communication skills, personal finance management.

Module 1: Understanding Financial Freedom

Objective: Define financial freedom and set personal financial goals.

Lesson 1: What is Financial Freedom?

Objective:

By the end of this lesson, you will:

- Understand the concept of financial freedom.

- Recognize why achieving financial freedom is crucial for both personal and professional growth.

- Be able to define and articulate your vision of financial freedom.

What is Financial Freedom?

Financial freedom means having control over your finances rather than letting them control you. It’s about building enough wealth so you can live the life you want, without being constantly stressed by money. With financial freedom, your money works for you, enabling you to make choices that aren’t limited by financial constraints.

Why Financial Freedom Matters

- Less Stress, More Options: When you’re financially free, money becomes a tool, not a source of worry. You have the power to choose how to spend your time—whether that means taking time off work, starting a new business, or pursuing a passion project.

- Peace of Mind: No longer worrying about how to cover bills or unexpected expenses leads to improved mental well-being and reduces stress. You can focus more on your work and life goals.

- Freedom to Take Risks: When you’re not tied to a paycheck, you have the freedom to take risks in your career, like launching a side hustle or switching careers without financial fear holding you back.

- Retirement on Your Terms: Achieving financial freedom means you can retire earlier or at least have the choice to work because you want to, not because you have to.

Key Elements of Financial Freedom

- Debt Elimination: Reducing or eliminating debt frees up your income and increases your financial security.

- Savings & Investments: Building a safety net (emergency fund) and investing wisely are key steps toward growing your wealth.

- Multiple Income Streams: Diversifying where your money comes from (salary, investments, passive income) adds stability to your finances.

- Control Over Time: Financial freedom gives you the ability to choose how you spend your time, whether that’s retiring early, traveling, or pursuing new passions.

Activity: Define Your Financial Freedom

Take a few minutes to think about your personal definition of financial freedom. Ask yourself:

- What would financial freedom look like for me?

- What goals would I accomplish if I weren’t limited by money?

- How would I spend my time differently?

Write down your thoughts, and share them with a partner. Practice explaining what financial freedom means to you using clear and confident language.

Key Vocabulary for the Lesson:

- Financial independence: The ability to live comfortably without relying on earned income.

- Passive income: Money earned with little or no effort after the initial setup (e.g., investments, royalties).

- Assets: Items that increase in value or provide a return (e.g., property, stocks).

- Liabilities: Debts or obligations that reduce your net worth (e.g., loans, credit card balances).

Wrap-Up:

Now that you understand what financial freedom is and why it matters, you’re one step closer to achieving it! In the next lessons, we’ll dive deeper into practical strategies like budgeting, debt management, and investing, helping you move toward financial independence.

Next Step: Start setting your financial freedom goals. In our next lesson, we’ll learn how to make those goals SMART—specific, measurable, achievable, relevant, and time-bound!

This first lesson introduces the concept in a friendly, approachable way. Let me know if you’d like to adjust anything!

Key Vocabulary for Lesson 1: What is Financial Freedom?

- Financial Independence:

- The ability to cover all your living expenses without relying on traditional employment or earned income. It means having enough savings, investments, or passive income to live comfortably for the rest of your life.

- Example: Once you achieve financial independence, you may choose to retire early or pursue your passions without worrying about money.

- The ability to cover all your living expenses without relying on traditional employment or earned income. It means having enough savings, investments, or passive income to live comfortably for the rest of your life.

- Passive Income:

- Income generated with little to no effort after the initial setup. Examples include rental income, dividends from stocks, or royalties from creative works.

- Example: By investing in real estate, you can earn passive income through rental payments.

- Income generated with little to no effort after the initial setup. Examples include rental income, dividends from stocks, or royalties from creative works.

- Debt:

- Money that is borrowed and must be repaid, typically with interest. This can include loans, credit card balances, mortgages, etc.

- Example: Paying off your credit card debt is a crucial step toward financial freedom.

- Money that is borrowed and must be repaid, typically with interest. This can include loans, credit card balances, mortgages, etc.

- Assets:

- Valuable items that you own, which can generate income or appreciate in value over time. Examples include property, stocks, and business ownership.

- Example: Your home and investments in the stock market are considered assets because they can grow in value.

- Valuable items that you own, which can generate income or appreciate in value over time. Examples include property, stocks, and business ownership.

- Liabilities:

- Debts or financial obligations that decrease your net worth. Examples include loans, credit card debt, and mortgages.

- Example: While a mortgage is an investment in property, it’s also a liability because it’s a debt you must repay.

