Green Investing PLR Course 23k Words

in Business Finance PLR , Finance PLR , Finance PLR Ebooks , PLR Checklists , PLR eBooks , PLR eCourses , PLR List Building Reports , Premium PLR , Premium PLR eBooks , Premium PLR Reports , Premium White Label Brandable PLR Coaching Courses , Private Label Rights ProductsChoose Your Desired Option(s)

has been added to your cart!

have been added to your cart!

#greeninvesting #plrcourse #sustainableinvesting #ecofriendlyfinance #investsmart #plrcontent #digitalproducts #financialfreedom #greenfinance #ecoinvesting

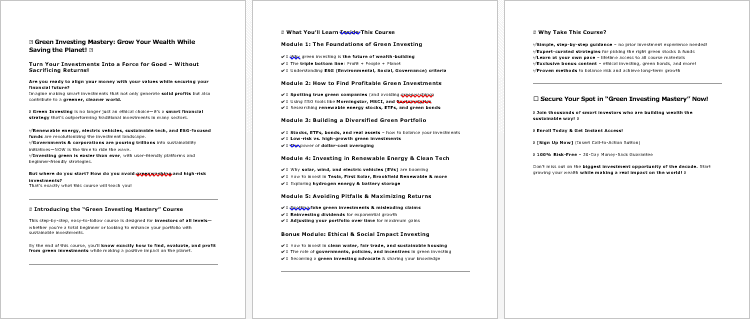

Green Investing PLR Course – Build Wealth & Save the Planet 🌱💰

Green Investing: A Step-by-Step Guide to Sustainable Wealth

Do you want to grow your wealth while making a positive impact on the planet? Welcome to the Green Investing PLR Course, a comprehensive, ready-to-use guide that teaches how to invest ethically, sustainably, and profitably.

With 21,959 words of high-quality, actionable content, this course is perfect for beginners, experienced investors, and entrepreneurs looking for a fully-packaged PLR product to sell, rebrand, or monetize in multiple ways.

Whether you want to start your own business, educate your audience, or generate passive income, the Green Investing PLR Course gives you everything you need to succeed in the fast-growing world of sustainable investing.

Presenting…

Green Investing PLR Course 23k Words

Why Green Investing Matters 🌍💚

The global economy is changing. More individuals and institutions are recognizing the importance of sustainable, ethical investments that support renewable energy, clean technology, and environmental innovation.

Green investing allows you to:

- Support the planet by funding eco-friendly businesses and initiatives

- Generate strong financial returns from growing sustainable industries

- Diversify your portfolio with green stocks, ETFs, bonds, and renewable energy projects

- Stay ahead of trends in an investment world increasingly focused on ESG (Environmental, Social, Governance) metrics

This course doesn’t just teach theory—it provides practical steps to start, grow, and manage a green investment portfolio successfully.

What’s Inside the Green Investing PLR Course?

This step-by-step guide covers everything from the basics to advanced green investing strategies.

Module 1: Understanding Green Investing

- What is Green Investing? Learn how to focus on companies and funds prioritizing environmental sustainability, including renewable energy, clean tech, and sustainable agriculture.

- Why Green Investing Matters: Discover how your investments can fight climate change while offering financial growth.

- Types of Green Investments: Stocks, mutual funds, ETFs, green bonds, renewable energy projects, and more.

- Common Myths Debunked: Green investments are profitable and accessible to everyone.

Module 2: Getting Started with Green Investing

- Setting Your Green Investment Goals: Define whether your focus is growth, sustainability, or both.

- Researching Green Companies & Funds: Use ESG ratings and trusted tools like Morningstar, MSCI, and Sustainalytics.

- Choosing Investment Platforms: Explore Betterment, M1 Finance, Vanguard, and Fidelity for green portfolios.

- Making Your First Investment: Start small, use dollar-cost averaging, and learn to invest confidently.

Module 3: Building a Profitable & Sustainable Portfolio

- Diversification: Combine stocks, ETFs, bonds, and real assets to minimize risk.

- Evaluating Risks & Returns: Balance high-growth opportunities with safer options.

- Investing in Renewable Energy & Clean Tech: Explore solar, wind, and EV stocks from companies like Tesla, NextEra Energy, and Brookfield Renewable.

- Avoiding Greenwashing: Ensure your investments truly benefit the environment.

Module 4: Monitoring & Growing Your Green Investments

- Tracking Performance: Use Personal Capital, Mint, or broker dashboards to monitor returns.

- Adjusting Your Portfolio Over Time: Rebalance every 3–6 months for optimal growth.

- Reinvesting Dividends: Use compound growth strategies to maximize profits.

- Supporting Sustainability Beyond Investing: Invest locally and make a real-world impact.

