Investment Strategies PLR Course 21k Words

in Finance PLR , Finance PLR Ebooks , PLR Checklists , PLR eBooks , PLR eCourses , PLR List Building Reports , Premium PLR , Premium PLR eBooks , Premium PLR Reports , Premium White Label Brandable PLR Coaching Courses , Private Label Rights ProductsChoose Your Desired Option(s)

has been added to your cart!

have been added to your cart!

#investmentstrategies #plrcourse #financesuccess #smartinvestments #financialfreedom #passiveincome #wealthbuilding #moneymanagement #investingtips #plrcontent

Unlock the Secrets to Financial Growth with the Investment Strategies PLR Course!

Are you ready to take control of your financial future and start building wealth with confidence? Whether you’re new to investing or looking to sharpen your skills, the Investment Strategies PLR Course is your comprehensive guide to understanding the essentials of investing. Packed with actionable steps, expert insights, and easy-to-follow lessons, this course is perfect for individuals and businesses aiming to master the art of smart investments.

With this high-quality PLR product, you can not only empower your audience but also profit by reselling this valuable course as your own!

Presenting…

Investment Strategies PLR Course 21k Words

What Will You Learn?

Module 1: Understanding the Basics of Investment

- Define Your Financial Goals

Start by identifying what you want to achieve—whether it’s saving for retirement, buying a home, or growing your wealth. - Learn Investment Types

Discover the differences between stocks, bonds, real estate, mutual funds, and more. - Understand Risk Tolerance

Assess your comfort level with financial risks and how it influences your investment strategy. - Build a Knowledge Base

Learn the basics of investing, from diversification to compounding, to start your journey on the right foot.

Module 2: Planning Your Investment Strategy

- Create a Budget for Investing

Allocate funds for investing without jeopardizing your daily needs or emergency savings. - Choose a Time Horizon

Short-term or long-term? Understand how your investment goals impact your strategy. - Research Investment Platforms

Explore and compare brokers and platforms to find the best fit for your needs. - Diversify Your Portfolio

Minimize risks by spreading your investments across various asset classes.

Module 3: Getting Started with Investing

- Open an Investment Account

Step-by-step guidance on choosing and setting up an account with a reputable platform. - Start Small

Learn how to begin investing with small amounts to build confidence. - Monitor Market Trends

Stay informed about market updates using reliable tools and resources. - Make Your First Investment

Apply your knowledge and take the exciting first step into the world of investing.

Module 4: Advanced Investment Techniques

- Explore Index Funds and ETFs

Learn why these diversified, low-cost investment options are ideal for long-term growth. - Understand Tax Implications

Discover strategies for managing taxes and maximizing your returns. - Rebalance Your Portfolio

Adjust your investments to align with your financial goals and risk tolerance. - Passive vs. Active Investing

Weigh the pros and cons of hands-off investing versus actively managing your portfolio.

Module 5: Staying Consistent and Growing Your Portfolio

- Set Regular Investment Schedules

Establish a habit of consistent investing to achieve long-term success. - Track Your Progress

Use tools to monitor your portfolio’s performance and identify areas for improvement. - Stay Educated

Continue expanding your knowledge with books, webinars, and advanced courses. - Embrace Patience and Discipline

Understand that investing is a long-term game requiring persistence and focus.

Who Can Benefit from This Course?

- Beginner Investors seeking a step-by-step guide to starting their financial journey.

- Professionals aiming to diversify their income through smart investments.

- Content Creators looking to rebrand and sell this course in the personal finance niche.

- Coaches and Educators wanting to provide their clients with high-value investment training materials.

What’s Included in Your PLR Package?

