Financial Independence PLR Course 25k Words

in Finance PLR , Finance PLR Ebooks , PLR Checklists , PLR eBooks , PLR eCourses , Premium PLR , Premium PLR eBooks , Premium PLR Reports , Premium White Label Brandable PLR Coaching Courses , Private Label Rights ProductsChoose Your Desired Option(s)

has been added to your cart!

have been added to your cart!

#financialindependence #plrcourse #wealthbuilding #passiveincome #moneymanagement #financialfreedom #personalfinance #plrcontent #incomestrategies #wealthcreation

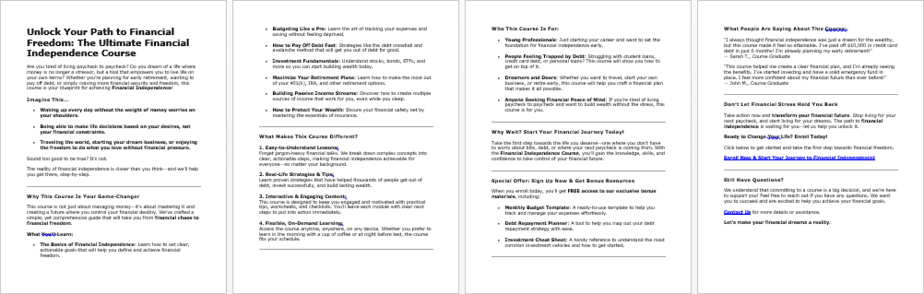

Unlock the Path to True Freedom with the Financial Independence PLR Course

Are you ready to guide your audience toward financial freedom? The Financial Independence PLR Course is here to empower your customers with the tools, strategies, and mindset they need to achieve lasting financial independence.

Whether they’re looking to eliminate debt, grow their wealth, or simply take control of their finances, this comprehensive course offers actionable steps and insights to make their financial dreams a reality.

Presenting…

Financial Independence PLR Course 25k Words

What’s Inside the Financial Independence PLR Course?

Module 1: Understanding Financial Independence

The foundation for financial freedom begins here.

- Define What Financial Independence Means: Help participants identify their unique goals, whether it’s early retirement, debt freedom, or pursuing their passions.

- Assess Current Finances: Guide learners in evaluating their income, expenses, and spending habits.

- Learn Key Principles: Dive into saving, investing, and creating passive income streams.

- Set SMART Goals: Teach them to set Specific, Measurable, Achievable, Relevant, and Time-bound financial objectives.

Module 2: Building a Solid Financial Foundation

Strengthen the groundwork for long-term success.

- Create a Realistic Budget: Practical strategies for designing a budget they can stick to.

- Establish an Emergency Fund: The importance of saving 3–6 months’ worth of expenses for unexpected events.

- Eliminate Debt Efficiently: Proven methods like the debt snowball or avalanche strategies.

- Protect with Insurance: Essential coverage types to safeguard financial stability.

Module 3: Growing Wealth

Master the art of wealth creation and management.

- Start Investing: Break down complex concepts like stocks, bonds, and mutual funds into simple terms.

- Maximize Retirement Accounts: Understand the benefits of 401(k)s, IRAs, and employer matches.

- Diversify Income Streams: Explore freelancing, side hustles, and passive income opportunities like real estate.

- Automate Finances: Simplify saving and investing with automated contributions.

Module 4: Mastering Your Money Mindset

Develop the mental tools needed for financial success.

- Identify Money Beliefs: Reflect on past experiences and how they shape financial habits.

- Adopt a Growth Mindset: Encourage positive thinking, shifting from “I can’t afford it” to “How can I afford it?”

- Overcome Financial Fears: Address common concerns and build confidence.

- Celebrate Wins: Highlight the importance of recognizing progress, no matter how small.

Module 5: Living Financial Independence

Turn goals into a sustainable lifestyle.

- Design Your Ideal Life: Visualize a future free from financial stress and full of possibilities.

- Plan for Long-Term Goals: Strategize for big milestones like buying a home, education, or travel.

- Give Back: Explore the value of contributing time, money, or skills to others.

- Keep Growing: Encourage lifelong learning and adapting to financial changes.

Why Choose This PLR Course?

Comprehensive Content

With 22,000+ words of expertly written material, this course offers actionable steps, real-life examples, and practical exercises.

