Family Finances PLR Course 25k Words

in Finance PLR , Finance PLR Ebooks , PLR Checklists , PLR eBooks , PLR eCourses , PLR List Building Reports , Premium PLR , Premium PLR eBooks , Premium PLR Reports , Premium White Label Brandable PLR Coaching Courses , Private Label Rights ProductsChoose Your Desired Option(s)

has been added to your cart!

have been added to your cart!

#familyfinances #plrcourse #financialplanning #moneymanagement #budgetingtips #savingstrategies #financialliteracy #familybudgeting #smartfinances #plrcontent

Empower Families to Achieve Financial Stability and Peace of Mind!

Managing family finances doesn’t have to be overwhelming. The Family Finances PLR Course is here to provide step-by-step guidance for families to take control of their financial future. Whether it’s saving for a vacation, paying off debt, or teaching kids about money, this comprehensive course makes financial literacy simple, practical, and accessible for everyone.

What Is the Family Finances PLR Course?

This course is a complete, ready-to-use guide designed to help families build strong financial foundations, plan for the future, and create habits that lead to long-term financial success. With 23,868 words of expert insights, actionable strategies, and family-friendly tips, this PLR course is a valuable resource for anyone looking to empower families with financial knowledge.

Presenting…

Family Finances PLR Course 25k Words

What’s Inside the Course?

Module 1: Understanding Your Financial Snapshot

- Assess Your Current Financial Situation: Learn how to create a simple budget and identify where your money goes.

- Set Financial Goals as a Family: Discuss short- and long-term goals like saving for education, paying off debt, or planning vacations.

- Track Spending for 30 Days: Discover patterns in spending and uncover opportunities to save.

- Review Financial Habits: Identify and change behaviors that hinder financial growth.

Module 2: Building a Strong Financial Foundation

- Create an Emergency Fund: Learn how to save 3–6 months of expenses for unexpected events.

- Understand Insurance Basics: Ensure your family is protected with the right health, life, and property coverage.

- Set Up a Debt Reduction Plan: Discover proven methods to pay off high-interest debt quickly.

- Start Retirement Savings: Explore simple strategies to start saving for retirement today.

Module 3: Smart Spending and Saving

- Differentiate Needs vs. Wants: Make better spending decisions by understanding what’s essential.

- Master Comparison Shopping: Use tools and techniques to get the best value for every purchase.

- Build a Family Savings Plan: Allocate a portion of income toward shared family goals.

- Cut Back Without Cutting Fun: Find affordable entertainment ideas like game nights and potlucks.

Module 4: Teaching Kids About Money

- Introduce Basic Money Concepts: Teach kids how to save, spend, and share responsibly.

- Encourage Earning Through Chores: Show children the value of hard work by assigning tasks with allowances.

- Set Savings Goals with Kids: Guide children through saving for a toy or gadget to teach delayed gratification.

- Teach the Power of Giving: Help kids understand the importance of generosity and community involvement.

Module 5: Planning for the Future

- Create a Family Financial Calendar: Organize bill payments, savings goals, and debt milestones.

- Explore Investment Options: Learn about mutual funds, stocks, and bonds for long-term growth.

- Prepare for Major Life Events: Plan ahead for college, weddings, or buying a home.

- Review and Adjust Regularly: Hold monthly family meetings to review progress and celebrate wins.

Why Choose the Family Finances PLR Course?

- Comprehensive and Practical Content

Over 23,000 words of actionable steps, tools, and strategies to simplify family financial planning. - Easy to Customize and Sell

The PLR content is ready to use as-is or can be rebranded to fit your business. - Targeted for Families

Designed to address common financial challenges families face, making it relatable and valuable. - Ideal for Multiple Platforms

Use it for blogs, courses, workshops, eBooks, or as a lead magnet to grow your audience.

Who Will Benefit From This Course?

- Parents: Simplify financial planning and create a secure future for your family.

- Financial Coaches: Offer a ready-made course to clients who want to improve their family’s finances.