- Complete Investment Strategies Course (19,358 Words):

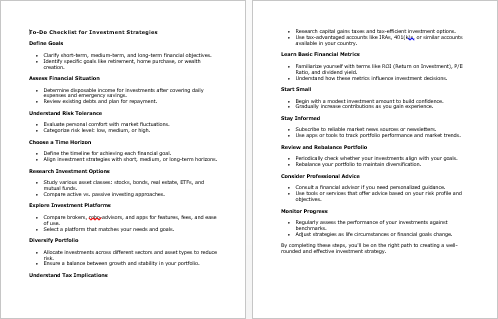

A professionally crafted, in-depth course covering all aspects of investing. - Investment Strategies Checklist (322 Words):

A simple, actionable guide to keep learners on track. - FAQs Document (964 Words):

Answers to the most common investment questions, saving you time and effort. - Sales Page (623 Words):

A high-converting, ready-to-use sales page to start selling instantly.

Why Choose This PLR Course?

- Completely Customizable:

Edit, rebrand, and resell the content to match your brand and audience. - Valuable and Evergreen Content:

Investment strategies are always in demand, making this course a long-term asset for your business. - Profitable Resell Opportunities:

Bundle it with other finance-related content, use it as a lead magnet, or sell it as a standalone product. - Easy-to-Implement Steps:

The course is designed to simplify investing, making it accessible to all learners.

How Can You Use and Profit from This Course?

- Sell It as a Premium Product:

Resell the course for $47-$97 and earn substantial profits. - Create Membership Content:

Offer exclusive access to the course as part of a paid subscription. - Break It into Mini-Courses:

Turn each module into individual courses or workshops for targeted learning. - Use It for Lead Generation:

Provide excerpts as free downloads to build your email list and generate leads. - Bundle It with Related Products:

Combine this course with other financial resources to create value-packed offerings. - Repurpose It into Digital Formats:

Transform the content into eBooks, webinars, or video courses for maximum flexibility.

Special Launch Offer: Only $14.99

Take advantage of this limited-time offer to own a high-quality PLR product in the lucrative personal finance niche. Help your audience gain confidence in investing while building a profitable product portfolio for your brand.

Click Here to Purchase the Investment Strategies PLR Course Now!

Don’t wait! Equip yourself and your audience with the knowledge to grow wealth, achieve financial independence, and make smart investment decisions today!

has been added to your cart!

have been added to your cart!

Here A Sample of Investment Strategies PLR Course

Course Description: This course is designed to guide you through the essentials of investment strategies, providing actionable steps to grow your financial knowledge and make informed decisions. Whether you’re a beginner or looking to refine your investment skills, this course will equip you with the tools to build a strong financial portfolio.

Module 1: Understanding the Basics of Investment

Step 1: Define Your Financial Goals

To achieve financial freedom and make informed investment decisions, the first critical step is defining your financial goals. This process requires deep reflection, strategic planning, and clarity about your aspirations. Here’s a detailed step-by-step guide to help you articulate and define your financial objectives:

1. Reflect on Your Life Aspirations

- Begin with a Vision: Think about the long-term vision for your life. Where do you see yourself in 5, 10, or 20 years?

- Identify Key Milestones: Write down significant milestones, such as retirement, purchasing a home, funding education, or starting a business.

- Use a Financial Timeline: Create a timeline of your life stages and align each stage with potential financial needs.

2. Categorize Your Goals

- Short-Term Goals (1-3 years):

- Examples: Saving for a vacation, building an emergency fund, or paying off minor debts.

- Examples: Saving for a vacation, building an emergency fund, or paying off minor debts.

- Medium-Term Goals (3-7 years):

- Examples: Purchasing a car, saving for a down payment on a home, or funding a family celebration.

- Examples: Purchasing a car, saving for a down payment on a home, or funding a family celebration.

- Long-Term Goals (7+ years):

- Examples: Retirement planning, wealth accumulation, or legacy planning.

- Examples: Retirement planning, wealth accumulation, or legacy planning.

- Assign specific time frames to each category for clarity.

3. Quantify Each Goal

- Estimate Costs: Research and estimate how much money you’ll need to achieve each goal.

- Example: If you aim to buy a home, factor in costs such as the down payment, taxes, and closing fees.

- Example: If you aim to buy a home, factor in costs such as the down payment, taxes, and closing fees.