Tailored for a Growing Audience

Financial independence is a hot topic among professionals, parents, freelancers, and anyone striving for financial freedom. This course caters to a wide audience looking for clear, accessible guidance.

Easy to Customize

Rebrand it, tweak the content, or add your personal touch to make it uniquely yours. Use it as a standalone course or bundle it with other financial resources for greater value.

Includes Ready-to-Use Extras

- Checklist: A simple guide to track financial progress.

- FAQs: Answer common questions about achieving financial independence.

- Sales Page Template: Quickly promote the course and start earning.

Who Will Benefit from This Course?

- Entrepreneurs and Freelancers: Gain financial control while managing irregular incomes.

- Young Professionals: Build a solid foundation for long-term success.

- Parents: Plan for children’s education, emergencies, and future needs.

- Retirement Planners: Create a roadmap for enjoying a stress-free retirement.

What’s Included in the PLR Package?

- Course Modules:

- 5 in-depth modules covering every aspect of financial independence.

- Bonus Materials:

- Comprehensive Checklist: Helps learners stay on track with their financial goals.

- FAQs Document: Answers the most pressing financial questions.

- Sales Page Template: Start marketing the course immediately.

- Editable Formats:

- Fully customizable files to make the course your own.

How to Use and Profit from This Course

- Sell the Course as a Standalone Product: Price it at $47–$97 and promote it to your audience.

- Break It into Mini-Guides: Create smaller eBooks or guides focused on budgeting, debt elimination, or investing.

- Bundle It with Other Products: Combine it with complementary courses or resources for added value.

- Launch a Membership Site: Offer the course as part of a subscription for recurring income.

- Use It as Lead Magnet Content: Offer parts of the course for free to grow your email list.

Why Your Customers Will Love It

- Beginner-Friendly: Written in simple, jargon-free language for maximum accessibility.

- Actionable Steps: Includes practical exercises and strategies to apply immediately.

- Focus on Mindset: Helps learners shift their thinking for long-term success.

- Proven Techniques: Backed by tested methods and real-life examples.

Special Introductory Offer: Just $14.99

Empower your audience with the knowledge and tools they need to achieve financial independence. Start delivering value today with the Financial Independence PLR Course!

has been added to your cart!

have been added to your cart!

Here A Sample of Financial Independence PLR Course

This course is designed to help you achieve financial independence through practical strategies, mindset shifts, and actionable steps. We’ll guide you in a friendly, approachable way to set your goals, make smart decisions, and take control of your finances.

Module 1: Understanding Financial Independence

Step 1: Define What Financial Independence Means to You

Achieving financial independence starts with a clear vision. To move forward effectively, you need to define what financial independence truly means to you. This step is about discovering your personal goals and bringing them into focus.

Step-by-Step Guide

1. Reflect on Your Current Situation

Start by asking yourself a few key questions:

- What is my biggest financial concern right now?

- What would my life look like if money wasn’t an issue?

- Do I want to retire early, pursue a passion, travel, or simply enjoy peace of mind?

Take 5–10 minutes to write down your answers in a journal or a digital document. Be honest and specific. This will help you uncover your true aspirations.

2. Imagine Your Ideal Day in Financial Independence

Close your eyes and picture your life once you’ve reached financial independence.

- What does your daily routine look like?

- Are you working because you love to or not working at all?

- Who are you spending time with, and what activities fill your day?

Example:

You might imagine waking up without an alarm clock, sipping coffee on a sunny balcony, spending quality time with family, or dedicating your afternoons to hobbies or volunteer work.

Write a detailed paragraph describing this ideal day. This exercise transforms vague dreams into a tangible vision.

3. Identify Your Key Goals

Break your vision into specific goals. Consider the following categories:

- Debt Freedom: Do you want to eliminate all credit card or loan debt?

- Savings and Investments: How much money do you need in savings or investments to feel secure?

- Lifestyle: What kind of lifestyle do you want? Simple and minimalist? Luxurious and adventurous?

- Passions and Purpose: Are there personal or professional dreams you want to pursue?

Write down at least three financial goals. For each goal, include a brief reason why it’s important to you.

Example:

- Goal: Pay off my student loans within five years.

Why: This will free up $500 a month for savings and give me peace of mind. - Goal: Save $1 million for retirement.

Why: I want to retire at 50 and travel full-time.

