Family Budgeting PLR Course 18k Words

in Finance PLR , Finance PLR Ebooks , PLR Checklists , PLR eBooks , PLR eCourses , PLR List Building Reports , Premium PLR , Premium PLR eBooks , Premium PLR Reports , Premium White Label Brandable PLR Coaching Courses , Private Label Rights ProductsChoose Your Desired Option(s)

has been added to your cart!

have been added to your cart!

#familybudgeting #moneymanagement #plrcourse #budgettips #financialwellness #smartspending #homefinance #financeforfamilies #budgetplanning

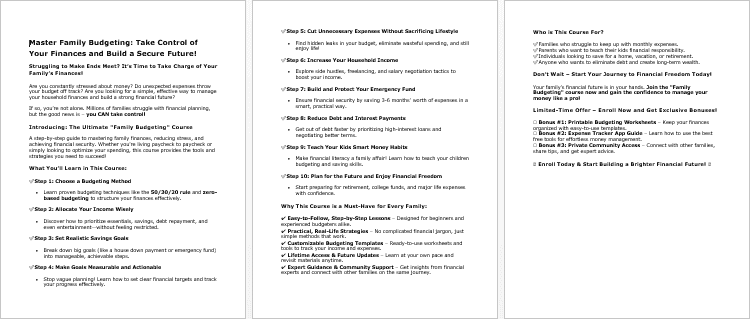

Welcome to the Family Budgeting PLR Course, a comprehensive guide to managing your family’s finances with ease! In today’s fast-paced world, managing money as a family can be stressful, but it doesn’t have to be. This course is designed to help you take control of your finances, reduce stress around money, and create a sustainable and secure financial future for you and your loved ones.

With this course, you’ll learn the basics of budgeting, smart spending, saving, and more—making sure your family’s financial goals are within reach. Whether you’re just starting your budgeting journey or looking to improve your current financial habits, this course will provide the guidance and tools you need.

Presenting…

Family Budgeting PLR Course 18k Words

What’s Included in the Course:

This Family Budgeting PLR Course is broken down into 5 easy-to-understand modules that cover everything from understanding your financial situation to building long-term financial stability. Each module provides you with actionable steps, tips, and advice that you can implement right away.

Module 1: Understanding Your Financial Situation

💡 Goal: Gain clarity on where you stand financially before setting up a budget.

- Step 1: Identify Your Income

Learn how to list all income sources, including salaries, side gigs, child support, and more. Calculate an average if your income fluctuates. - Step 2: Track Your Expenses

Discover how to keep track of your spending using an app, a spreadsheet, or even a simple notebook. Learn to record bills, groceries, subscriptions, and entertainment expenses. - Step 3: Categorize Your Spending

Differentiate between needs (like rent, food, utilities) and wants (like eating out, shopping, streaming services). Spot unnecessary expenses to reduce. - Step 4: Calculate Your Net Income

Subtract your total expenses from your income to get a clear picture of your financial situation. If your expenses exceed income, don’t worry, we’ll fix it in the next modules!

Module 2: Setting Financial Goals for Your Family

💡 Goal: Align your budgeting with clear, actionable financial goals.

- Step 1: Define Your Short-Term and Long-Term Goals

Set clear short-term goals (3–12 months) like paying off a credit card or saving for a vacation, and long-term goals (1–5 years) like buying a house or planning for retirement. - Step 2: Prioritize Your Goals

Learn how to prioritize your goals—decide which ones are most urgent (e.g., building an emergency fund before going on a vacation) and which ones can wait. - Step 3: Set Realistic Savings Targets

Break down larger goals into smaller monthly targets. For example, if you’re saving for a house, set up a monthly savings goal for the down payment. - Step 4: Make Goals Measurable and Actionable

Turn vague goals like “saving money” into specific targets, like “I will save $200 per month for our emergency fund.” Assign responsibilities to family members to track progress together.

Module 3: Creating a Family Budget That Works

💡 Goal: Build a practical and sustainable family budget.

- Step 1: Choose a Budgeting Method

Learn the two most popular budgeting methods:- 50/30/20 Rule: 50% for needs, 30% for wants, 20% for savings.