Module 5: The Future of Green Investing

- Emerging Trends: Hydrogen energy, battery storage, sustainable blockchain, and carbon capture technologies.

- Government Incentives: Take advantage of green bonds and sustainability-focused policies.

- Ethical & Social Impact Investing: Invest in initiatives that benefit people, planet, and profit.

- Becoming a Green Investing Advocate: Share knowledge and inspire others to invest sustainably.

Bonus Materials Included

- Green Investing Checklist (367 words): Step-by-step reminders to ensure nothing is missed.

- Green Investing FAQs (600 words): Answer common questions and address concerns.

- Ready-to-Use Sales Page (540 words): Quickly promote and sell the course under your brand.

Who Can Benefit from This PLR Course?

The Green Investing PLR Course is perfect for:

- Entrepreneurs & Coaches: Sell it as a digital course, eBook, or membership content.

- Financial Bloggers & Influencers: Share sections as blog posts or lead magnets to grow your audience.

- Investment Enthusiasts: Learn sustainable investing while having a fully packaged guide to reference.

- PLR Buyers: Rebrand and sell under your name for instant income.

Monetization Ideas: How to Profit from This Course 💵

This PLR course comes with full resale rights, giving you multiple ways to monetize:

- Sell the course as-is: Use minor tweaks to make it yours and offer it as a digital download.

- Create smaller reports: Break the content into individual reports ($10–$20 each).

- Bundle with other products: Combine with related PLR content ($47–$97 bundles).

- Set up a membership site: Offer ongoing access to content and generate residual income.

- Develop a multi-week eClass: Charge $297–$497 for access to a structured course.

- Convert to audio, video, or physical products: Expand your audience and revenue.

- Use as lead magnets: Share excerpts on blogs or email campaigns to grow your subscriber list.

- Create a full site flip: Build a website around the course and sell it for a premium.

The possibilities are endless, giving you freedom to build your business exactly how you want.

PLR License Terms 📄

Permissions:

- Sell the content as-is with minor tweaks.

- Substantially change content (75%) to claim copyright.

- Break into small reports or create bundles.

- Convert into audio, video, membership, or physical products.

- Use excerpts as lead magnets or blog content.

Restrictions:

- Cannot pass on PLR or resell rights.

- Maximum affiliate commission: 75%.

- Cannot give away complete materials for free.

- Cannot add content to a customer order without extra purchase.

Why Choose the Green Investing PLR Course?

- Comprehensive Content: Covers everything from basic concepts to advanced investing strategies.

- Ready-to-Use: Comes with checklist, FAQs, and sales page.

- Profit Potential: Multiple monetization avenues from one high-value product.

- Expert Guidance: Helps anyone start investing sustainably, regardless of experience.

- Impactful: Invest in companies and initiatives that make a real difference for the planet.

Final Thoughts: Start Building Sustainable Wealth Today! 🌟

With the Green Investing PLR Course, you’ll have a complete toolkit to:

- Educate yourself or your audience about green investing

- Start your own digital product business

- Make money while supporting sustainability

- Build long-term wealth responsibly

Don’t wait—the future of investing is green, and the opportunity to profit while helping the planet has never been better.

Start today, rebrand, and sell your Green Investing PLR Course!

has been added to your cart!

have been added to your cart!

Here A Sample of Green Investing PLR Course

Welcome to Green Investing! 🌱 This course will help you understand how to invest in a way that benefits both your portfolio and the planet. Whether you’re a beginner or already investing, this step-by-step guide will show you how to make ethical, sustainable, and profitable investment choices.

Let’s dive in! 🚀

Module 1: Understanding Green Investing

Before you start investing, it’s important to understand what green investing is and why it matters. This module will introduce you to the basics.

Step 1: What is Green Investing?

Introduction

Green investing is a strategic approach to financial investment that prioritizes environmental sustainability and social responsibility while aiming for solid financial returns. Unlike traditional investing, which often focuses solely on profit maximization, green investing aligns capital with companies, funds, and projects that actively contribute to environmental protection and sustainable development.

As global climate concerns continue to rise, green investing has gained momentum among individual investors, institutional investors, and governments worldwide. This investment strategy supports industries such as renewable energy, clean technology, sustainable agriculture, water conservation, and eco-friendly transportation.

By understanding what green investing is, investors can make informed decisions that not only benefit their portfolios but also drive positive change for the planet.

Key Concepts of Green Investing

1. The Core Idea Behind Green Investing

Green investing revolves around funding environmentally responsible companies and projects. These investments focus on businesses that:

- Reduce carbon emissions and environmental pollution

- Promote energy efficiency and renewable energy sources

- Develop innovative technologies for environmental sustainability

- Support sustainable agricultural and food production practices

- Encourage water conservation and responsible waste management

This investment approach ensures that money is directed towards businesses that actively seek solutions to environmental challenges while maintaining financial growth potential.