- Debts or financial obligations that decrease your net worth. Examples include loans, credit card debt, and mortgages.

By familiarizing yourself with these terms, you’ll feel more confident discussing financial concepts in professional settings. You’ll also be able to make informed decisions about your own journey to financial freedom.

Activity: Reflect on Your Financial Goals and Aspirations

Objective: To help you gain clarity about your financial goals, so you can start making a plan to achieve them.

Step 1: Personal Reflection

Take a few minutes to quietly reflect on your current financial situation and where you would like to be in the future. Consider the following questions:

- What does financial freedom mean to you personally?

- How would your life change if you didn’t have to worry about money?

- What are the top three financial goals you’d like to achieve in the next 1, 5, and 10 years?

- Are there any financial habits or challenges currently holding you back?

Example Prompts:

- “In five years, I want to be debt-free and own my home.”

- “I want to retire by age 50 and travel the world.”

- “My goal is to build an emergency fund with six months’ worth of expenses.”

Step 2: Write Down Your Goals

After reflecting, write down your top three financial goals. Be as specific as possible. For example:

- Short-Term Goal: Pay off credit card debt within 12 months.

- Medium-Term Goal: Save for a down payment on a house within 3 years.

- Long-Term Goal: Build a retirement fund that allows me to retire by age 55.

Step 3: Pair and Share

Once you’ve written your goals, find a partner and take turns sharing. Use this opportunity to practice communicating your financial aspirations clearly and confidently. As you share, consider how these goals reflect your vision of financial freedom.

Tips for Sharing:

- Speak clearly and confidently.

- Use some of the new vocabulary, like financial independence or assets.

- Offer feedback and encouragement to your partner.

Step 4: Group Discussion

After sharing with your partner, we’ll regroup as a class to discuss:

- What common goals did we notice?

- What were some unique goals shared?

- How can we stay accountable to our goals?

Wrap-Up: Reflecting on your financial goals is the first step toward taking control of your financial future. These aspirations will guide your actions as we move through the rest of the course. In future lessons, we’ll develop practical strategies to turn these goals into reality!

Lesson 2: Creating SMART Financial Goals

Objective:

By the end of this lesson, you will:

- Understand the importance of setting SMART financial goals.

- Be able to create your own Specific, Measurable, Achievable, Relevant, and Time-bound goals to guide your financial journey.

What Are SMART Financial Goals?

Setting clear and actionable goals is a key step toward achieving financial freedom. SMART goals give your financial dreams structure and a timeline, making them easier to track and accomplish.

SMART stands for:

- Specific: Your goal should be clear and well-defined.

- Measurable: You need to track progress and know when you’ve achieved it.

- Achievable: Your goal should be realistic, considering your current resources and constraints.

- Relevant: It should align with your broader financial aspirations and life goals.

- Time-bound: Set a deadline to keep yourself accountable.

Why Set SMART Financial Goals?

Without clear goals, it’s easy to drift or become overwhelmed by the big picture of financial independence. SMART goals give you a clear roadmap, help you stay motivated, and allow you to track your progress.

Breaking Down SMART Goals

1. Specific

- Vague: “I want to save money.”

- Specific: “I want to save ₹1,00,000 for a down payment on a home.”

Why it matters: A specific goal provides clarity and helps you stay focused on what exactly you’re working toward.

2. Measurable

- Vague: “I want to be debt-free.”

- Measurable: “I will pay off ₹50,000 of my credit card debt within the next year.”

Why it matters: Measurable goals let you track progress. You can break them down into smaller milestones and celebrate victories along the way.

3. Achievable

- Vague: “I want to become a millionaire next year.”

- Achievable: “I will increase my income by ₹25,000 per month through a side business or freelancing.”

Why it matters: It’s important to set goals that challenge you but are also realistic, given your current financial situation.

4. Relevant

- Vague: “I want to invest in stocks.”

- Relevant: “I want to start investing ₹5,000 monthly into a diversified stock portfolio to build long-term wealth.”

Why it matters: A relevant goal aligns with your broader life aspirations, like retiring early or creating a passive income stream.

5. Time-bound

- Vague: “I want to save for retirement.”

- Time-bound: “I want to have ₹20,00,000 saved in my retirement account by the time I turn 50.”

Why it matters: Setting a deadline creates urgency and prevents procrastination.

Example of a SMART Financial Goal:

SMART Goal:

“I will save ₹5,000 per month for the next 12 months to build an emergency fund of ₹60,000 by the end of the year.”