4. Create a Vision Statement

Combine your reflections and goals into a single, powerful vision statement. Think of it as your personal mission for financial independence.

Example:

“My vision of financial independence is to live debt-free, with enough passive income to cover my living expenses. I want the freedom to work on projects I’m passionate about, spend quality time with my family, and travel the world without financial stress.”

Keep this statement somewhere visible—like your desk or phone wallpaper—to remind yourself of your ultimate goal.

Why This Step Matters

Defining financial independence gives you a sense of purpose and clarity. It’s not about following someone else’s version of success. It’s about creating a life that aligns with your values, dreams, and aspirations.

By writing down and envisioning your goals, you set the foundation for everything else in this course. It’s like setting your destination on a map—you can’t reach it if you don’t know where you’re going.

Step 2: Assess Your Current Financial Situation

Understanding where you stand financially is a crucial step toward achieving financial independence. It’s like checking your GPS before starting a road trip—without knowing your starting point, you can’t map the route to your destination. This step involves taking an honest, detailed look at your income, expenses, and spending habits.

Step-by-Step Guide

1. Calculate Your Total Income

Begin by listing all sources of income. Be thorough—include both primary and secondary earnings.

- Primary Income: Your salary, freelance work, or business revenue.

- Secondary Income: Side hustles, rental income, dividends, or any other earnings.

Write down the total amount you earn monthly and annually.

Example:

- Monthly Salary: ₹50,000

- Freelance Writing: ₹10,000

- Rental Income: ₹5,000

- Total Monthly Income: ₹65,000

2. Track Your Expenses

Understanding where your money is going is critical. Break your expenses into categories:

- Fixed Expenses: Rent, utilities, insurance premiums, loan repayments.

- Variable Expenses: Groceries, dining out, entertainment, travel.

- Discretionary Spending: Shopping, hobbies, luxury items.

For one month, track every expense meticulously. Use tools like budgeting apps, a spreadsheet, or even a notebook to record daily spending.

Example of Expenses:

- Rent: ₹20,000

- Utilities: ₹5,000

- Groceries: ₹10,000

- Dining Out: ₹3,000

- Entertainment: ₹2,000

- Total Monthly Expenses: ₹40,000

3. Analyze Your Spending Patterns

Once you have a clear view of your expenses, look for patterns:

- Are you spending more than you earn?

- Which categories take up the largest portion of your income?

- Are there unnecessary expenses you can reduce or eliminate?

Highlight areas where you can cut back and reallocate funds to savings or investments.

Example Analysis:

- High discretionary spending on dining out: ₹3,000/month.

- Potential savings: Reduce this to ₹1,000 and save ₹2,000 monthly.

4. Calculate Your Net Worth

Your net worth is the difference between what you own and what you owe.

- Assets: List everything you own, including cash, investments, property, and valuables.

- Liabilities: List all your debts, such as credit card balances, loans, or mortgages.

Formula:

Net Worth = Total Assets – Total Liabilities

Example Calculation:

- Assets: Savings ₹2,00,000 + Investments ₹3,00,000 + Property ₹10,00,000 = ₹15,00,000

- Liabilities: Credit Card Debt ₹50,000 + Loan ₹1,00,000 = ₹1,50,000

- Net Worth: ₹15,00,000 – ₹1,50,000 = ₹13,50,000

Why This Step Matters

This exercise gives you a financial “snapshot” of your current reality. It’s the foundation for creating a plan to bridge the gap between where you are now and where you want to be.

Be honest with yourself. The goal isn’t to feel bad about past mistakes but to gain clarity and take control. Armed with this information, you’re ready to start building a plan that aligns with your vision of financial independence!

Step 3: Learn the Key Principles of Financial Independence

Now that you’ve defined your financial goals and assessed your current situation, it’s time to explore the key principles that pave the way to financial independence. This step introduces you to the powerful trio of saving, investing, and creating passive income—the cornerstones of financial freedom.

Step-by-Step Guide1. Understand the Power of Saving

Savings is the first step toward building wealth and financial security. Without a solid savings habit, you’ll struggle to move toward financial independence. Here’s how to get started:

- Set a Savings Goal: Decide how much of your income you want to save. A good rule of thumb is the 50-30-20 rule: 50% of your income for essentials, 30% for wants, and 20% for savings.

- Build an Emergency Fund: Before you invest, ensure you have at least 3–6 months’ worth of living expenses saved in a liquid account. This fund will shield you from unexpected financial shocks.