- Adjust for Inflation: Account for inflation when estimating long-term goals.

- Set Specific Targets: Define exact figures rather than vague ambitions (e.g., “Save $20,000 for a car in 5 years” instead of “Save for a car”).

4. Prioritize Your Goals

- Rank Goals by Importance: Decide which goals matter most to you and require immediate attention.

- For example, prioritize building an emergency fund before investing in a luxury vacation.

- For example, prioritize building an emergency fund before investing in a luxury vacation.

- Balance Competing Priorities: Strike a balance between goals that provide financial security (e.g., debt repayment) and those that offer lifestyle satisfaction (e.g., travel).

5. Assess Your Current Financial Situation

- Evaluate Assets and Liabilities: Calculate your net worth by subtracting liabilities from your total assets.

- Review Income Sources: Understand your income streams and their reliability.

- Identify Cash Flow: Analyze how much money you save or spend monthly to determine how much can be allocated toward your goals.

6. Align Goals with Values

- Define What Matters Most: Ensure your financial goals align with your core values. For instance, if family is your top priority, focus on saving for education or family security.

- Avoid External Pressure: Your financial goals should reflect your aspirations, not societal or peer expectations.

7. Document Your Goals

- Write Them Down: Use a journal, digital planner, or financial goal-setting tool to document each goal.

- Create a Vision Board: Incorporate images, numbers, and symbols that represent your goals visually.

- Use International Standards: Clearly mark currency and dates (e.g., USD, EUR, or GBP for currencies; ISO date format like 2024-12-28 for dates).

8. Set SMART Goals

- Specific: Clearly define what you want to achieve (e.g., “Save $50,000 for retirement by 2040”).

- Measurable: Ensure progress can be tracked.

- Achievable: Set realistic goals based on your current situation.

- Relevant: Align goals with broader life objectives.

- Time-Bound: Specify deadlines for each goal.

9. Review and Adjust Regularly

- Schedule Periodic Reviews: Revisit your goals monthly or quarterly to track progress and make adjustments.

- Adapt to Life Changes: Be flexible in updating goals as life circumstances evolve (e.g., career changes, family needs).

10. Consult a Financial Advisor

- Seek Professional Guidance: If needed, consult with an international financial advisor to refine your goals and ensure they align with global financial strategies and standards.

- Leverage Financial Planning Tools: Use globally recognized tools like budgeting apps, retirement calculators, or investment platforms.

By following this step-by-step approach, you’ll have a well-defined roadmap for achieving your financial goals. Clarity in this phase sets the foundation for making strategic investment decisions and navigating your financial journey with confidence.

Step 2: Learn Investment Types

Understanding the different types of investments is crucial for building a diversified portfolio and achieving your financial goals. Each investment type comes with unique characteristics, risks, and rewards. Here’s a detailed, step-by-step guide for learning about various investment options.

1. Begin with Investment Basics

- Definition of Investments: Understand that investments involve allocating resources (usually money) to assets with the expectation of generating income or capital appreciation.

- Types of Returns: Familiarize yourself with two main types of returns:

- Income: Regular earnings such as dividends, interest, or rent.

- Capital Gains: Profit earned when the value of an asset increases over time.

- Income: Regular earnings such as dividends, interest, or rent.

2. Explore Common Investment Types

- Stocks (Equities):

- What They Are: Shares of ownership in a company.

- Risk-Reward Profile: High risk with the potential for high returns.

- Key Considerations:

- Volatility: Stock prices can fluctuate widely.

- Dividend Potential: Some stocks pay regular dividends.

- Example: Investing in a multinational company listed on the New York Stock Exchange (NYSE).

- What They Are: Shares of ownership in a company.

- Bonds (Fixed Income):

- What They Are: Debt instruments where you lend money to an entity (government or corporation) in exchange for regular interest payments and principal repayment.

- Risk-Reward Profile: Lower risk compared to stocks but with lower returns.