- Educators: Provide families with tools to teach financial literacy at home.

- Bloggers: Use this as content for family finance-focused websites or newsletters.

What’s Included in the Package?

- Family Finances Course (23,868 Words): A step-by-step guide covering every aspect of family financial management.

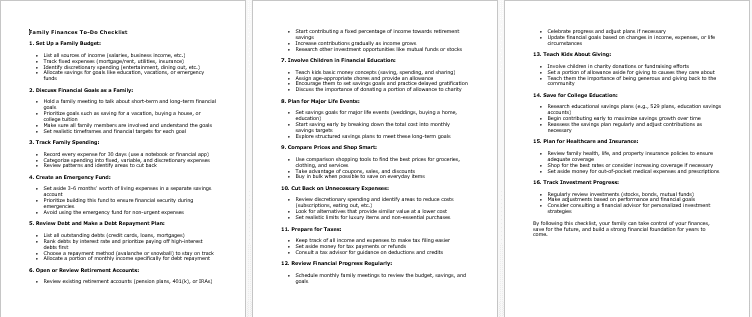

- Checklist (646 Words): A practical tool to keep families on track with their financial goals.

- FAQs (1,163 Words): Common questions answered to help users get the most out of the course.

- Sales Page (838 Words): Professionally written sales copy to start selling the course immediately.

How to Profit From This Course

- Sell It as a Standalone Product

Market it as a premium financial planning guide for families at $47-$97. - Bundle It With Other Products

Combine it with budgeting tools, parenting guides, or personal finance courses for added value. - Create a Membership Program

Use the content as part of a subscription service with regular updates and tools. - Repurpose the Content

Turn the modules into blog posts, lead magnets, or social media content to attract more customers. - Launch an Online Course

Convert the material into an interactive eLearning experience that sells for $297+.

Special Launch Price: Only $14.99!

Take advantage of this limited-time offer to own a ready-made course packed with value. Empower families, grow your business, and enjoy the benefits of high-quality PLR content.

has been added to your cart!

have been added to your cart!

Here A Sample of Family Finances PLR Course

Helping families build a solid financial foundation while fostering better communication and planning for a brighter future.

Module 1: Understanding Your Financial Snapshot

Step 1: Assess Your Current Financial Situation

Point: Create a Simple Budget Worksheet

Understanding where your money comes from and where it goes is the foundation of good financial management. In this step, we will create a simple budget worksheet to organize your finances and gain a clear picture of your current situation.

Why This Is Important

A budget worksheet acts like a map for your finances, helping you see where you are now and where you need to go. It allows you to identify patterns, cut unnecessary spending, and allocate resources effectively.

Step-by-Step Instructions

1. Gather All Financial Information

Start by collecting all relevant documents and data that reflect your income and expenses. These may include:

- Pay slips or salary statements

- Bank statements (savings and checking accounts)

- Credit card statements

- Utility bills

- Receipts for daily spending

Having this information ready will make it easier to input accurate figures into your worksheet.

2. Create the Budget Worksheet Template

You can use a spreadsheet software (e.g., Excel, Google Sheets) or download a pre-made template. Alternatively, you can use a notebook if you prefer a manual approach.

Divide the worksheet into three main sections:

- Income: Money coming in

- Fixed Expenses: Regular, consistent costs

- Discretionary Spending: Variable, optional expenses

3. List All Sources of Income

In the Income section, include all streams of revenue you receive on a regular basis. Examples:

- Monthly salary after taxes (net income)

- Rental income, if applicable

- Side business or freelancing income

- Dividends from investments

- Pensions or retirement funds

Write down the exact amount for each source. If your income fluctuates, use an average based on the last 3–6 months.

4. List Fixed Expenses

Fixed expenses are regular, predictable costs that are necessary for your day-to-day life. In the Fixed Expenses section, include:

- Rent or mortgage payments

- Utility bills (electricity, water, gas, internet, phone)

- Loan payments (car loans, student loans, personal loans)

- Insurance premiums (health, life, car, home)

- Transportation costs (public transport passes, car maintenance, fuel)

Assign the exact or approximate monthly cost to each item.