- Zero-Based Budgeting: Allocate every dollar before the month starts.

- Step 2: Allocate Your Income Wisely

Start by allocating money to essentials (housing, utilities, food, transportation), then set aside amounts for savings, debt repayment, and fun activities. - Step 3: Include a “Family Fun” Budget

Don’t forget to budget for entertainment! A family fun budget ensures you can still enjoy outings, vacations, and hobbies while sticking to your goals. - Step 4: Make Adjustments as Needed

Your first budget might not be perfect. Review and tweak it monthly, and involve the whole family to ensure it aligns with everyone’s needs.

Module 4: Saving More and Spending Smarter

💡 Goal: Find practical ways to save more and spend less while staying within budget.

- Step 1: Cut Unnecessary Expenses

Learn how to cancel unused subscriptions, reduce takeout, and shop with a list to avoid impulse purchases. - Step 2: Find Ways to Increase Income

Discover ideas to increase your family’s income, such as side gigs, freelance work, or selling unused items. Even asking for a raise can help improve your financial situation. - Step 3: Build an Emergency Fund

Aim to save 3-6 months of expenses in an emergency fund. Learn how to start small—$25 a week adds up—and how this fund provides peace of mind. - Step 4: Reduce Debt and Interest Payments

Discover strategies for paying off high-interest debt, like credit cards and payday loans. Learn how to negotiate lower interest rates and consolidate debts for better management.

Module 5: Maintaining and Growing Your Family’s Financial Health

💡 Goal: Build long-term habits that promote financial stability and growth.

- Step 1: Review and Adjust Your Budget Monthly

Set aside time each month to review your budget with your family. What worked? What didn’t? Adjust for any changes in income, expenses, or goals. - Step 2: Teach Your Kids About Money

Involve your children in the budgeting process. Teach them how to save, set goals, and manage their own money. - Step 3: Plan for the Future

Start saving for retirement now, and explore life insurance options for long-term financial security. Learn how to prepare for future expenses like college and healthcare. - Step 4: Celebrate Your Progress!

Set milestones to track your progress and reward your family when you reach them. This helps motivate everyone to stay on track and feel good about their financial journey.

Bonus Materials Included:

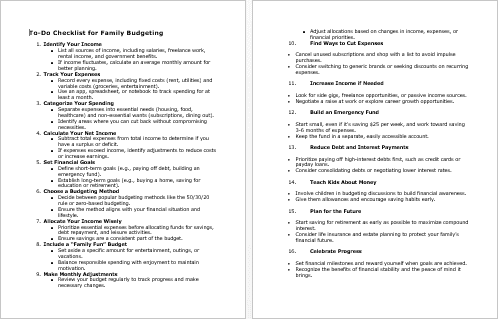

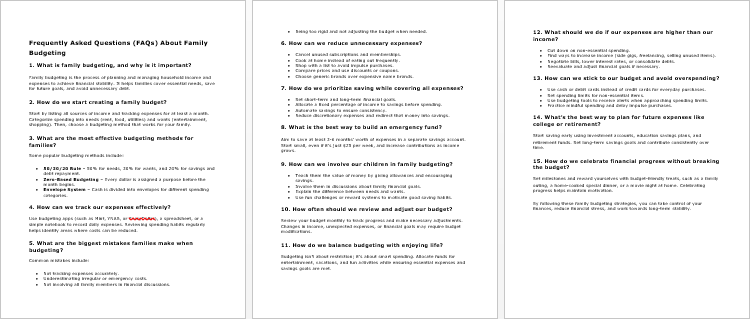

- Family Budgeting Checklist (477 Words)

A quick guide to help you stay on top of your family’s budgeting process, with easy-to-follow steps and helpful reminders. - Family Budgeting FAQs (676 Words)

Answers to common questions about budgeting, including tips for overcoming challenges and staying on track. - Family Budgeting Salespage (594 Words)

A professionally crafted sales page to help you market and sell this course.

How to Profit from This Course:

The Family Budgeting PLR Course offers multiple opportunities for monetization:

- Sell the Course Directly: You can sell this course to individuals, families, or even financial coaches looking to teach others about effective budgeting.