- Key Considerations:

- Credit Risk: Risk of default by the issuer.

- Interest Rate Sensitivity: Bond prices decrease when interest rates rise.

- Example: U.S. Treasury bonds or Euro-denominated corporate bonds.

- What They Are: Debt instruments where you lend money to an entity (government or corporation) in exchange for regular interest payments and principal repayment.

- Mutual Funds:

- What They Are: Pooled funds managed by professionals to invest in a diversified portfolio of stocks, bonds, or other securities.

- Risk-Reward Profile: Medium risk, depending on the fund’s composition.

- Key Considerations:

- Expense Ratios: Management fees charged by the fund.

- Diversification: Reduces risk by spreading investments.

- Example: Global equity mutual funds or balanced funds.

- What They Are: Pooled funds managed by professionals to invest in a diversified portfolio of stocks, bonds, or other securities.

- Real Estate:

- What It Is: Investment in property, including residential, commercial, or land.

- Risk-Reward Profile: Medium to high risk, with potential for steady rental income and capital appreciation.

- Key Considerations:

- Liquidity: Real estate is less liquid than other investments.

- Maintenance Costs: Ongoing costs can affect profitability.

- Example: Purchasing rental properties or real estate investment trusts (REITs).

- What It Is: Investment in property, including residential, commercial, or land.

3. Delve into Alternative Investments

- Commodities:

- What They Are: Physical assets like gold, silver, oil, or agricultural products.

- Risk-Reward Profile: High risk due to price volatility.

- Key Considerations:

- Hedging: Often used to hedge against inflation.

- Market Dependency: Prices depend on global supply and demand.

- What They Are: Physical assets like gold, silver, oil, or agricultural products.

- Cryptocurrencies:

- What They Are: Digital or virtual currencies using blockchain technology.

- Risk-Reward Profile: Extremely high risk with potential for significant returns.

- Key Considerations:

- Regulatory Risks: Subject to government regulations.

- Volatility: Prices can fluctuate dramatically.

- What They Are: Digital or virtual currencies using blockchain technology.

- Private Equity and Venture Capital:

- What They Are: Investments in private companies or startups.

- Risk-Reward Profile: High risk with potential for high returns.

- Key Considerations:

- Long-Term Commitment: Investments are typically illiquid.

- Expertise Required: Often requires extensive due diligence.

- What They Are: Investments in private companies or startups.

4. Assess the Risks and Rewards

- Risk Tolerance: Understand your ability and willingness to endure investment losses.

- Risk Types:

- Market Risk: Potential losses due to market fluctuations.

- Inflation Risk: The possibility of returns not keeping up with inflation.

- Liquidity Risk: Difficulty in converting investments into cash quickly.

- Reward Potential: Learn about how different investments generate returns, from interest payments to capital gains.

5. Understand Investment Vehicles

- Exchange-Traded Funds (ETFs):

- Similar to mutual funds but traded on stock exchanges.

- Similar to mutual funds but traded on stock exchanges.

- Index Funds:

- Track specific market indices and offer lower fees.

- Track specific market indices and offer lower fees.

- Certificates of Deposit (CDs):

- Fixed-term investments with guaranteed returns.

6. Use Global Standards for Understanding Investments

- Currencies: Always indicate investments in standard international formats (e.g., USD, EUR, GBP).

- Indexes: Familiarize yourself with global indices like the S&P 500, FTSE 100, or Nikkei 225.

- International Markets: Understand the role of international exchanges, such as the London Stock Exchange (LSE) or Tokyo Stock Exchange (TSE).

7. Leverage Educational Resources

- Books and Courses: Read reputable books on investing and take online courses.

- Professional Advice: Consult certified financial advisors or investment planners.

- Simulators: Use investment simulators to practice without real money.

8. Compare Historical Performance

- Analyze historical returns and risks associated with different investment types.

- Use resources like Bloomberg, Morningstar, or financial publications for research.

9. Create a Diversified Portfolio

- Mix various investment types to spread risk and enhance returns.