2. The Link Between Sustainability and Profitability

Many investors mistakenly believe that green investing means sacrificing financial returns. However, research shows that companies with strong environmental, social, and governance (ESG) practices often outperform traditional businesses in the long run. This is because:

- Regulatory advantages: Governments worldwide are increasingly promoting green policies, offering incentives, tax benefits, and subsidies to eco-friendly businesses.

- Consumer demand: The global shift toward sustainable products and services means that companies focusing on sustainability are well-positioned for future growth.

- Risk management: Green businesses are less exposed to environmental risks, such as regulatory fines, resource shortages, and reputational damage from unsustainable practices.

As a result, green investing can provide competitive financial returns while contributing to a more sustainable world.

Types of Green Investments

Investors interested in green investing have multiple options. These include individual stocks, mutual funds, exchange-traded funds (ETFs), and green bonds that fund environmentally responsible projects.

1. Renewable Energy Investments

Renewable energy is one of the most popular sectors in green investing. It focuses on companies that generate power from sources such as:

- Solar energy – Photovoltaic panel manufacturers, solar farms, and related technologies

- Wind energy – Wind turbine manufacturers and offshore/onshore wind farms

- Hydropower – Companies involved in hydroelectric energy production

- Geothermal energy – Businesses that use heat from the Earth to generate power

Investing in renewable energy helps reduce reliance on fossil fuels and supports the transition to cleaner energy sources.

2. Clean Technology (Cleantech) Investments

Cleantech investments focus on technology-driven solutions that reduce environmental impact while increasing efficiency. Examples include:

- Energy-efficient building materials and appliances

- Smart grids and energy storage solutions

- Electric vehicle (EV) technology and charging infrastructure

- Recycling and waste management innovations

Companies in the cleantech sector aim to improve energy efficiency and reduce carbon footprints across industries.

3. Sustainable Agriculture and Food Production

Agriculture plays a significant role in environmental sustainability. Green investing in this sector includes:

- Organic farming and regenerative agriculture that reduce soil degradation and chemical usage

- Plant-based food companies that offer sustainable alternatives to meat production

- Precision agriculture technologies that optimize resource use (water, fertilizers, pesticides)

Supporting sustainable agriculture helps combat deforestation, soil depletion, and excessive water consumption.

4. Water Conservation and Management

Water is a critical resource, and investing in sustainable water management solutions is essential. This includes:

- Water purification and filtration systems

- Desalination technologies that provide fresh water in arid regions

- Smart irrigation systems for agriculture

- Companies focusing on wastewater treatment and recycling

With water scarcity becoming a global concern, investments in water sustainability are both financially and environmentally rewarding.

5. Eco-Friendly Transportation and Infrastructure

Green investing also extends to sustainable mobility and infrastructure, including:

- Electric vehicle (EV) manufacturers and battery technology providers

- Public transportation solutions that reduce carbon footprints

- Sustainable urban planning and green building initiatives

Governments and corporations worldwide are investing in these solutions to promote sustainable living.

Benefits of Green Investing

1. Financial Growth with Sustainability

Green investing provides opportunities for long-term financial growth by investing in industries with future potential. As regulations and market trends favor sustainable practices, green companies have a competitive edge over traditional businesses.

2. Environmental and Social Impact

Investors actively support the transition to a greener economy by financing projects that:

- Reduce carbon emissions and air pollution

- Promote renewable energy and energy efficiency

- Improve waste management and recycling efforts

- Conserve water and protect natural ecosystems

3. Portfolio Diversification

Adding green investments to an existing portfolio helps investors diversify their assets, reducing exposure to industries negatively impacted by climate regulations (e.g., coal, oil, and gas companies).

4. Compliance with Global Trends and Regulations

Governments and regulatory bodies worldwide are implementing stricter environmental policies. Investing in sustainable industries ensures compliance with these policies and reduces investment risks associated with climate change-related regulations.

Challenges and Considerations in Green Investing

While green investing offers many advantages, it also comes with challenges:

1. Greenwashing (False Sustainability Claims)

Some companies mislead investors by presenting themselves as environmentally responsible when, in reality, their sustainability efforts are minimal. Investors should:

- Research third-party ESG ratings from organizations like MSCI, Sustainalytics, and Morningstar

- Review corporate sustainability reports for detailed environmental impact data

- Cross-check company claims with independent sources

2. Market Volatility and Emerging Sectors

Certain green industries, such as renewable energy and clean technology, can be highly volatile due to factors like government policies, competition, and technological advancements. Investors should:

- Diversify across multiple green sectors

- Invest in established companies as well as emerging startups

- Stay updated on policy changes affecting sustainability markets

3. Regulatory and Policy Changes

Green investments are influenced by government regulations and incentives. Changes in subsidies, tax benefits, and environmental laws can affect investment returns. Investors should:

- Monitor local and international environmental policies

- Understand carbon pricing, tax credits, and renewable energy incentives

Green investing is a powerful financial strategy that enables investors to build wealth while promoting environmental sustainability. By understanding the core principles, investment options, benefits, and challenges, investors can make informed decisions that align with both their financial goals and global sustainability efforts.