- Bundle the Course: Combine this course with other personal finance or family-related content to create premium bundles for more value.

- Create a Membership Site: Offer this course as part of a larger membership site that provides ongoing financial education and tools for families.

- Turn it into a Video Course: Break down the content into engaging video modules and sell the course at a higher price point.

- Affiliate Marketing: Promote the course through affiliate marketing to increase sales.

Licensing Terms:

With the Family Budgeting PLR Course, you are allowed to:

- Sell the content as-is or customize it to fit your branding.

- Break it into smaller pieces and sell them individually for $10-$20 each.

- Bundle it with other products for a premium offering ($47-$97).

- Create a membership site or eClass and generate recurring revenue.

What You Can’t Do:

- Resell PLR rights or relicense the content.

- Give it away for free in its entirety (you can use excerpts for blog posts or lead magnets).

- Offer 100% commission to affiliates; you can offer up to 75% commission.

Start Your Family’s Financial Journey Today!

Empower yourself and your family to take control of your financial future. Click here to purchase the Family Budgeting PLR Course for just $14.99 and start making lasting changes to your financial health. Take the first step toward financial freedom today!

has been added to your cart!

have been added to your cart!

Here A Sample of Family Budgeting PLR Course

Welcome! Managing a family budget doesn’t have to be stressful. This course is designed to help you take control of your finances, reduce money stress, and create a secure financial future for your family.

Let’s get started!

Module 1: Understanding Your Financial Situation

Before making a budget, you need to understand where you stand financially.

Step 1: Identify Your Income

Before you can create a successful family budget, you must first understand how much money is coming into your household. This step is critical because it provides the foundation for all financial planning decisions. Whether you have a fixed salary, multiple sources of income, or fluctuating earnings, knowing your total income will help you allocate funds wisely and avoid financial shortfalls.

1. Gather All Sources of Income

Income comes from various sources, and it’s essential to list every single one to get an accurate picture of your financial situation. Consider all possible streams of income, including:

A. Primary Income (Fixed or Salaried Income)

- If you or your spouse/partner have a full-time job, note down your monthly or annual salary.

- Include bonuses, commissions, or performance-based incentives if they are a regular part of your income.

- If you receive benefits such as company-paid housing or allowances, consider their financial value.

B. Self-Employment or Freelance Income

- If you are a freelancer, contractor, or business owner, your income may fluctuate from month to month.

- Keep track of your income using invoices, bank statements, or accounting software.

- If you run an online business, include earnings from sales, subscriptions, or services.

C. Side Gigs and Part-Time Work

- Income from side jobs, such as tutoring, consulting, or selling handmade products, should be accounted for.

- If you drive for a ride-sharing service, rent out a property, or monetize a YouTube channel, include this income.

D. Passive Income

- Rental income from properties, commercial spaces, or short-term vacation rentals.

- Royalties from books, music, patents, or digital courses.

- Dividends from stocks, interest from savings accounts, or other investments.

E. Government Assistance and Benefits

- Child support or alimony payments.

- Government grants, unemployment benefits, or social security payments.

- Tax refunds or credits that provide additional financial support.

F. Other Irregular Income Sources

- Gifts, inheritances, or one-time financial windfalls.

- Payouts from insurance claims or legal settlements.

At this stage, write down all sources of income, no matter how small. Even an irregular or minor source can contribute to financial stability.

2. Organize and Record Income Figures

Once you have listed all income sources, record the amounts and categorize them as fixed or variable income:

- Fixed Income: Consistent amounts received regularly (e.g., a monthly salary).

- Variable Income: Earnings that fluctuate, such as freelance work, commission-based pay, or rental income that depends on occupancy rates.

Using a spreadsheet, budgeting app, or financial notebook, create a table with the following columns:

| Income Source | Fixed or Variable | Frequency | Monthly Amount |

| Full-time Salary | Fixed | Monthly | $3,500 |

| Freelance Writing | Variable | Weekly | $1,200 (avg) |

| Rental Income | Variable | Quarterly | $800 (avg) |

| Dividends & Stocks | Variable | Annually | $500 (avg) |

This table allows you to see your total monthly income, making it easier to plan your budget effectively.