- Balance between high-risk and low-risk investments based on your financial goals.

10. Stay Updated

- Monitor financial news and global economic trends.

- Continuously update your knowledge to adapt to changing markets.

By mastering these investment types and their intricacies, you’ll build a strong foundation to make informed decisions that align with your financial objectives.

Step 3: Understand Risk Tolerance

Risk tolerance is a critical factor in investment decision-making. It reflects your ability and willingness to endure fluctuations in investment value and potential losses in pursuit of financial gains. Understanding your risk tolerance is essential to crafting a strategy that aligns with your financial goals and personal comfort. Here’s a detailed step-by-step guide:

1. Define Risk Tolerance

- What is Risk Tolerance?

- Risk tolerance is your emotional and financial ability to handle the ups and downs of investing.

- It is influenced by personal factors such as age, income, financial goals, and personality.

- Three Types of Risk Tolerance:

- Aggressive: Comfortable with high-risk, high-reward investments.

- Moderate: Prefers a balanced approach, combining growth and safety.

- Conservative: Focuses on preserving capital with low-risk investments.

- Aggressive: Comfortable with high-risk, high-reward investments.

2. Reflect on Personal Comfort with Risk

- Ask Yourself Key Questions:

- How would you feel if the value of your investment dropped by 20% overnight?

- Can you stay invested during market downturns, or would you panic and sell?

- Understand Emotional Responses:

- Recognize how uncertainty and volatility impact your decision-making.

- Identify whether you’re naturally a cautious saver or a bold risk-taker.

3. Evaluate Financial Capacity for Risk

- Assess Current Financial Situation:

- Review your income, expenses, and savings.

- Determine how much money you can afford to lose without jeopardizing your financial stability.

- Time Horizon:

- Longer investment horizons generally allow for higher risk tolerance because there’s more time to recover from losses.

- Example: A 30-year-old saving for retirement in 30 years may tolerate more risk than someone nearing retirement.

- Liquidity Needs:

- If you need quick access to funds, your risk tolerance may be lower since volatile investments may not be easily liquidated.

4. Use Risk Assessment Tools

- Risk Tolerance Questionnaires:

- Use tools provided by financial institutions or investment platforms to assess your risk tolerance.

- Common questions include:

- What’s your primary investment objective? (e.g., growth, income, preservation)

- How would you react to market declines?

- Financial Ratios:

- Calculate your debt-to-income ratio and savings rate to gauge your ability to absorb financial shocks.

5. Align Risk Tolerance with Investment Goals

- Match Goals to Risk Levels:

- Short-term goals often require lower risk tolerance (e.g., saving for a vacation).

- Long-term goals may allow for higher risk (e.g., building a retirement fund).

- Reassess During Life Changes:

- Major life events like marriage, having children, or career changes may affect your risk tolerance.

6. Understand the Relationship Between Risk and Reward

- Higher Risk = Higher Potential Reward:

- Investments like stocks and cryptocurrencies carry higher risks but may yield significant returns.

- Investments like stocks and cryptocurrencies carry higher risks but may yield significant returns.

- Lower Risk = Lower Potential Reward:

- Investments like bonds and savings accounts offer stability but limited growth potential.

- Investments like bonds and savings accounts offer stability but limited growth potential.

- Diversification to Balance Risk:

- Spread investments across asset classes to mitigate risk.

7. Learn from Market History

- Review Case Studies:

- Study historical market events like the 2008 financial crisis or the dot-com bubble to understand how different investments behaved during volatile times.

- Study historical market events like the 2008 financial crisis or the dot-com bubble to understand how different investments behaved during volatile times.

- Volatility Patterns:

- Learn about standard deviations and how they measure the variability of investment returns.

8. Consult with a Financial Advisor

- Seek Professional Advice:

- Financial advisors can provide personalized insights into your risk tolerance and recommend suitable investments.

- Financial advisors can provide personalized insights into your risk tolerance and recommend suitable investments.