Key Takeaways:

✔ Green investing focuses on environmentally responsible companies and projects

✔ Sustainable industries include renewable energy, cleantech, sustainable agriculture, water conservation, and eco-friendly transportation

✔ Green investments can be profitable while supporting long-term environmental and social impact

✔ Investors must research and verify sustainability claims to avoid greenwashing

✔ Global trends favor sustainability, making green investing an essential part of modern investment strategies

As the world transitions to a low-carbon economy, green investing will continue to shape the future of finance. By starting today, investors can be part of the movement toward a more sustainable and profitable world.

Step 2: Why Does Green Investing Matter?

Introduction

The world is undergoing a profound transformation, with sustainability at the forefront of global economic, political, and social discussions. Climate change, resource depletion, and environmental degradation are pressing concerns that require immediate action. Green investing provides a unique opportunity to be part of the solution while also benefiting from strong financial returns.

By investing in environmentally responsible companies, individuals and institutions can help combat climate change, promote sustainable business practices, and drive innovation in clean technology. At the same time, the financial sector is recognizing that sustainable businesses are not just ethical investments but also smart, future-proof investments that align with global trends and regulations.

This step will explore why green investing is important and how it plays a crucial role in shaping a more sustainable and financially stable future.

Key Reasons Why Green Investing Matters

1. Addressing Climate Change Through Investment

Climate change is one of the most significant challenges of our time. Rising global temperatures, extreme weather events, and environmental degradation threaten economies, industries, and communities worldwide.

Green investing enables capital to flow into companies and projects that directly reduce carbon emissions, improve energy efficiency, and develop sustainable solutions. Some key ways green investments address climate change include:

- Funding renewable energy projects to replace fossil fuels

- Supporting electric vehicle (EV) adoption to reduce transportation emissions

- Investing in carbon capture and storage technologies

- Encouraging sustainable agricultural and forestry practices

By directing funds toward these industries, green investing helps accelerate the global transition to a low-carbon economy while ensuring long-term sustainability.

2. Strong Financial Returns and Future-Proof Investments

One of the biggest misconceptions about green investing is that it comes at the cost of profitability. However, data suggests that sustainable investments are outperforming traditional investments over the long term.

Why Green Investments Are Financially Rewarding:

- Growing Market Demand: Consumers, businesses, and governments are shifting towards sustainability. Companies that embrace this change are better positioned for long-term growth.

- Government Incentives: Many countries offer subsidies, tax credits, and regulatory support for green industries, making them attractive investment options.

- Reduced Risk Exposure: Companies with strong environmental, social, and governance (ESG) practices are less likely to face fines, lawsuits, or reputational damage related to environmental issues.

- Long-Term Stability: Industries such as renewable energy and cleantech are expected to grow exponentially, providing investors with sustainable returns.

Examples of High-Growth Green Investments:

- The renewable energy sector is expected to reach trillions of dollars in market value as fossil fuel reliance decreases.

- The electric vehicle (EV) market is expanding rapidly, with leading automakers shifting towards sustainable transportation.

- Sustainable food production and plant-based alternatives are gaining popularity, creating profitable investment opportunities.

Investing in green industries ensures that capital is placed in sectors that will thrive in a future shaped by sustainability policies and consumer preferences.

3. Encouraging Corporate Responsibility and Ethical Business Practices

Investors have significant power in shaping corporate behavior. Green investing pressures companies to adopt sustainable business models and prioritize environmental responsibility.

When investors actively choose sustainable and ethical businesses, companies are incentivized to:

- Reduce greenhouse gas emissions and pollution

- Improve waste management and recycling efforts

- Adopt sustainable supply chain practices

- Increase transparency regarding their environmental impact

This shift toward sustainability not only benefits the environment but also enhances corporate reputations and attracts conscious consumers. Investors play a key role in holding companies accountable and pushing for responsible business operations.

4. Supporting Global Sustainable Development Goals (SDGs)

The United Nations has established 17 Sustainable Development Goals (SDGs) to address major global challenges, including poverty, inequality, and climate change. Green investing directly contributes to several of these goals, such as:

- Affordable and Clean Energy (Goal 7): Investing in solar, wind, hydro, and other renewable energy sources ensures access to clean energy for all.