3. Calculate Average Income for Fluctuating Earnings

If your income varies each month, it is crucial to determine an average monthly income to make budgeting more predictable.

Method for Calculating an Average:

- Gather your last 6-12 months of earnings from variable income sources.

- Add up the total earnings over this period.

- Divide the total by the number of months to get an average monthly income.

Example Calculation (Freelance Work Income Over 6 Months):

| Month | Income Earned |

| January | $1,100 |

| February | $900 |

| March | $1,500 |

| April | $1,200 |

| May | $1,300 |

| June | $1,000 |

| Total | $7,000 |

- $7,000 ÷ 6 months = $1,166 (Average Monthly Income)

Using an average ensures that you do not overestimate or underestimate your income, which can lead to financial shortfalls or missed savings goals.

4. Adjust for Seasonal or Unexpected Income Changes

Income can fluctuate due to seasonal trends, job changes, or unexpected financial gains. Consider the following:

- If your income is seasonal (e.g., retail during holidays, tourism-related businesses), base your budget on your lowest-income months to avoid overspending during high-earning periods.

- If you receive large, infrequent payments, such as bonuses or tax refunds, divide them over multiple months rather than spending them immediately.

- Plan for potential job loss or reductions in income by saving a portion of high-earning months as a buffer.

A good rule of thumb is to set aside at least 10-20% of variable income into an emergency fund to stabilize finances during low-income months.

5. Finalize and Confirm Your Total Income

Once all sources of income are listed, categorized, and averaged (if necessary), calculate your total monthly income. This final figure is the foundation of your budget.

Example Final Calculation:

| Income Source | Monthly Income |

| Full-Time Salary | $3,500 |

| Freelance Writing (Avg) | $1,166 |

| Rental Income (Avg) | $800 |

| Dividend Income (Avg) | $500 |

| Total Monthly Income | $5,966 |

With this number in place, you are ready to move on to the next step: tracking and categorizing expenses to ensure a balanced family budget.

Key Takeaways

- Identify all sources of income, whether fixed, variable, passive, or irregular.

- Record income amounts accurately using a spreadsheet, budgeting tool, or notebook.

- Calculate an average monthly income if earnings fluctuate.

- Plan for seasonal changes and unexpected income fluctuations by saving a percentage of variable income.

- Confirm your total monthly income as the baseline for your family budget.

Now that you have a clear understanding of your income, let’s move forward to Step 2: Track Your Expenses to see where your money goes each month.

Step 2: Track Your Expenses

Now that you have identified your total income, the next crucial step in creating a solid family budget is tracking your expenses. This process allows you to understand exactly where your money is going, recognize spending patterns, and find areas where you can save.

Many people underestimate their spending, which can lead to financial strain. By carefully tracking your expenses, you will have a clear picture of your financial habits and make informed decisions about budgeting, saving, and cutting unnecessary costs.

1. Identify and Categorize Your Expenses

Before you start tracking, it’s helpful to divide expenses into clear categories. This makes it easier to analyze your spending habits and identify areas for potential savings.

A. Fixed Expenses (Essentials You Must Pay)

These are regular, predictable expenses that remain the same each month.

- Housing Costs: Rent or mortgage payments, property taxes, home insurance.

- Utilities: Electricity, water, gas, internet, phone bills.

- Loan Payments: Car loans, student loans, credit card minimum payments, personal loans.

- Childcare & Education: School fees, daycare costs, tuition fees.

- Insurance: Health, life, vehicle, and home insurance.

B. Variable Expenses (Fluctuate Each Month)

These are necessary expenses, but the amount you spend can change.

- Groceries & Household Essentials: Food, cleaning supplies, toiletries.

- Transportation: Fuel, public transportation, vehicle maintenance.

- Medical Expenses: Doctor visits, medications, supplements.

C. Discretionary (Non-Essential) Expenses

These are optional expenses that contribute to lifestyle and entertainment.

- Dining Out & Takeout: Restaurants, coffee shops, fast food.

- Entertainment: Streaming services, movie tickets, concerts.

- Shopping & Personal Spending: Clothing, beauty products, hobbies.

- Vacations & Travel: Hotel stays, flights, road trips.