- Discuss Global Context:

- International financial advisors can help assess geopolitical risks and currency fluctuations affecting your portfolio.

9. Document Your Risk Profile

- Create a Risk Tolerance Statement:

- Write a personal statement summarizing your comfort level with risk and your financial goals.

- Example: “I am a moderate investor seeking balanced growth and income, willing to tolerate a 10% fluctuation in my portfolio value annually.”

- Review Periodically:

- Revisit your risk profile every 6-12 months or after significant market changes.

10. Test Your Risk Tolerance in Simulations

- Use Investment Simulators:

- Platforms like paper trading accounts allow you to test strategies without real money.

- Observe your reactions to simulated losses and gains.

- Participate in Scenarios:

- Set hypothetical investment challenges to evaluate how much risk you can emotionally and financially endure.

11. Adapt Your Portfolio Accordingly

- Risk-Averse Portfolio:

- Focus on bonds, cash equivalents, and dividend-paying stocks.

- Focus on bonds, cash equivalents, and dividend-paying stocks.

- Risk-Tolerant Portfolio:

- Include growth stocks, emerging market investments, and alternative assets like real estate or commodities.

- Include growth stocks, emerging market investments, and alternative assets like real estate or commodities.

- Balance and Rebalance:

- Regularly adjust your portfolio to ensure alignment with your evolving risk tolerance.

By understanding your risk tolerance, you’ll gain the confidence to make informed investment decisions that align with your financial goals and personal comfort. This step serves as the foundation for building a resilient and well-balanced investment strategy.

Step 4: Build a Basic Knowledge Base

Creating a strong foundation of knowledge is essential before diving into the world of investing. A solid understanding of key concepts, strategies, and terminology will help you make informed decisions and confidently manage your investments. This step-by-step guide outlines how to develop your basic knowledge base effectively.

1. Understand Why a Knowledge Base is Crucial

- Minimizes Risk: Knowledge helps reduce the chances of making costly mistakes.

- Enhances Confidence: Familiarity with investment terms and strategies boosts your confidence in navigating financial markets.

- Improves Decision-Making: Informed investors are better equipped to evaluate opportunities and risks.

2. Start with Beginner-Friendly Resources

- Books for Beginners:

- Look for books that explain financial concepts in plain language.

- Examples:

- The Intelligent Investor by Benjamin Graham.

- Rich Dad Poor Dad by Robert Kiyosaki.

- Podcasts:

- Listen to podcasts tailored for new investors.

- Examples:

- The Dave Ramsey Show.

- Invest Like a Boss.

- Videos and Online Courses:

- Platforms like YouTube and Udemy offer free or affordable courses.

- Search for topics like “Investing 101” or “Basics of Financial Markets.”

3. Familiarize Yourself with Key Terms

- Core Concepts:

- Diversification: Spreading investments across different assets to reduce risk.

- Compounding: Earning returns on both the original investment and previous gains.

- Asset Classes: Different types of investments like stocks, bonds, and real estate.

- Liquidity: How quickly an investment can be converted into cash.

- Diversification: Spreading investments across different assets to reduce risk.

- Glossaries and Resources:

- Refer to glossaries on investment websites or apps for clear explanations.

4. Explore Interactive Learning Tools

- Investment Simulators:

- Use free tools like paper trading accounts to simulate investing without real money.

- Examples: Investopedia Simulator, TradingView.

- Apps for Beginners:

- Apps like Robinhood, Acorns, and Stash offer beginner-friendly platforms.

5. Join Online Forums and Communities

- Engage with Experienced Investors:

- Join forums like Reddit’s r/personalfinance or r/investing to ask questions and read advice.

- Join forums like Reddit’s r/personalfinance or r/investing to ask questions and read advice.

- Learn from Global Perspectives:

- Participate in international discussions to understand how investing works in different countries.

- Participate in international discussions to understand how investing works in different countries.

- Stay Updated on Trends:

- Follow reputable financial news outlets and discussions to stay informed about market trends.