- Industry, Innovation, and Infrastructure (Goal 9): Green investments fund sustainable infrastructure and technological advancements that reduce environmental impact.

- Climate Action (Goal 13): Capital directed toward sustainable projects accelerates efforts to combat climate change.

- Responsible Consumption and Production (Goal 12): Investing in companies that prioritize sustainable resource use and waste reduction promotes eco-friendly economic growth.

By aligning investment decisions with these global objectives, green investors contribute to a more equitable, sustainable, and prosperous world.

5. Shaping the Future of Business and Finance

The financial industry is rapidly evolving, with sustainability becoming a key factor in investment decisions. Large institutional investors, banks, and asset managers are integrating Environmental, Social, and Governance (ESG) factors into their portfolios.

The Rise of ESG Investing:

- Major investment firms are prioritizing companies with strong ESG ratings.

- Sustainable finance regulations are increasing, requiring businesses to disclose environmental impacts.

- Green bonds and sustainable funds are gaining popularity among investors looking for responsible investment options.

This shift means that green investing is not just an ethical choice—it is a smart financial strategy that aligns with the future of the global economy.

Challenges and Considerations in Green Investing

While green investing offers numerous benefits, there are challenges that investors must be aware of:

1. Greenwashing and Misleading Claims

Not all companies claiming to be “green” or “sustainable” truly prioritize environmental responsibility. Some engage in greenwashing, a practice where businesses exaggerate or falsely advertise their sustainability efforts.

How to Avoid Greenwashing:

- Look for third-party ESG ratings and certifications from trusted organizations.

- Review corporate sustainability reports to assess real environmental impact.

- Cross-check company claims with independent sources and industry benchmarks.

2. Market Volatility in Emerging Green Sectors

Some green industries, such as renewable energy and clean technology, are still developing. This means they can experience market fluctuations due to regulatory changes, technological advancements, or shifting consumer preferences.

Investment Strategy for Risk Management:

- Diversify investments across multiple green sectors.

- Focus on established companies with strong sustainability practices.

- Stay informed about policy changes that could impact green industries.

3. Long-Term Commitment to Sustainable Growth

Green investing is a long-term strategy that requires patience. While certain green investments may yield immediate returns, the full benefits of sustainable industries will unfold over years or decades.

Investors should be prepared for long-term capital appreciation rather than short-term gains.

Green investing is more than just a trend—it is a critical financial movement that supports sustainability, innovation, and long-term profitability. As the world transitions to a more sustainable future, investors have the power to drive change while benefiting from high-growth sectors.

Key Takeaways:

✔ Green investing fights climate change by funding sustainable industries.

✔ Sustainable investments offer strong financial returns due to global demand and regulatory support.

✔ Investors influence corporate responsibility and push for ethical business practices.

✔ Green investments support the UN’s Sustainable Development Goals (SDGs).

✔ The financial industry is shifting toward ESG investing, making sustainability a core investment strategy.

By understanding why green investing matters, investors can confidently contribute to a better world while securing their financial future.

Step 3: The Different Types of Green Investments

Introduction

Green investing is a broad and diverse field that allows investors to align their financial goals with their values. As more individuals and institutions prioritize sustainability, the market for environmentally responsible investments continues to grow. Whether you are a beginner or an experienced investor, there are various ways to build a portfolio that supports green initiatives while generating financial returns.

This step will explore the different types of green investments, their benefits, and how they contribute to a more sustainable future. By the end of this lesson, you will have a clear understanding of the various options available and how to choose investments that align with your financial and ethical objectives.

1. Stocks in Eco-Friendly Companies

What Are Green Stocks?

Green stocks refer to shares of publicly traded companies that prioritize sustainability, environmental protection, and ethical business practices. These companies operate in sectors such as renewable energy, clean technology, water conservation, and sustainable agriculture.

Investing in eco-friendly stocks allows investors to directly support businesses that are committed to reducing carbon footprints, minimizing pollution, and promoting sustainable development.

Examples of Eco-Friendly Companies:

- Renewable Energy Companies – Firms that develop solar, wind, hydro, and geothermal energy solutions.

- Electric Vehicle (EV) Manufacturers – Companies producing electric cars, charging infrastructure, and battery technologies.

- Sustainable Agriculture and Food Companies – Businesses that focus on organic farming, plant-based food alternatives, and eco-friendly packaging.

- Water Conservation and Waste Management Firms – Companies specializing in clean water technology, recycling, and waste reduction.

How to Invest in Green Stocks:

- Research Companies with Strong ESG (Environmental, Social, and Governance) Ratings – Look for firms with high sustainability scores from organizations such as MSCI, Sustainalytics, and Morningstar.