- Specific: You’ve identified an emergency fund as the goal.

- Measurable: You’ll know you’ve succeeded when you reach ₹60,000.

- Achievable: ₹5,000 a month is realistic, given your current budget.

- Relevant: It aligns with your broader financial independence goals.

- Time-bound: You have set a clear deadline—12 months.

Activity: Craft Your Own SMART Financial Goals

Step 1: Choose a Financial Goal

Think about one of your financial aspirations—whether it’s paying off debt, saving for a big purchase, or building an investment portfolio.

Step 2: Apply the SMART Framework

Break your goal down using the SMART criteria. Write down each component and be specific:

- Specific: What exactly do you want to accomplish?

- Measurable: How will you measure your progress?

- Achievable: Is it realistic given your current circumstances?

- Relevant: How does this goal align with your overall financial plans?

- Time-bound: By when do you want to achieve it?

Step 3: Share and Discuss

Pair up with a classmate to share your SMART financial goals. Explain how you applied each of the SMART criteria and give each other feedback on how to refine the goals further.

Key Vocabulary for the Lesson:

- SMART Goals: A goal-setting framework to ensure clarity and structure in achieving objectives.

- Emergency Fund: A savings fund set aside for unexpected expenses, such as medical emergencies or job loss.

- Diversification: The process of spreading investments across different assets to reduce risk.

- Return on Investment (ROI): The profit or loss generated from an investment relative to the initial amount invested.

Wrap-Up:

Now that you know how to set SMART financial goals, you’re ready to take control of your financial future in a structured way. Setting these goals is the first actionable step toward achieving financial freedom.

Next Step: In the next lesson, we’ll focus on Budgeting and Saving Strategies, so you can start working toward your SMART goals efficiently!

This lesson focuses on making financial goals tangible and actionable, giving professionals the tools they need to break down their aspirations into achievable steps.

Phrases for Communication: Expressing Financial Goals

In professional settings, being able to communicate your financial goals clearly and confidently is essential. Here are some useful phrases that you can use when discussing your SMART financial goals:

1. “My goal is to achieve…”

- Use this phrase when you want to state your goal clearly and directly.

- Example: “My goal is to achieve financial independence by saving 20% of my income each month.”

2. “I plan to…”

- This phrase is great for outlining the specific steps or actions you will take to reach your goal.

- Example: “I plan to invest ₹5,000 monthly into a diversified stock portfolio to grow my wealth.”

3. “I will accomplish [goal] by [timeframe]…”

- This phrase helps you communicate your commitment to achieving the goal within a specific time frame.

- Example: “I will accomplish paying off my student loans by setting aside ₹10,000 per month for the next 3 years.”

4. “I’m working toward…”

- Use this phrase to describe your ongoing progress and efforts toward a goal.

- Example: “I’m working toward building an emergency fund of ₹1,00,000 by saving ₹8,000 every month.”

5. “I aim to…”

- This is a strong, assertive phrase that shows you are serious about your goal.

- Example: “I aim to eliminate my credit card debt by the end of this year.”

6. “My financial target is…”

- Use this when discussing a specific number or measurable goal.

- Example: “My financial target is to save ₹5,00,000 by the end of 2025.”

7. “By [date], I will have… ”

- This phrase helps set a clear timeline for your goal.

- Example: “By December 2024, I will have paid off all my credit card debt.”

Practice Scenario

Imagine you’re in a business meeting discussing personal finance strategies with your colleagues. You might say:

- “My goal is to achieve financial freedom within the next 10 years by building passive income streams.”

- “I plan to increase my investment contributions by 15% this year to grow my portfolio.”

- “I will accomplish my debt-free goal by saving 30% of my income each month.”

Using these phrases will not only make you sound confident but also keep your financial goals top of mind as you work toward achieving them.

Practice Activity: Write Your SMART Financial Goals and Share for Feedback

Objective: To create your own SMART financial goals and practice communicating them clearly with a partner. This activity will help you refine your goals and gain confidence in discussing them.

Step 1: Write Your SMART Financial Goals

Take a few minutes to think about a financial goal you want to achieve. Now, using the SMART framework, write down your goal. Make sure it’s:

- Specific: Clearly define the goal.

- Measurable: How will you track progress?

- Achievable: Is it realistic and within your control?

- Relevant: Does it align with your long-term financial aspirations?

- Time-bound: Set a deadline for achieving it.

Example of a SMART goal:

- Specific: “I want to save ₹1,00,000.”