- Subscriptions & Memberships: Magazines, gym memberships, online courses.

D. Unexpected & One-Time Expenses

Some expenses don’t occur every month, but they should be planned for.

- Car Repairs & Home Maintenance: Emergency fixes, appliance replacements.

- Medical Emergencies: Unexpected health issues, dental work.

- Gifts & Celebrations: Birthdays, holidays, anniversaries.

By categorizing expenses, you can see which areas are consuming the most money and where adjustments can be made.

2. Choose a Method to Track Expenses

To get an accurate picture of your spending habits, you must record every expense—big or small—for at least a month. There are multiple ways to track expenses, so choose the one that suits you best.

A. Budgeting Apps & Online Tools

For those who prefer automation, there are many budgeting apps that track spending, categorize expenses, and generate reports.

- Popular Apps: Mint, YNAB (You Need a Budget), PocketGuard, GoodBudget.

- Banking Apps: Many banks offer expense tracking features in their mobile banking apps.

- Spreadsheets: Google Sheets or Excel allow you to create custom tracking templates.

B. Manual Tracking (Notebook or Journal)

If you prefer a hands-on approach, writing down your expenses in a notebook can be effective.

- Carry a small notebook or use a budgeting journal to log each expense.

- At the end of the day, review your spending and categorize it.

- This method requires discipline but gives full control over expense tracking.

C. Save and Review Receipts

- Keep physical or digital copies of all receipts for purchases.

- At the end of the week, total up your spending and categorize expenses.

- Some banking apps allow you to take photos of receipts for easy tracking.

D. Cash Envelope System

This is a great option for people who struggle with overspending.

- Withdraw cash and divide it into labeled envelopes for each category (e.g., groceries, entertainment).

- Once an envelope is empty, you cannot spend more in that category until the next month.

Regardless of the method you choose, consistency is key to successful expense tracking.

3. Track Expenses for at Least One Month

The best way to understand your spending habits is to track every expense for a full month. Here’s how to do it effectively:

Week 1: Start Small & Build the Habit

- Begin by recording every purchase, no matter how small.

- Don’t make any changes to your spending habits—simply track and observe.

- Use one tracking method consistently (app, spreadsheet, or notebook).

Week 2: Identify Spending Patterns

- Review where most of your money is going.

- Look for any unexpected or impulse purchases.

- Begin categorizing expenses to spot trends.

Week 3: Analyze & Adjust If Necessary

- Are there areas where you can cut back?

- Are you spending more than you earn?

- Are you saving anything after covering expenses?

Week 4: Summarize & Prepare for Budgeting

- Add up your total monthly expenses by category.

- Compare your spending with your total income.

- Identify areas where you can reduce spending to increase savings.

At the end of the month, you should have a clear understanding of your financial habits, which will help with the next step—creating a realistic budget.

4. Analyze & Evaluate Your Spending

Once you have tracked your expenses for a full month, it’s time to review and analyze your financial habits.

Ask Yourself These Questions:

- Are you spending more than you earn?

- Which categories consume the largest portion of your income?

- Are there any unnecessary expenses that can be reduced or eliminated?

- How much are you setting aside for savings and emergencies?

Common Expense Issues & How to Fix Them:

- Overspending on entertainment? Reduce streaming services, dining out, or impulse purchases.

- Too many subscriptions? Cancel unused memberships or switch to more affordable plans.

- Grocery costs too high? Plan meals in advance, use coupons, and avoid food waste.

- Struggling with impulse buying? Set a 24-hour rule before making non-essential purchases.

This analysis will set the foundation for the next step: creating a budget that aligns with your financial goals.

Key Takeaways

- Track all expenses for at least one month to understand your spending habits.

- Categorize your expenses into fixed, variable, discretionary, and unexpected costs.

- Choose a tracking method (budgeting apps, spreadsheets, notebooks, or cash envelope systems).

- Review and analyze spending patterns to find areas for improvement.

- Make necessary adjustments to align spending with financial goals.

Now that you have tracked your expenses, you’re ready to move to Step 3: Create a Realistic Budget to plan and control your finances effectively.