- Analyze Financial Performance – Ensure the company has a solid financial track record, growth potential, and long-term profitability.

- Check Sustainability Reports – Review annual sustainability reports to assess the company’s environmental impact and commitments.

- Diversify Your Portfolio – Invest in multiple green stocks across different industries to minimize risk.

Benefit: Green stocks allow investors to participate in the growing sustainable economy while potentially achieving high returns.

2. Green Mutual Funds & ETFs (Exchange-Traded Funds)

What Are Green Mutual Funds and ETFs?

Green mutual funds and ETFs are professionally managed investment funds that focus on sustainable companies and environmentally friendly industries. These funds pool money from multiple investors and allocate it to stocks, bonds, and other assets that meet specific green investment criteria.

Key Differences Between Mutual Funds and ETFs:

- Mutual Funds – Actively managed portfolios that may have higher fees but provide professional oversight.

- ETFs – Passively managed funds that track sustainability indexes and offer lower expense ratios.

Types of Green Mutual Funds and ETFs:

- Clean Energy Funds – Focused on renewable energy companies, such as solar, wind, and hydrogen energy firms.

- Low Carbon ETFs – Invest in companies that have reduced carbon footprints and support the transition to a low-carbon economy.

- Water Sustainability Funds – Target companies involved in water purification, desalination, and efficient water usage technologies.

- Socially Responsible Investing (SRI) Funds – Include companies that meet strict ESG criteria while excluding businesses in fossil fuels, tobacco, and other harmful industries.

How to Invest in Green Mutual Funds & ETFs:

- Use a Sustainable Investing Platform – Platforms like Vanguard, BlackRock, and Fidelity offer ESG-focused funds.

- Evaluate the Fund’s Holdings – Check if the fund invests in industries and companies aligned with your sustainability goals.

- Compare Expense Ratios and Fees – Choose funds with lower costs to maximize returns.

- Assess Performance Over Time – Review historical returns and compare them with benchmark indexes.

Benefit: Green funds provide an easy way to invest in multiple sustainable companies without having to select individual stocks.

3. Impact Bonds That Fund Sustainable Projects

What Are Green and Impact Bonds?

Green bonds, also known as impact bonds or climate bonds, are fixed-income securities designed to raise capital for projects that benefit the environment. Governments, corporations, and financial institutions issue these bonds to fund renewable energy projects, energy-efficient infrastructure, and sustainable agriculture.

Types of Impact Bonds:

- Green Bonds – Finance projects like solar farms, wind energy plants, and eco-friendly public transportation.

- Social Impact Bonds – Support projects that address social and environmental challenges, such as clean water access and climate adaptation efforts.

- Sustainability Bonds – Combine environmental and social initiatives, ensuring both economic and ecological benefits.

How to Invest in Impact Bonds:

- Check Bond Issuers – Invest in bonds issued by governments, international organizations (e.g., the World Bank), and sustainable corporations.

- Review Bond Ratings – Ensure the bond has a strong credit rating to minimize risk.

- Look for Third-Party Verification – Certified green bonds follow international sustainability standards such as the Climate Bonds Initiative (CBI).

- Understand Maturity and Interest Rates – Consider the duration and expected yield before investing.

Benefit: Impact bonds offer stable returns while funding large-scale environmental projects that drive global sustainability.

4. Renewable Energy Investments: Solar, Wind, and Beyond

Why Invest in Renewable Energy?

The demand for renewable energy is growing exponentially as countries phase out fossil fuels and commit to net-zero carbon emissions. Investing in renewable energy provides long-term financial returns while reducing environmental harm.

Types of Renewable Energy Investments:

- Solar Energy – Investing in solar panel manufacturers, solar farms, and battery storage technologies.

- Wind Energy – Funding wind turbine companies and offshore wind power projects.

- Hydropower – Supporting companies that develop hydroelectric dams and water energy solutions.

- Geothermal Energy – Investing in companies that harness underground heat for electricity production.

- Hydrogen Energy – Emerging as a clean alternative fuel for transportation and industry.

Ways to Invest in Renewable Energy:

- Buy Stocks in Renewable Energy Companies – Leading firms like Tesla (solar storage), Vestas (wind turbines), and First Solar (solar panels) are publicly traded.

- Invest in Green Energy ETFs and Mutual Funds – Funds that focus on clean energy stocks provide diversified exposure.

- Participate in Crowdfunding Projects – Platforms like Abundance and Trine allow investors to fund community-based renewable energy projects.

- Invest in Infrastructure Projects – Some countries offer investment opportunities in large-scale wind and solar farms through government programs.

Benefit: Renewable energy investments provide long-term stability as the world shifts toward clean energy solutions.