- Automate Your Savings: Set up automatic transfers to your savings account each month. This ensures you’re saving consistently without having to think about it.

Why It Matters: Saving is the foundation of financial independence. It allows you to seize opportunities, manage risks, and reduce stress about money.

2. Master the Basics of Investing

Investing is how your money works for you, helping you grow your wealth over time. Unlike saving, investing involves taking calculated risks to achieve higher returns.

- Start Small but Start Early: Even a small amount invested consistently can grow significantly thanks to compound interest.

- Learn About Different Investment Options: Educate yourself on stocks, mutual funds, bonds, real estate, and other options. Each comes with its risks and rewards.

- Focus on Long-Term Growth: Avoid the temptation of short-term gains. Financial independence is a marathon, not a sprint. Choose investments that align with your goals and risk tolerance.

Example: If you invest ₹5,000 a month in an index fund with an annual return of 10%, you’ll have approximately ₹12.2 lakh after 10 years.

Why It Matters: Investing is the bridge between saving and wealth creation. It accelerates your journey to financial independence by growing your money faster than inflation.

3. Explore the Concept of Passive Income

Passive income is money earned with minimal ongoing effort, making it a game-changer for financial independence. The goal is to create income streams that support your lifestyle without constant work.

- Types of Passive Income: Rental income, dividends, royalties, affiliate marketing, and creating online courses or products.

- Start with What You Know: If you’re skilled in writing, consider publishing an eBook. If you have extra cash, explore real estate investments.

- Reinvest Earnings: Use passive income to reinvest in other ventures, growing your wealth exponentially.

Why It Matters: Passive income reduces reliance on active work, giving you time freedom and financial security.

4. Understand the Role of Discipline and Mindset

Finally, achieving financial independence requires the right mindset and discipline. Without these, even the best financial strategies will falter.

- Stay Consistent: Stick to your savings and investment plan, even when tempted by short-term spending.

- Delay Gratification: Focus on long-term goals instead of immediate wants.

- Learn Continuously: Stay curious about personal finance. The more you know, the better decisions you’ll make.

Pro Tip: Follow financial blogs, listen to podcasts, or read books like Rich Dad Poor Dad or The Intelligent Investor.

Why It Matters: Financial independence isn’t just about numbers; it’s a lifestyle. Discipline and a growth mindset keep you on track, even when challenges arise.

Why This Step Matters

Saving builds the foundation, investing grows your wealth, and passive income provides freedom. Combined with the right mindset, these principles become a powerful strategy for achieving financial independence.

By mastering these concepts, you’ll have the tools and knowledge to create a life where money works for you—not the other way around!

Step 4: Set SMART Financial Goals

Setting financial goals is like plotting milestones on your journey to financial independence. Without clear goals, you might feel overwhelmed or directionless. The SMART framework—Specific, Measurable, Achievable, Relevant, and Time-bound—helps you create focused and actionable objectives.

In this step, we’ll break down how to craft these SMART financial goals in detail.

Step-by-Step Guide

1. Make Your Goals Specific

A vague goal like “I want to save more money” doesn’t provide clear direction. Specificity gives you clarity and purpose.

How to Do It:

Ask yourself the following questions:

- What exactly do I want to achieve?

- Why is this goal important to me?

- Who is involved, and where will this take place?

Example:

- Vague Goal: Save money for the future.

- Specific Goal: Save ₹5,00,000 for a down payment on a house within the next three years.

Why It Matters:

A specific goal provides focus and eliminates ambiguity, helping you create a clear action plan.

2. Make Your Goals Measurable

A measurable goal allows you to track progress and stay motivated. Without metrics, it’s difficult to determine whether you’re on track or need adjustments.

How to Do It:

- Use numbers, percentages, or deadlines to quantify your goal.

- Break it down into smaller milestones to track progress regularly.

Example:

If your goal is to save ₹5,00,000 in three years, this translates to:

- Saving ₹1,67,000 per year.

- Saving ₹13,900 per month.

Why It Matters:

Measuring progress keeps you accountable and helps you celebrate small wins along the way.

3. Make Your Goals Achievable

Your goals should challenge you but still be realistic. If they’re too ambitious, you risk feeling discouraged.

How to Do It:

- Assess your current financial situation.

- Identify obstacles and resources that can help you achieve the goal.