Step 3: Categorize Your Spending

Now that you have tracked your expenses for a full month, it’s time to take the next step in mastering your family budget—categorizing your spending. This step will help you clearly see how your income is being allocated and identify areas where you can make adjustments to save money.

Many people find themselves struggling financially not because they don’t earn enough, but because they don’t manage their spending effectively. By categorizing your spending into needs and wants, you can make informed financial decisions, reduce wasteful expenses, and create a balanced budget that aligns with your financial goals.

Let’s break this process down step by step.

1. Understand the Difference Between Needs and Wants

Before categorizing your spending, it’s essential to understand the difference between “needs” and “wants.” This distinction is key to making smart financial choices.

A. What Are “Needs”?

Needs are essential expenses required for daily living. These are things you must pay for to survive and maintain a stable life.

Examples of Needs:

- Housing: Rent or mortgage payments, property taxes, home insurance.

- Utilities: Electricity, water, gas, phone, and internet (basic plan).

- Groceries: Essential food items for cooking at home.

- Transportation: Gas, public transit, car maintenance, insurance.

- Health & Medical: Doctor visits, prescriptions, health insurance.

- Debt Repayments: Minimum payments on loans, credit cards.

- Basic Childcare & Education: School fees, daycare, tuition.

Without these essential expenses, your quality of life and financial stability would be at risk.

B. What Are “Wants”?

Wants are non-essential expenses that enhance your lifestyle but are not necessary for survival. While these can improve your quality of life, they should be managed carefully to avoid financial strain.

Examples of Wants:

- Dining Out & Takeout: Restaurants, coffee shops, fast food.

- Entertainment: Streaming services (Netflix, Spotify), gaming, concerts, movies.

- Shopping & Fashion: Clothing, accessories, gadgets, beauty products.

- Luxury Items: Brand-name products, expensive furniture, high-end electronics.

- Hobbies & Recreational Activities: Gym memberships, travel, spa treatments.

- Subscription Services: Magazines, premium apps, personal coaching programs.

The key to budgeting effectively is to ensure that needs are always covered before spending on wants.

2. Categorize Every Expense from Your Tracking Report

Now that you understand the difference between needs and wants, it’s time to go through your list of expenses and categorize each item.

Step-by-Step Process to Categorize Expenses:

- Gather Your Expense Data

- Use the list of expenses you tracked in Step 2.

- Include everything from bills and groceries to entertainment and shopping.

- Create Two Primary Categories:

- Needs: Essential expenses required for survival.

- Wants: Non-essential expenses that improve lifestyle but can be reduced.

- Further Subdivide Categories for More Clarity:

- Fixed Needs: Rent, utilities, loan payments (do not fluctuate much).

- Variable Needs: Groceries, fuel, medical expenses (costs vary month to month).

- Discretionary Wants: Shopping, entertainment, travel, luxury services.

- Use a Highlighter or Spreadsheet for Easy Organization:

- Mark “Needs” in one color (e.g., blue).

- Mark “Wants” in another color (e.g., red).

- This visual method makes it easier to see spending patterns at a glance.

By the end of this step, you should have a clear, organized list of expenses separated into needs and wants.

3. Identify Unnecessary Expenses & Reduce Spending

Once you’ve categorized your expenses, the next step is to identify areas where you can cut back.

How to Spot Unnecessary Expenses:

- Look for duplicate or unused subscriptions. Are you paying for multiple streaming services? Do you really use all of them?

- Identify impulse purchases. Did you buy items you didn’t need while shopping online or at the mall?

- Examine dining out costs. How often do you eat at restaurants or order takeout? Could you cook at home instead?

- Check shopping habits. Are you buying new clothes, electronics, or home decor regularly?

- Analyze entertainment spending. Are you going to movies, concerts, or events too frequently?

Where to Cut Back:

- Reduce dining out: Cook at home more often and plan meals in advance.

- Limit subscriptions: Keep only essential ones (e.g., cancel extra streaming services).

- Cut back on luxury spending: Delay non-essential purchases and avoid impulse buying.

- Adjust travel & entertainment expenses: Find low-cost entertainment options like free events or outdoor activities.

- Use discount programs & coupons: Take advantage of loyalty programs, cashback apps, and discount coupons to save money.