5. List Discretionary Spending

Discretionary spending refers to non-essential expenses that can vary. In the Discretionary Spending section, include items such as:

- Dining out and takeaways

- Entertainment (movies, concerts, subscriptions like Netflix or Spotify)

- Hobbies and leisure activities

- Shopping (clothing, electronics, home decor)

- Gifts and donations

Write down approximate amounts based on your spending habits from the last 1–3 months.

6. Add Totals for Each Section

At the bottom of each section, calculate the total. This will give you three key figures:

- Total income

- Total fixed expenses

- Total discretionary spending

7. Calculate Your Net Balance

Subtract the sum of your fixed expenses and discretionary spending from your total income:

Net Balance=Total Income−(Fixed Expenses+Discretionary Spending)\text{Net Balance} = \text{Total Income} – (\text{Fixed Expenses} + \text{Discretionary Spending})Net Balance=Total Income−(Fixed Expenses+Discretionary Spending)

This number will show you if you are living within your means (a positive balance) or overspending (a negative balance).

8. Evaluate the Results

Review your worksheet to identify trends. Ask yourself:

- Are my expenses exceeding my income?

- Can I cut back on discretionary spending?

- Am I allocating enough towards savings and future goals?

Pro Tips for Success

- Keep It Simple: Don’t overcomplicate the worksheet. Use clear labels and avoid unnecessary categories.

- Be Honest: Record all expenses truthfully to get an accurate picture.

- Update Regularly: Revisit and adjust your worksheet monthly to track progress and make improvements.

Outcome of This Step

By the end of this step, you will have a clear understanding of your current financial situation. This will serve as a foundation for the rest of the course, helping you set realistic goals, cut unnecessary expenses, and build financial security.

Step 2: Identify Financial Goals as a Family

Point: Sit Together as a Family to Discuss Short-Term and Long-Term Goals

Establishing clear financial goals is a critical step toward financial harmony and success. By involving all family members in the goal-setting process, you foster a sense of shared responsibility and teamwork. This step ensures that everyone’s priorities are considered, and together, you can create a roadmap for your family’s financial future.

Why This Is Important

Financial goals guide your spending, saving, and investment decisions. Aligning as a family ensures that everyone’s needs and aspirations are acknowledged, reducing conflicts and creating a unified approach to managing money.

Step-by-Step Instructions

1. Schedule a Family Financial Meeting

Choose a quiet, convenient time for all family members to gather. Ensure there are no distractions like phones, TV, or urgent tasks.

- Why: A dedicated meeting allows everyone to focus on the topic without feeling rushed.

- Tip: Set a relaxed tone to make it a positive and inclusive experience.

2. Discuss the Importance of Financial Goals

Begin the meeting by explaining why setting financial goals is important. Use relatable examples to emphasize benefits like financial security, achieving dreams, and reducing stress.

- Example: “By saving for a family vacation, we can create memories together without worrying about finances.”

- Why: Understanding the purpose motivates everyone to participate meaningfully.

3. Brainstorm Short-Term Goals

Encourage each family member to share their ideas for goals that can be achieved within 1–3 years. Examples include:

- A weekend getaway or family vacation

- Saving for a new car or home appliance

- Reducing or paying off small debts

- Setting up an emergency fund

Write these ideas down on a shared document or whiteboard.

- Why: Brainstorming ensures all voices are heard, fostering collaboration and inclusivity.

4. Brainstorm Long-Term Goals

Shift the focus to goals that take more time, typically 5–10 years or longer. Examples include:

- Saving for children’s education or college tuition

- Paying off a mortgage or other significant debts

- Planning for retirement

- Investing in property or starting a family business

Discuss the importance of patience and discipline when working toward these goals.

- Tip: Frame long-term goals as achievable milestones rather than overwhelming challenges.