- Measurable: “I will save ₹10,000 per month.”

- Achievable: “I can allocate this amount from my monthly salary.”

- Relevant: “It will help me build an emergency fund.”

- Time-bound: “I will achieve this within 10 months.”

Now, write your own SMART goal following this structure.

Step 2: Share Your Goal with a Partner

Once you’ve written your goal, find a partner and take turns sharing. Use the phrases for communication you’ve learned, such as:

- “My goal is to achieve…”

- “I plan to…”

- “I will accomplish [goal] by [timeframe]…”

After you share, ask your partner for feedback. You might want to discuss:

- Is your goal clear and specific enough?

- Are the steps measurable and achievable?

- Is the timeframe realistic?

Step 3: Refine Your Goal Based on Feedback

After receiving feedback, make any necessary adjustments to your SMART financial goal. You can clarify the timeframe, adjust the amount you plan to save, or ensure the goal is truly relevant to your larger financial aspirations.

Wrap-Up

By sharing your SMART financial goal, you’ll gain valuable insights and a sense of accountability. This exercise will help you stay on track toward achieving your goal, and practicing these conversations will prepare you for discussing financial matters confidently in professional settings.

We’re also giving these extra bonuses

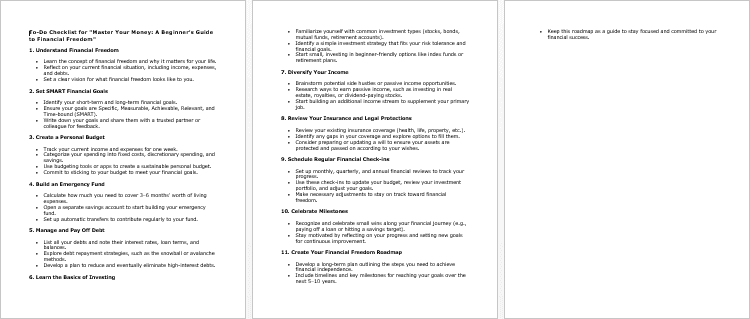

Master Your Money – Checklist

Master Your Money – FAQs

Master Your Money – Salespage Content

Package Details:

Module 1: Understanding Financial Freedom

Module 2: Budgeting Basics

Module 3: Managing Debt Effectively

Module 4: Saving and Investing

Module 5: Building Multiple Income Streams

Module 6: Protecting Your Wealth

Module 7: Staying on Track with Your Financial Journey

Final Module: Your Financial Freedom Roadmap

Word Count: 26 847 Words

Number of Pages: 120

Master Your Money – Bonus Content

Checklist

Word Count: 472 words

FAQs

Word Count: 808 words

Salespage Content

Word Count: 605 words

Total Word Count: 28 732 Words

Your PLR License Terms

PERMISSIONS: What Can You Do With These Materials?

Sell the content basically as it is (with some minor tweaks to make it “yours”).

If you are going to claim copyright to anything created with this content, then you must substantially change at 75% of the content to distinguish yourself from other licensees.

Break up the content into small portions to sell as individual reports for $10-$20 each.

Bundle the content with other existing content to create larger products for $47-$97 each.

Setup your own membership site with the content and generate monthly residual payments!

Take the content and convert it into a multiple-week “eclass” that you charge $297-$497 to access!

Use the content to create a “physical” product that you sell for premium prices!

Convert it to audios, videos, membership site content and more.

Excerpt and / or edit portions of the content to give away for free as blog posts, reports, etc. to use as lead magnets, incentives and more!

Create your own original product from it, set it up at a site and “flip” the site for megabucks!

RESTRICTIONS: What Can’t You Do With These Materials?

To protect the value of these products, you may not pass on the rights to your customers. This means that your customers may not have PLR rights or reprint / resell rights passed on to them.

You may not pass on any kind of licensing (PLR, reprint / resell, etc.) to ANY offer created from ANY PORTION OF this content that would allow additional people to sell or give away any portion of the content contained in this package.

You may not offer 100% commission to affiliates selling your version / copy of this product. The maximum affiliate commission you may pay out for offers created that include parts of this content is 75%.

You are not permitted to give the complete materials away in their current state for free – they must be sold. They must be excerpted and / or edited to be given away, unless otherwise noted. Example: You ARE permitted to excerpt portions of content for blog posts, lead magnets, etc.

You may not add this content to any part of an existing customer order that would not require them to make an additional purchase. (IE You cannot add it to a package, membership site, etc. that customers have ALREADY paid for.)

Share Now!