4. Create a Balanced Spending Plan

Now that you’ve categorized your expenses and found areas to cut back, it’s time to balance your spending.

A. Set Spending Limits for Each Category

A good rule of thumb is the 50/30/20 budgeting rule:

- 50% on Needs (Essentials like housing, food, utilities, transportation).

- 30% on Wants (Non-essentials like entertainment, shopping, travel).

- 20% on Savings & Debt Repayment (Emergency fund, investments, extra loan payments).

If your “wants” category exceeds 30%, look for areas where you can cut back and redirect that money toward savings.

B. Plan for Emergencies & Future Goals

- Set aside money for emergencies (unexpected medical expenses, car repairs).

- Prioritize savings & investments (retirement fund, education fund).

- Create realistic financial goals (home ownership, business investments, family vacations).

C. Adjust Your Spending Monthly

- Review your budget every month to track progress.

- Adjust as needed based on changes in income or unexpected expenses.

- Make continuous improvements by cutting unnecessary costs and increasing savings.

By following this structured approach, you’ll gain control over your spending, avoid unnecessary debt, and work towards financial stability.

Key Takeaways

- Categorizing expenses helps you identify where your money is going.

- Separate spending into “Needs” (essential) and “Wants” (non-essential).

- Analyze where you can cut unnecessary costs and make adjustments.

- Use the 50/30/20 budgeting rule to balance your expenses.

- Review your budget monthly to ensure financial stability.

Now that you have categorized your spending, the next step is to set financial goals and create a personalized family budget to maintain financial discipline and long-term success.

Step 4: Calculate Your Net Income

Now that you have categorized your expenses into needs and wants, it’s time to determine your net income. This step is essential because it shows you whether you are living within your means, overspending, or have room to save and invest.

Your net income is the amount left after subtracting your total expenses from your total income. This figure provides a clear picture of your financial health and helps guide the next steps in your budgeting journey.

Even if you discover that your expenses exceed your income, don’t worry—the next modules will help you make the necessary adjustments to regain control.

Let’s go step by step to calculate your net income accurately.

1. Gather Your Financial Data

Before you begin the calculation, make sure you have:

- Total Income Amount (from Step 1)

- Total Expenses Amount (from Step 3)

If you haven’t done so already, compile all your financial information in a notebook, spreadsheet, or budgeting app. Having a structured financial overview makes this step easier and more accurate.

A. Reconfirm Your Income

Review your total monthly income from all sources, including:

- Salaries or wages (after tax deductions)

- Side business earnings

- Freelance or gig income

- Rental income

- Pension or retirement payments

- Child support or alimony

- Any other regular financial support

Make sure your income figures are realistic and up-to-date. If your income fluctuates, use an average of the last 3–6 months to get a reliable estimate.

B. Reconfirm Your Expenses

Review your total expenses (Step 3), ensuring that every category—housing, groceries, transportation, debt payments, and discretionary spending—is included.

If possible, double-check bank statements, receipts, and bills to confirm accuracy. Even small overlooked expenses can impact your financial picture significantly.

2. Calculate Your Net Income

Now that you have both numbers—total income and total expenses—it’s time to do the calculation.

Formula for Net Income:

Net Income = Total Income – Total Expenses

Example 1: Positive Net Income

- Total Income: $4,000

- Total Expenses: $3,200

- Net Income Calculation: $4,000 – $3,200 = $800 (Surplus)

This means you have $800 left over at the end of the month. You can use this amount to build savings, invest, or pay off debt faster.

Example 2: Zero Net Income

- Total Income: $4,000

- Total Expenses: $4,000

- Net Income Calculation: $4,000 – $4,000 = $0 (Break-Even)

In this case, your spending is exactly equal to your earnings, meaning you don’t have extra money for savings or emergencies. This could be risky if unexpected expenses arise.

Example 3: Negative Net Income

- Total Income: $4,000

- Total Expenses: $4,500

- Net Income Calculation: $4,000 – $4,500 = (-$500) (Deficit)

If your expenses exceed your income, you are operating at a financial deficit. This means you might be relying on credit cards, loans, or savings to cover your expenses, which is unsustainable long-term.