5. Prioritize the Goals

Once you have a list of short-term and long-term goals, work together to prioritize them. Use these criteria:

- Urgency: Which goals need immediate attention? (e.g., paying off high-interest debt)

- Impact: Which goals will benefit the family the most? (e.g., building an education fund)

- Feasibility: Which goals are realistic given your current financial situation?

Rank the goals from most to least important.

- Why: Prioritizing helps you focus your resources on what matters most.

6. Assign Responsibilities

Divide responsibilities among family members based on age and ability.

- Parents may handle budgeting and investing.

- Teenagers can track their spending and contribute to savings for joint goals.

- Younger children can save pocket money for smaller family goals.

- Why: Involving everyone builds accountability and strengthens teamwork.

7. Set Specific, Measurable Goals

Convert each goal into a specific, measurable plan. Use the SMART criteria:

- Specific: Clearly define the goal. (e.g., Save $5,000 for a family vacation.)

- Measurable: Track progress over time.

- Achievable: Ensure the goal is realistic.

- Relevant: Align with family values and priorities.

- Time-bound: Set a deadline for achieving the goal.

8. Document the Goals

Write down all agreed-upon goals in a family financial plan or worksheet. Include:

- A brief description of each goal

- The target amount needed

- A realistic timeline

- Who is responsible for each step

- Tip: Use a digital tool like Google Docs or a shared app to keep the plan accessible to everyone.

Pro Tips for Success

- Communicate Openly: Encourage honest conversations about financial habits, challenges, and aspirations.

- Celebrate Small Wins: Acknowledge milestones achieved along the way to maintain motivation.

- Review Regularly: Schedule quarterly or annual family meetings to reassess and adjust goals as needed.

Outcome of This Step

By completing this step, your family will have a clear and shared vision of its financial future. Everyone will understand their role in achieving the goals, creating a sense of unity and purpose. With short-term wins and long-term aspirations in place, you’ll be ready to move forward confidently.

Step 3: Track Your Spending for 30 Days

Point: Use a Notebook or an App to Record Every Penny Spent

Tracking your spending for 30 days is a powerful way to uncover your financial habits, pinpoint unnecessary expenditures, and identify opportunities for savings. This exercise provides a clear and accurate view of where your money is going, which is essential for taking control of your finances.

Why This Is Important

Many people underestimate how much they spend on small, daily expenses. Tracking every penny helps you analyze patterns, uncover hidden spending, and ensure that your money aligns with your financial goals.

Step-by-Step Instructions

1. Choose Your Tracking Method

Decide how you will record your spending. You have two main options:

- Notebook: Ideal for those who prefer manual tracking. Carry a small notebook and pen wherever you go.

- Mobile App: Use a budgeting app (e.g., Mint, YNAB, PocketGuard) that syncs with your bank accounts and allows you to log transactions on the go.

- Why: Picking a method that suits your lifestyle ensures consistency.

2. Record Every Expense

For 30 days, write down every single expense, no matter how small or insignificant it seems. Include:

- Daily essentials: Groceries, transportation, utility bills

- Discretionary spending: Dining out, entertainment, hobbies

- One-time costs: Repairs, gifts, medical expenses

- Cash purchases: These are often overlooked but must be included

- Tip: Record expenses immediately to avoid forgetting any. If you’re busy, keep receipts to log later.

3. Categorize Your Spending

Divide your expenses into clear categories. Use broad categories like:

- Housing: Rent, mortgage, utilities

- Food: Groceries, dining out, coffee shops

- Transportation: Public transit, fuel, maintenance

- Health: Insurance, medical bills, gym memberships

- Entertainment: Streaming services, movies, concerts

- Miscellaneous: Clothing, gifts, donations

- Why: Categorization simplifies analysis and highlights areas where spending can be adjusted.

4. Add Up Weekly Totals

At the end of each week, calculate the total spending for each category. This step helps you identify trends over shorter periods, giving you a better sense of your spending habits.

- Why: Weekly totals provide quick insights into overspending or areas that need immediate adjustment.

5. Analyze Spending Patterns

After 30 days, review your recorded data and look for patterns.