There are many ways to incorporate sustainability into your investment portfolio. Whether you prefer individual stocks, funds, bonds, or renewable energy projects, green investing provides opportunities for financial growth while contributing to environmental protection.

Key Takeaways:

✔ Green stocks allow direct investment in eco-friendly companies.

✔ Mutual funds and ETFs provide diversified exposure to sustainable businesses.

✔ Impact bonds finance large-scale projects that combat climate change.

✔ Renewable energy investments support the transition to a clean energy future.

By choosing the right mix of green investments, investors can align financial success with global sustainability goals and play an active role in shaping a greener economy.

Step 4: Common Myths About Green Investing

Introduction

Green investing is growing rapidly as more people realize that sustainability and financial success can go hand in hand. However, despite its increasing popularity, there are still many misconceptions that prevent potential investors from getting started.

In this step, we will break down the most common myths about green investing, provide factual insights, and show why sustainable investments can be just as profitable—if not more—than traditional investments. Whether you are a beginner or an experienced investor, understanding these myths will help you make informed decisions and confidently invest in green opportunities.

Myth 1: “Green Investments Don’t Make Money” – False!

Reality: Many Green Investments Outperform Traditional Markets

One of the biggest misconceptions about green investing is that it is purely ethical and does not generate competitive financial returns. However, this is far from the truth. Many sustainable investments have outperformed traditional markets in recent years, proving that being environmentally responsible does not mean sacrificing profitability.

Why Green Investments Can Be Profitable:

- Growing Demand for Sustainability – Consumers, businesses, and governments are prioritizing eco-friendly products and services, driving up the value of green companies.

- Government Incentives – Many countries provide subsidies, tax credits, and funding for renewable energy, electric vehicles, and sustainable agriculture, benefiting investors.

- Resilience to Market Shocks – Studies show that ESG (Environmental, Social, and Governance) investments tend to weather economic downturns better than traditional investments.

- Long-Term Growth Potential – The shift toward clean energy, electric mobility, and responsible business practices is a long-term trend, not a short-term fad.

Case Studies & Market Data:

- Renewable energy stocks have outperformed fossil fuel stocks in the past decade, with companies like NextEra Energy and Tesla showing significant long-term gains.

- Sustainable ETFs and mutual funds have shown competitive returns compared to conventional investment funds.

- ESG-focused funds have been proven to perform as well as, if not better than, traditional funds in various global stock markets.

✅ Fact: Green investing is not just ethical—it can also be a smart financial move with strong potential for long-term gains.

Myth 2: “Green Investing Is Only for Experts” – False!

Reality: Anyone Can Start with the Right Guidance

Many people believe that green investing is too complicated or that it requires extensive financial expertise. While understanding investments always requires some learning, green investing is not more difficult than traditional investing.

Why Green Investing Is Accessible for Everyone:

- User-Friendly Investment Platforms – Many online platforms and apps provide easy access to green stocks, ETFs, and mutual funds with beginner-friendly interfaces.

- Sustainable Investment Funds – Investors can simply choose ESG mutual funds or ETFs without needing to pick individual stocks.

- Third-Party ESG Ratings – Organizations like MSCI, Morningstar, and Sustainalytics provide sustainability ratings, making it easier to select responsible investments.

- Educational Resources – Free guides, online courses, and investment tools help new investors learn the basics of green investing.

How Beginners Can Get Started Easily:

- Step 1: Learn the Basics – Start with simple research on what green investing is and why it matters.

- Step 2: Choose an Investment Method – Decide whether to invest in stocks, funds, or bonds based on risk tolerance and financial goals.

- Step 3: Use Investment Platforms – Many platforms now highlight green investment options, making selection easy.

- Step 4: Start Small – Green investing doesn’t require large amounts of money; many platforms allow small initial investments.

✅ Fact: Green investing is for everyone, not just financial experts. With the right tools, even beginners can successfully build a sustainable investment portfolio.

Myth 3: “Green Investments Are Just a Trend” – False!

Reality: Green Investing Is the Future of Finance

Some skeptics argue that green investing is a short-term trend that will eventually fade. However, all major financial indicators show that sustainability is not a passing phase—it is the future of global finance.

Why Green Investing Is Here to Stay:

- Corporate Sustainability Commitments – Many of the world’s largest companies are adopting net-zero goals and sustainability strategies to stay competitive.

- Regulatory Changes – Governments worldwide are introducing carbon taxes, green energy policies, and stricter regulations that favor sustainable businesses.

- Investor Demand – More institutional investors (such as pension funds and hedge funds) are shifting towards ESG investments, increasing market stability for green assets.

- Climate Crisis Awareness – The urgency of climate change is driving permanent shifts in business models, consumer behavior, and financial markets.