- Adjust the timeline or target if necessary to make it more attainable.

Example:

If saving ₹13,900 per month isn’t feasible due to existing expenses, start with ₹10,000 per month and gradually increase it as your income grows or expenses decrease.

Why It Matters:

Achievable goals keep you motivated and prevent burnout or frustration.

4. Make Your Goals Relevant and Time-bound

Goals should align with your broader vision of financial independence and have a clear deadline.

How to Do It:

- Relevant: Ensure the goal fits your long-term aspirations. For example, saving for a house aligns with financial independence if owning property is part of your vision.

- Time-bound: Set a specific deadline for achieving the goal. This creates urgency and keeps you focused.

Example:

- Relevant Goal: Save ₹5,00,000 for a down payment because homeownership is a part of your long-term plan.

- Time-bound Goal: Achieve this within 36 months (3 years).

Why It Matters:

Relevant goals ensure you’re working toward what truly matters to you, while deadlines help you stay committed and avoid procrastination.

Combining It All: A SMART Goal Example

Here’s how a SMART financial goal might look:

“I will save ₹5,00,000 for a down payment on a house within the next 3 years by saving ₹13,900 per month. I will track my progress monthly to ensure I stay on target, and I’ll cut discretionary spending to make this achievable.”

This goal is:

- Specific: Saving for a down payment on a house.

- Measurable: ₹5,00,000 in 3 years, ₹13,900 per month.

- Achievable: Based on a realistic assessment of expenses and income.

- Relevant: Aligns with the vision of homeownership.

- Time-bound: Deadline of 3 years.

Pro Tips for Setting SMART Financial Goals

- Start Small: If long-term goals feel overwhelming, start with short-term ones. For example, aim to save ₹1,00,000 in the next 6 months.

- Think Big: Once you’re comfortable achieving smaller goals, expand your vision.

- Review Regularly: Life changes, and so should your goals. Check in every quarter to adjust as needed.

Why This Step Matters

SMART financial goals give you direction, motivation, and a clear path to success. They turn dreams into actionable steps, helping you build momentum on your journey to financial independence. With each goal you achieve, you’ll gain confidence and move closer to the freedom you’ve envisioned!

We’re also giving these extra bonuses

Financial Independence – Checklist

Financial Independence – FAQs

Financial Independence – Salespage Content

Package Details:

Word Count: 22 666 Words

Number of Pages: 95

Financial Independence – Bonus Content

Checklist

Word Count: 637 words

FAQs

Word Count: 1209 words

Salespage Content

Word Count: 897 words

Total Word Count: 25 409 Words

Your PLR License Terms

PERMISSIONS: What Can You Do With These Materials?

Sell the content basically as it is (with some minor tweaks to make it “yours”).

If you are going to claim copyright to anything created with this content, then you must substantially change at 75% of the content to distinguish yourself from other licensees.

Break up the content into small portions to sell as individual reports for $10-$20 each.

Bundle the content with other existing content to create larger products for $47-$97 each.

Setup your own membership site with the content and generate monthly residual payments!

Take the content and convert it into a multiple-week “eclass” that you charge $297-$497 to access!

Use the content to create a “physical” product that you sell for premium prices!

Convert it to audios, videos, membership site content and more.

Excerpt and / or edit portions of the content to give away for free as blog posts, reports, etc. to use as lead magnets, incentives and more!

Create your own original product from it, set it up at a site and “flip” the site for megabucks!

RESTRICTIONS: What Can’t You Do With These Materials?

To protect the value of these products, you may not pass on the rights to your customers. This means that your customers may not have PLR rights or reprint / resell rights passed on to them.

You may not pass on any kind of licensing (PLR, reprint / resell, etc.) to ANY offer created from ANY PORTION OF this content that would allow additional people to sell or give away any portion of the content contained in this package.

You may not offer 100% commission to affiliates selling your version / copy of this product. The maximum affiliate commission you may pay out for offers created that include parts of this content is 75%.

You are not permitted to give the complete materials away in their current state for free – they must be sold. They must be excerpted and / or edited to be given away, unless otherwise noted. Example: You ARE permitted to excerpt portions of content for blog posts, lead magnets, etc.

You may not add this content to any part of an existing customer order that would not require them to make an additional purchase. (IE You cannot add it to a package, membership site, etc. that customers have ALREADY paid for.)

Share Now!