- Ask Yourself:

- Where is most of my money going?

- Are there categories where I consistently overspend?

- Are there unnecessary expenses that I can cut or reduce?

- Examples:

- Dining out multiple times a week adds up significantly.

- Streaming subscriptions you rarely use can be canceled.

- Why: Understanding your habits is the first step toward change.

6. Highlight Areas for Savings

Identify specific expenses that can be minimized or eliminated without compromising your quality of life. For example:

- Switch to generic brands for groceries.

- Cook at home more often instead of dining out.

- Cancel unused memberships or subscriptions.

- Use public transport or carpool to save on fuel.

Estimate how much you could save monthly and reallocate those funds toward your financial goals.

7. Reflect on Spending Triggers

Think about the factors that lead to unnecessary purchases.

- Triggers to Watch For:

- Emotional spending during stress or boredom

- Impulse buys during sales or online shopping

- Peer pressure to spend in social situations

- Why: Identifying triggers helps you implement strategies to avoid them in the future.

8. Create a Summary Report

Prepare a summary of your 30-day spending to share with your family or save for personal reference. Include:

- Total amount spent in each category

- Areas of overspending

- Potential savings identified

Use charts or graphs to make the data visual and easier to understand.

Pro Tips for Success

- Be Honest and Accurate: Record every expense, no matter how small, to get a realistic picture.

- Automate Where Possible: Use apps that sync with your bank accounts to reduce manual effort.

- Stay Consistent: Set daily or weekly reminders to log expenses and review progress.

Outcome of This Step

By completing this 30-day spending tracker, you will gain a detailed understanding of your financial habits. This newfound clarity will help you make informed decisions, allocate resources wisely, and move closer to achieving your financial goals. This step serves as the cornerstone for creating a sustainable family budget.

Step 4: Review Your Financial Habits

Point: Reflect on Habits That Support or Hinder Financial Stability

Reviewing your financial habits is a crucial step toward building a stable and sustainable financial future. By evaluating your behaviors around money, you can identify patterns that contribute positively to your finances and those that may hinder your progress. This process is about awareness and making intentional changes to align your habits with your financial goals.

Why This Is Important

Financial habits, whether good or bad, shape your overall financial health. Reflecting on these habits provides an opportunity to recognize what works, what doesn’t, and where you can improve. Awareness is the first step toward creating lasting, positive change.

Step-by-Step Instructions

1. Create a List of Current Financial Habits

Start by listing all your financial habits, both positive and negative. Use the data from Step 3 (Tracking Spending) to guide this process. Consider:

- Good Habits: Saving a percentage of your income, paying bills on time, budgeting

- Bad Habits: Impulse buying, relying on credit for non-essentials, avoiding savings

- Why: A comprehensive list gives you a clear starting point for reflection.

2. Reflect on Positive Habits

Review your list and focus on the habits that contribute to financial stability.

- Examples:

- Consistently saving 10% of your income

- Comparing prices before making purchases

- Planning meals to avoid dining out

- Questions to Ask:

- What impact does this habit have on my financial goals?

- How can I reinforce or expand this habit?

- Why: Recognizing your strengths builds confidence and motivates you to keep improving.

3. Identify Negative Habits

Shift your focus to habits that hinder your financial stability.

- Examples:

- Impulse shopping when stressed or bored

- Missing bill payments and incurring late fees

- Failing to set aside money for emergencies

- Questions to Ask:

- Why do I engage in this habit?

- What triggers it (e.g., emotions, environment, social pressure)?

- How does it affect my financial health?

- Why: Understanding the root causes of negative habits is essential for overcoming them.

4. Analyze Spending Triggers

Use the insights from Step 3 to pinpoint patterns and triggers behind your financial decisions.

- Common Triggers:

- Emotional Spending: Shopping as a way to cope with stress or boredom

- Social Influence: Spending to keep up with friends or trends

- Convenience: Choosing expensive options due to lack of planning (e.g., eating out instead of cooking)

- Emotional Spending: Shopping as a way to cope with stress or boredom

- Why: Identifying triggers helps you implement strategies to avoid or mitigate them.