6. Create a Study Schedule

- Daily Commitment:

- Dedicate at least 20–30 minutes a day to reading, listening, or learning about investments.

- Dedicate at least 20–30 minutes a day to reading, listening, or learning about investments.

- Structured Approach:

- Monday: Read a chapter from a beginner’s book.

- Wednesday: Listen to a podcast episode.

- Friday: Watch a video or join a webinar.

7. Learn the Basics of Financial Instruments

- Understand Common Investment Vehicles:

- Stocks: Ownership in a company.

- Bonds: Loans made to governments or corporations.

- Mutual Funds: Pools of money invested in diversified portfolios.

- Exchange-Traded Funds (ETFs): Funds traded on stock exchanges like stocks.

- Stocks: Ownership in a company.

- Research Historical Performances:

- Study how these instruments have performed over the years.

8. Apply What You Learn

- Start Small:

- Begin with small investments in low-risk options like index funds.

- Begin with small investments in low-risk options like index funds.

- Track Your Progress:

- Use spreadsheets or investment apps to monitor your learning and practice.

9. Consult with Experts When Necessary

- Financial Advisors:

- Seek guidance from certified advisors to clarify complex concepts.

- Seek guidance from certified advisors to clarify complex concepts.

- Workshops and Webinars:

- Attend live sessions to gain practical insights.

10. Stay Updated

- Follow Reputable News Sources:

- Examples: Bloomberg, Financial Times, and CNBC.

- Examples: Bloomberg, Financial Times, and CNBC.

- Set Alerts:

- Use apps to receive notifications about market movements and new learning materials.

By dedicating time to building a basic knowledge base, you’ll equip yourself with the tools and confidence needed to take the next steps in your investment journey. This foundational knowledge will empower you to make smarter decisions, align your strategies with your goals, and ultimately achieve financial success.

We’re also giving these extra bonuses

Investment Strategies – Checklist

Investment Strategies – FAQs

Investment Strategies – Salespage Content

Package Details:

Word Count: 19 358 Words

Number of Pages: 93

Investment Strategies – Bonus Content

Checklist

Word Count: 322 words

FAQs

Word Count: 964 words

Salespage Content

Word Count: 623 words

Total Word Count: 21 267 Words

Your PLR License Terms

PERMISSIONS: What Can You Do With These Materials?

Sell the content basically as it is (with some minor tweaks to make it “yours”).

If you are going to claim copyright to anything created with this content, then you must substantially change at 75% of the content to distinguish yourself from other licensees.

Break up the content into small portions to sell as individual reports for $10-$20 each.

Bundle the content with other existing content to create larger products for $47-$97 each.

Setup your own membership site with the content and generate monthly residual payments!

Take the content and convert it into a multiple-week “eclass” that you charge $297-$497 to access!

Use the content to create a “physical” product that you sell for premium prices!

Convert it to audios, videos, membership site content and more.

Excerpt and / or edit portions of the content to give away for free as blog posts, reports, etc. to use as lead magnets, incentives and more!

Create your own original product from it, set it up at a site and “flip” the site for megabucks!

RESTRICTIONS: What Can’t You Do With These Materials?

To protect the value of these products, you may not pass on the rights to your customers. This means that your customers may not have PLR rights or reprint / resell rights passed on to them.

You may not pass on any kind of licensing (PLR, reprint / resell, etc.) to ANY offer created from ANY PORTION OF this content that would allow additional people to sell or give away any portion of the content contained in this package.

You may not offer 100% commission to affiliates selling your version / copy of this product. The maximum affiliate commission you may pay out for offers created that include parts of this content is 75%.

You are not permitted to give the complete materials away in their current state for free – they must be sold. They must be excerpted and / or edited to be given away, unless otherwise noted. Example: You ARE permitted to excerpt portions of content for blog posts, lead magnets, etc.

You may not add this content to any part of an existing customer order that would not require them to make an additional purchase. (IE You cannot add it to a package, membership site, etc. that customers have ALREADY paid for.)

Share Now!