3. Analyze Your Net Income Result

Once you’ve calculated your net income, interpret what it means for your financial stability.

A. If You Have a Surplus (Positive Net Income):

- Great job! You are earning more than you spend.

- Next Steps:

- Allocate extra funds towards savings, investments, or paying off debt.

- Consider increasing contributions to an emergency fund or retirement account.

B. If You Break Even (Zero Net Income):

- You are spending exactly what you earn, which is risky.

- Next Steps:

- Identify areas where you can cut back to create a savings buffer.

- Look for opportunities to increase your income through side gigs or upskilling.

C. If You Have a Deficit (Negative Net Income):

- This means you are spending more than you earn—a financial red flag.

- Next Steps:

- Don’t panic! The next module will help fix this issue.

- Start by identifying unnecessary expenses that can be reduced or eliminated.

- Look for ways to increase your income (freelancing, part-time work, selling unused items).

- Avoid relying on credit cards or loans to cover shortfalls.

If you find yourself in consistent financial difficulty, take proactive steps now to balance your budget before debt becomes unmanageable.

4. Plan for Adjustments in the Next Modules

Now that you have a clear understanding of your net income, the next modules will help you:

✅ Adjust your expenses to fit your income.

✅ Build a smart budget that ensures long-term financial stability.

✅ Find practical ways to save money without sacrificing important needs.

✅ Increase your income through smart financial planning.

Remember: Even if your current net income is negative, it is fixable! Budgeting is a skill that improves with time, awareness, and small, intentional changes.

Key Takeaways from Step 4:

✔ Net income is the difference between your total income and total expenses.

✔ A positive net income means you have extra money to save or invest.

✔ A zero net income means you’re spending exactly what you earn, which is risky.

✔ A negative net income means you are spending more than you earn, requiring urgent adjustments.

✔ The next steps will focus on fixing any deficits and creating a sustainable budget.

Now that you have calculated your net income, the next module will guide you through budgeting strategies to ensure that your income always covers your expenses—and leaves room for financial growth!

We’re also giving these extra bonuses

Family Budgeting – Checklist

Family Budgeting – FAQs

Family Budgeting – Salespage Content

Package Details:

Word Count: 17 208 Words

Number of Pages: 83

Family Budgeting – Bonus Content

Checklist

Word Count: 477 words

FAQs

Word Count: 676 words

Salespage Content

Word Count: 594 words

Total Word Count: 18 955 Words

Your PLR License Terms

PERMISSIONS: What Can You Do With These Materials?

Sell the content basically as it is (with some minor tweaks to make it “yours”).

If you are going to claim copyright to anything created with this content, then you must substantially change at 75% of the content to distinguish yourself from other licensees.

Break up the content into small portions to sell as individual reports for $10-$20 each.

Bundle the content with other existing content to create larger products for $47-$97 each.

Setup your own membership site with the content and generate monthly residual payments!

Take the content and convert it into a multiple-week “eclass” that you charge $297-$497 to access!

Use the content to create a “physical” product that you sell for premium prices!

Convert it to audios, videos, membership site content and more.

Excerpt and / or edit portions of the content to give away for free as blog posts, reports, etc. to use as lead magnets, incentives and more!

Create your own original product from it, set it up at a site and “flip” the site for megabucks!

RESTRICTIONS: What Can’t You Do With These Materials?

To protect the value of these products, you may not pass on the rights to your customers. This means that your customers may not have PLR rights or reprint / resell rights passed on to them.

You may not pass on any kind of licensing (PLR, reprint / resell, etc.) to ANY offer created from ANY PORTION OF this content that would allow additional people to sell or give away any portion of the content contained in this package.

You may not offer 100% commission to affiliates selling your version / copy of this product. The maximum affiliate commission you may pay out for offers created that include parts of this content is 75%.

You are not permitted to give the complete materials away in their current state for free – they must be sold. They must be excerpted and / or edited to be given away, unless otherwise noted. Example: You ARE permitted to excerpt portions of content for blog posts, lead magnets, etc.

You may not add this content to any part of an existing customer order that would not require them to make an additional purchase. (IE You cannot add it to a package, membership site, etc. that customers have ALREADY paid for.)

Share Now!