5. Replace Negative Habits with Positive Actions

For each negative habit, brainstorm a constructive alternative.

- Examples:

- Replace impulse shopping with a 24-hour waiting rule for purchases.

- Automate bill payments to avoid late fees.

- Start a “fun fund” for discretionary spending to curb overspending.

- Why: Positive replacements make it easier to transition away from unhelpful habits.

6. Set Clear Boundaries and Rules

Establish guidelines for your spending and saving to maintain discipline.

- Examples:

- Limit dining out to twice a month.

- Stick to a specific budget for entertainment or clothing.

- Only use credit cards for planned, budgeted purchases.

- Tip: Write these rules down and keep them visible as a reminder.

7. Monitor Progress Regularly

Track your progress in replacing negative habits and reinforcing positive ones.

- How to Track:

- Keep a journal or log to document successes and challenges.

- Use apps to monitor spending and saving habits.

- Why: Regular monitoring keeps you accountable and helps you stay on track.

8. Involve Your Family

Encourage family members to reflect on their financial habits as well.

- How:

- Share your reflections and encourage open discussions about spending habits.

- Set family-wide goals to address common issues, such as reducing dining out or saving for a shared goal.

- Why: Collective reflection and action create a supportive environment for lasting change.

Pro Tips for Success

- Be Honest: Acknowledge both strengths and weaknesses without judgment.

- Start Small: Focus on changing one habit at a time to avoid feeling overwhelmed.

- Celebrate Wins: Recognize improvements, no matter how small, to stay motivated.

Outcome of This Step

By completing this step, you will gain a deeper understanding of your financial habits and their impact on your overall financial health. With this awareness, you’ll be better equipped to replace negative habits with constructive actions, creating a strong foundation for financial stability and progress toward your family’s goals.

We’re also giving these extra bonuses

Family Finances – Checklist

Family Finances – FAQs

Family Finances – Salespage Content

Package Details:

Word Count: 23 868 Words

Number of Pages: 99

Family Finances – Bonus Content

Checklist

Word Count: 646 words

FAQs

Word Count: 1163 words

Salespage Content

Word Count: 838 words

Total Word Count: 24 295 Words

Your PLR License Terms

PERMISSIONS: What Can You Do With These Materials?

Sell the content basically as it is (with some minor tweaks to make it “yours”).

If you are going to claim copyright to anything created with this content, then you must substantially change at 75% of the content to distinguish yourself from other licensees.

Break up the content into small portions to sell as individual reports for $10-$20 each.

Bundle the content with other existing content to create larger products for $47-$97 each.

Setup your own membership site with the content and generate monthly residual payments!

Take the content and convert it into a multiple-week “eclass” that you charge $297-$497 to access!

Use the content to create a “physical” product that you sell for premium prices!

Convert it to audios, videos, membership site content and more.

Excerpt and / or edit portions of the content to give away for free as blog posts, reports, etc. to use as lead magnets, incentives and more!

Create your own original product from it, set it up at a site and “flip” the site for megabucks!

RESTRICTIONS: What Can’t You Do With These Materials?

To protect the value of these products, you may not pass on the rights to your customers. This means that your customers may not have PLR rights or reprint / resell rights passed on to them.

You may not pass on any kind of licensing (PLR, reprint / resell, etc.) to ANY offer created from ANY PORTION OF this content that would allow additional people to sell or give away any portion of the content contained in this package.

You may not offer 100% commission to affiliates selling your version / copy of this product. The maximum affiliate commission you may pay out for offers created that include parts of this content is 75%.

You are not permitted to give the complete materials away in their current state for free – they must be sold. They must be excerpted and / or edited to be given away, unless otherwise noted. Example: You ARE permitted to excerpt portions of content for blog posts, lead magnets, etc.

You may not add this content to any part of an existing customer order that would not require them to make an additional purchase. (IE You cannot add it to a package, membership site, etc. that customers have ALREADY paid for.)

Share Now!