✅ Fact: Green investing is not a temporary trend; it is a major shift in the global economy that will define the future of finance.

Myth 4: “Green Investing Limits Your Choices” – False!

Reality: There Are Many Diverse Investment Opportunities

Some believe that green investing limits their options or forces them into only a few industries. In reality, sustainable investing covers a wide range of sectors and investment types.

Diverse Green Investment Options Include:

- Renewable Energy – Solar, wind, hydro, and geothermal power.

- Electric Vehicles & Battery Technology – Companies producing EVs, charging networks, and battery storage solutions.

- Sustainable Real Estate – Investing in energy-efficient buildings, smart cities, and eco-friendly urban development.

- Sustainable Agriculture & Water Conservation – Organic farming, plant-based food companies, and clean water technology.

- Impact Bonds & ESG Funds – Investment funds dedicated to socially and environmentally responsible projects.

✅ Fact: Green investing offers a wide variety of choices, allowing investors to build diverse portfolios while supporting sustainable initiatives.

Green Investing Is a Smart and Profitable Choice

Now that we’ve debunked these common myths, it’s clear that green investing is both financially rewarding and accessible to everyone. Whether you are a seasoned investor or just getting started, green investments offer strong returns, growing opportunities, and long-term stability.

Key Takeaways:

✔ Green investments can be just as profitable as, or even more profitable than, traditional investments.

✔ Anyone can start green investing, regardless of experience, with the right guidance and tools.

✔ Sustainable investing is not a passing trend—it is the future of global finance.

✔ There are many investment options in green sectors, from stocks and bonds to funds and real estate.

By overcoming these myths, investors can confidently take part in the sustainable finance revolution, supporting the planet while securing their financial future.

We’re also giving these extra bonuses

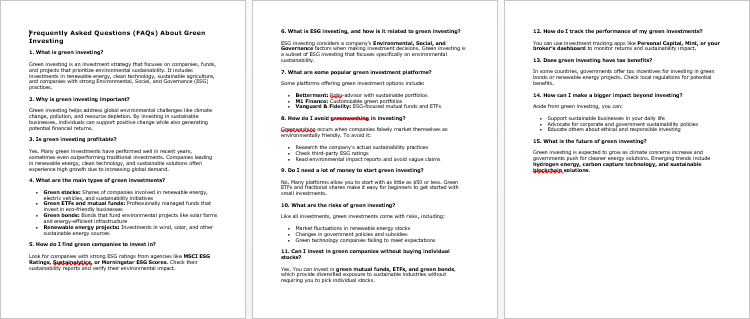

Green Investing – Checklist

Green Investing – FAQs

Green Investing – Salespage Content

Package Details:

Word Count: 21 959 Words

Number of Pages: 110

Green Investing – Bonus Content

Checklist

Word Count: 367 words

FAQs

Word Count: 600 words

Salespage Content

Word Count: 540 words

Total Word Count: 23 466 Words

Your PLR License Terms

PERMISSIONS: What Can You Do With These Materials?

Sell the content basically as it is (with some minor tweaks to make it “yours”).

If you are going to claim copyright to anything created with this content, then you must substantially change at 75% of the content to distinguish yourself from other licensees.

Break up the content into small portions to sell as individual reports for $10-$20 each.

Bundle the content with other existing content to create larger products for $47-$97 each.

Setup your own membership site with the content and generate monthly residual payments!

Take the content and convert it into a multiple-week “eclass” that you charge $297-$497 to access!

Use the content to create a “physical” product that you sell for premium prices!

Convert it to audios, videos, membership site content and more.

Excerpt and / or edit portions of the content to give away for free as blog posts, reports, etc. to use as lead magnets, incentives and more!

Create your own original product from it, set it up at a site and “flip” the site for megabucks!

RESTRICTIONS: What Can’t You Do With These Materials?

To protect the value of these products, you may not pass on the rights to your customers. This means that your customers may not have PLR rights or reprint / resell rights passed on to them.

You may not pass on any kind of licensing (PLR, reprint / resell, etc.) to ANY offer created from ANY PORTION OF this content that would allow additional people to sell or give away any portion of the content contained in this package.

You may not offer 100% commission to affiliates selling your version / copy of this product. The maximum affiliate commission you may pay out for offers created that include parts of this content is 75%.

You are not permitted to give the complete materials away in their current state for free – they must be sold. They must be excerpted and / or edited to be given away, unless otherwise noted. Example: You ARE permitted to excerpt portions of content for blog posts, lead magnets, etc.

You may not add this content to any part of an existing customer order that would not require them to make an additional purchase. (IE You cannot add it to a package, membership site, etc. that customers have ALREADY paid for.)

Share Now!